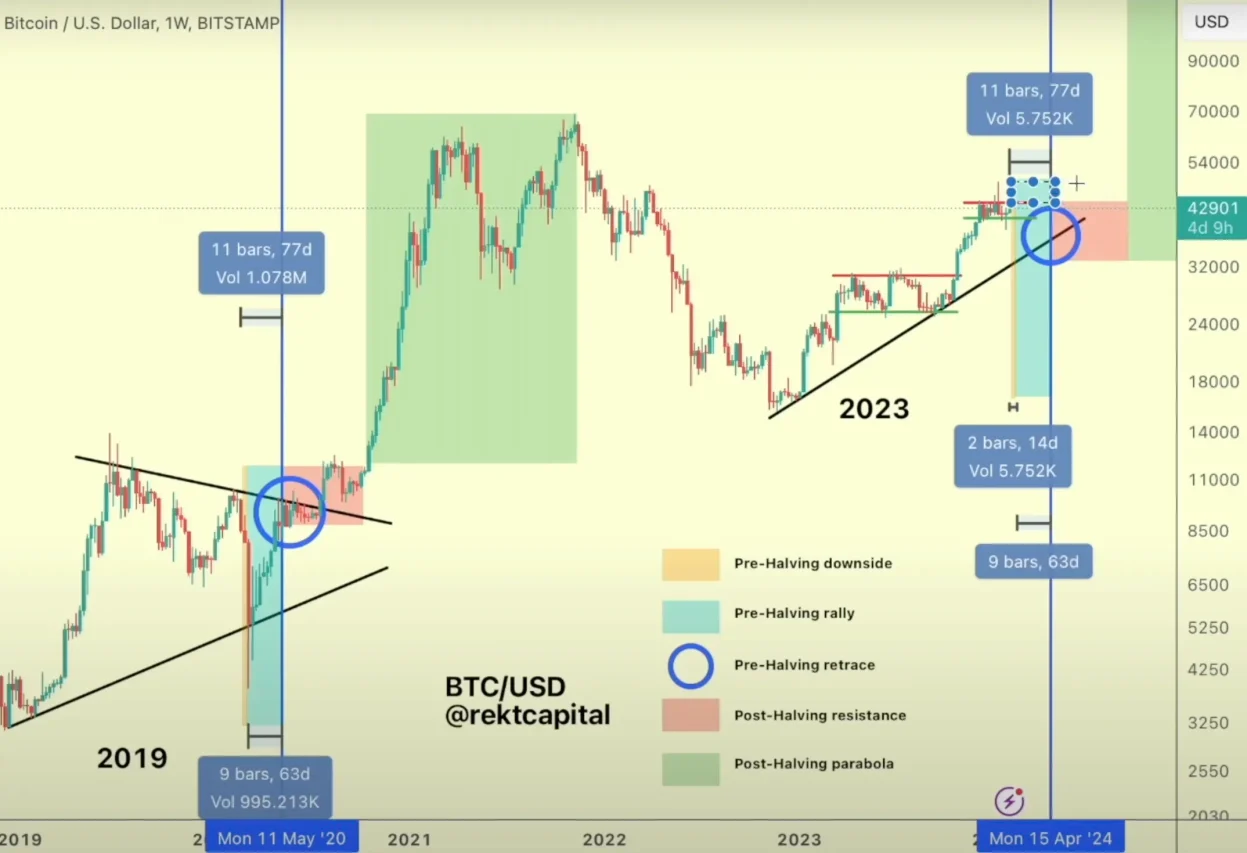

Rekt Capital, which has made a name for itself in the cryptocurrency world, shared a new analysis about Bitcoin (BTC). The analyst suggested that the BTC halving event, which will take place in mid-April, will cause an increase in the value of the cryptocurrency, repeating the pattern in 2016. However, the analyst warned that Bitcoin may decline in the near term and stated that caution should be exercised as the crypto king is still in the accumulation range. Here are the details…

