The tension between Russia and Ukraine, which has recently caused volatility in all financial assets, is moving to a new dimension. There is a risk of war. And this risk continues to have a devastating effect on the markets. Here, I will evaluate for you the possible risks and the impact on the markets.

In the last case, Russia recognized the independence of Donetsk and Luhansk. Along with this, the information that Russian soldiers had entered the region was also received. In other words, the event took a turn from tension to conflict. The transformation of this event into conflict will trigger sanctions on the side of the European Union and the USA. However, what is important here is will the conflict remain as a mere conflict or will it progress and turn into a war?

Yes, my friends, it’s time for analysis. The markets have been moving quite turbulently for a while. There are some weak movements across the markets. I want to evaluate them together. Lets start.$btc $eth #gold #dollar

— Furkan Bozkurt (@BzkrtFrkn) February 20, 2022

Here, the markets have been pricing in the Russia-Ukraine tension for a while. However, how much it can grow is a mystery for now. Therefore, the volatility in the markets will continue. Because when investors’ minds are not clear, pricing is not clear either.

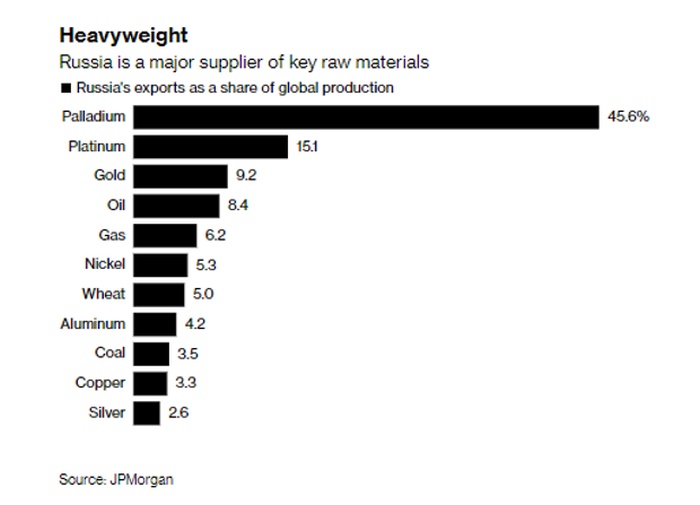

This raises energy prices. Because Russia meets 46% of the EU’s energy supply. The concern that oil prices will exceed $100 threatens the economies. Energy is the basic input for production and creates direct inflationary pressure. It will trigger rising inflation especially in the USA and EU. Russia uses this as leverage and threatens the EU with energy prices.

Markets Are Anxious About Possible Sanctions!

On the other hand, Russia and Ukraine are two important wheat exporting countries. In other words, price increases in basic food products may also be waiting for us. It should also not be forgotten that it is an important producer of palladium, nickel, copper, aluminum and plutonium. On the other hand, it is possible for the USA to push Russia out of the International payment system. In this way, it will harm Russia’s banking system. Of course, not only that, some big Russian companies may also be sanctioned. So, we may see trade restrictions.

“Welcome to a world where Europeans will pay 2,000 euros for gas,” the former Russian president said. The statement shows that energy prices will continue to climb with the tension. While Russia threatens with energy prices, the US and EU will respond with trade restrictions. This will be a situation where the only winner will be gold if the tension becomes war. It will trigger rises under the risk of both rising inflation and war. In particular, it seems that the risk of inflation will not cease to be a problem in 2022.

On the one hand, the risk of global war, on the other hand, the tightening policies of the central banks create a reflex in the markets to take shelter in safe harbors. It is important how far Russia will go in the military field and how harshly NATO will respond to it. Markets have not yet fully priced in these risks. Therefore, the situation of US indices will be especially important. If the negative pricing in the indices deepens, we may see sales, especially in cryptocurrencies. Because an OBO structure has been formed in the indices. Hence, future sales may be tougher after that.

It is risky to take a position in a period of very rapid and sudden developments. Especially before the critical FED meeting, it is necessary to see what will happen without taking strong positions. In the short term, it is important not to take strong poses until we get through the March meeting. On the technical side, trading attempts can be made. However, in order to take a net position, the risks on the fundamental analysis side also need to decrease.

You can follow my analysis of the markets on my Twitter account.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.