Cryptocurrency Kaiko, one of the leading providers of market data, has released its quarterly cryptocurrency report for the second quarter of the year, providing an update on the liquidity rankings of various crypto assets.

The report highlights the direct impact of recent lawsuits by the US Securities and Exchange Commission (SEC) on the liquidity of assets defined as securities. In addition, the report compares the liquidity scores of each asset with its market value, revealing the most misleading tokens in terms of liquidity.

Among the key findings of the report, APT And ARB It turns out that the liquidity of tokens is better than their market value and these tokens are more liquid than their size. on the other hand LEO, TON, TRX And OCD Tokens have much worse liquidity than their market caps suggest, which can be quite misleading for investors who rely on market cap as a liquidity indicator.

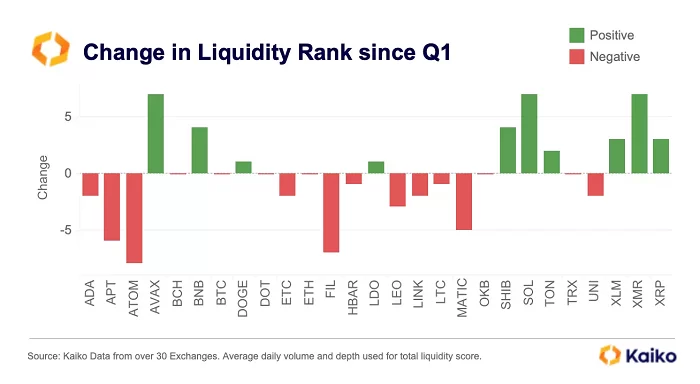

The report also reveals that there were significant changes in liquidity rankings in the second quarter. AVAX, LEFT And XMR All of its tokens have witnessed a remarkable improvement in liquidity, with each token moving up seven places in the rankings. Against this, ATOM, FIL And MATIC tokens experienced the most significant drops in liquidity rankings during the quarter.

Kaiko’s liquidity ranking model takes into account a variety of metrics, including volumes and market depth. Volumes are strongly linked to order book liquidity metrics such as market depth and spread, but relying solely on trading volume may not adequately assess liquidity due to potential market manipulation.

Among major tokens with high volumes in Q2 XRP And ARB while taking place, BCH Despite the recent EDX exchange listing announcement, it stands out for its lack of volume. (This report was published ahead of BCH’s recent rises.)

Market depth, which takes into account the level and breadth of open orders, is another important factor in evaluating liquidity. ELEPHANT And ATOM Such tokens have witnessed a significant reduction in market depth due to their designation as securities in SEC lawsuits. Native token of Binance, one of the most liquid exchanges BNB, Despite its high market value, it continues to show limited depth.

The report concludes by emphasizing that assuming a token’s liquidity is equivalent to its market value should be avoided.

*Not investment advice.

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android And iOS Start live price tracking right now by downloading our apps!