Munich The global robot industry has overcome the corona shock for the time being. “The demand from China has clearly picked up again,” said Susanne Bieller, General Secretary of the International Federation of Robotics (IFR) to the Handelsblatt. According to the latest figures, last year went better than initially expected, with a slight increase.

The industry association is now anticipating an increase in sales of around 13 percent to 435,000 robots sold this year. This would exceed the record level of 2018. The industry also expects further growth in the coming years. According to this, half a million robots could be sold for the first time in 2024.

However, as with many mechanical engineers, the situation is paradoxical: demand has recovered surprisingly quickly after the corona shock. “The order books are full,” said Bieller. But manufacturers find it difficult to meet demand. “86 percent of the German robotics and automation specialists recently reported noticeable to serious restrictions due to problems in the supply chains,” said Bieller. A shortage of raw materials and chips would hit the industry hard.

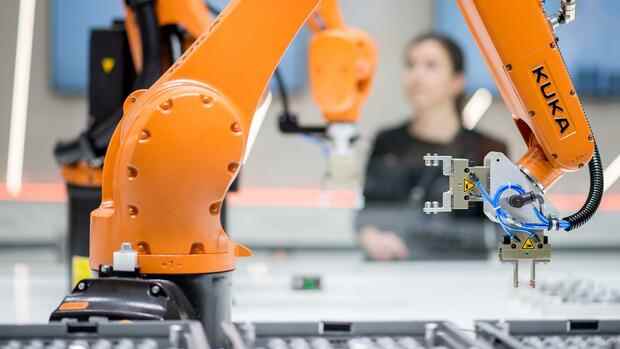

After robot manufacturers such as Yaskawa, Kuka and ABB had rushed from sales record to sales record for a long time, there was a slight sag before Corona. In the pandemic, car manufacturers in particular, who are still the most important buyers of heavy industrial robots, were reluctant to invest.

Top jobs of the day

Find the best jobs now and

be notified by email.

Overall, however, optimism currently prevails: thanks to the recovery in the second half of the year, sales in 2020 were finally increased by 0.5 percent to 384,000 robots sold, according to the final IFR report. “In the Chinese manufacturing industry, incoming orders and production rates began to pick up again as early as the second quarter of 2020,” said IFR President Milton Guerry. The North American economy recovered in the second half of the year. “Europe followed a little later.”

The development was similar for the individual manufacturers: For example, ABB was able to increase incoming orders in its robotics and automation division by a comparable 20 percent to 2.7 billion dollars in the first nine months of this year. Sales increased by twelve percent to $ 2.5 billion.

The automaker’s investments in electric car factories benefited automation expert Kuka. In the first nine months, incoming orders improved by more than a third to 2.7 billion euros, while sales increased by a good quarter to 2.4 billion euros.

Asia remains the largest market for industrial robots

In Europe, the upturn in the industry is somewhat more subdued than in the USA and China. According to the IFR, sales in Europe should increase by eight percent to 73,000 units sold this year. In 2020, the number of sales also fell by eight percent to 67,700 deliveries. In the auto industry, sales fell by as much as 20 percent last year.

According to the IFR, robot sales in Germany remained at least stable last year with 22,300 units sold. “The home market is likely to grow slowly, mainly supported by the demand for low-cost robots in general industry and outside of manufacturing,” predicts the IFR.

Production in Germany fell by seven percent to just under 21,700 robots manufactured last year. This corresponded to six percent of global production.

Asia remains by far the largest market for industrial robots. 71 percent of all newly installed units were set up in Asia last year. China remains the most important customer country, there are currently almost a million industrial robots in use. The IFR expects sales in Asia to increase by 15 percent this year. In North America, growth of 17 percent is expected.

Corona gave the industry a boost, said IFR Secretary General Bieller. For example, companies in the food industry would have had to keep production going – and in some cases bought new robots for this.

In the next few years, the robotics industry wants to grow, especially in sectors outside of the automotive industry. The electronics industry still has some catching up to do when it comes to automation. The smaller, collaborative robots (cobots), which can work right next to people, should also help. During the pandemic, these helped in many places to maintain production despite distance rules. Last year, according to Bieller, the cobot segment accounted for around six percent of sales – with an upward trend.

More: Germany now also has a robot unicorn