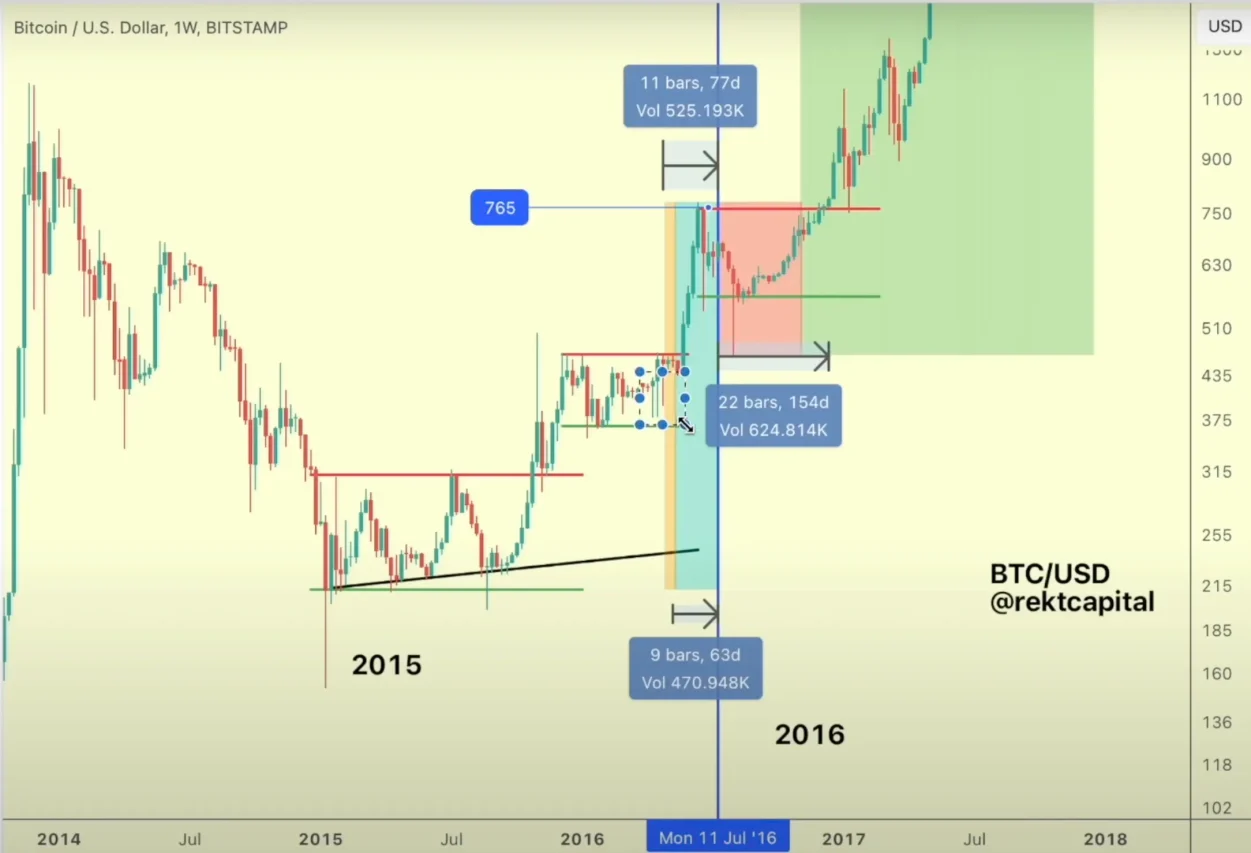

Pseudonymous analyst Rekt Capital focused on BTC halving, which he sees as an important factor affecting Bitcoin’s price performance. The analyst predicts that this event will repeat a similar situation in 2016 and the value of Bitcoin will increase. Halving usually leads to price increases by causing a partial decrease in supply as the rewards earned by miners decrease.

However, Rekt Capital states that Bitcoin is currently in the accumulation range and warns that this situation may affect the price of the cryptocurrency.

“As can be seen, we are once again in the accumulation range, very similar to 2016. And in 2016, we saw the downward divergence igniting in the accumulation range again.

NEWS CONTINUES BELOWWhat we see in this cycle is a downward wick, but not below, not within, but just below the reaccumulation range. (…) Therefore, if history repeats itself compared to 2016, we should see some kind of uptick in the pre-halving rally.”

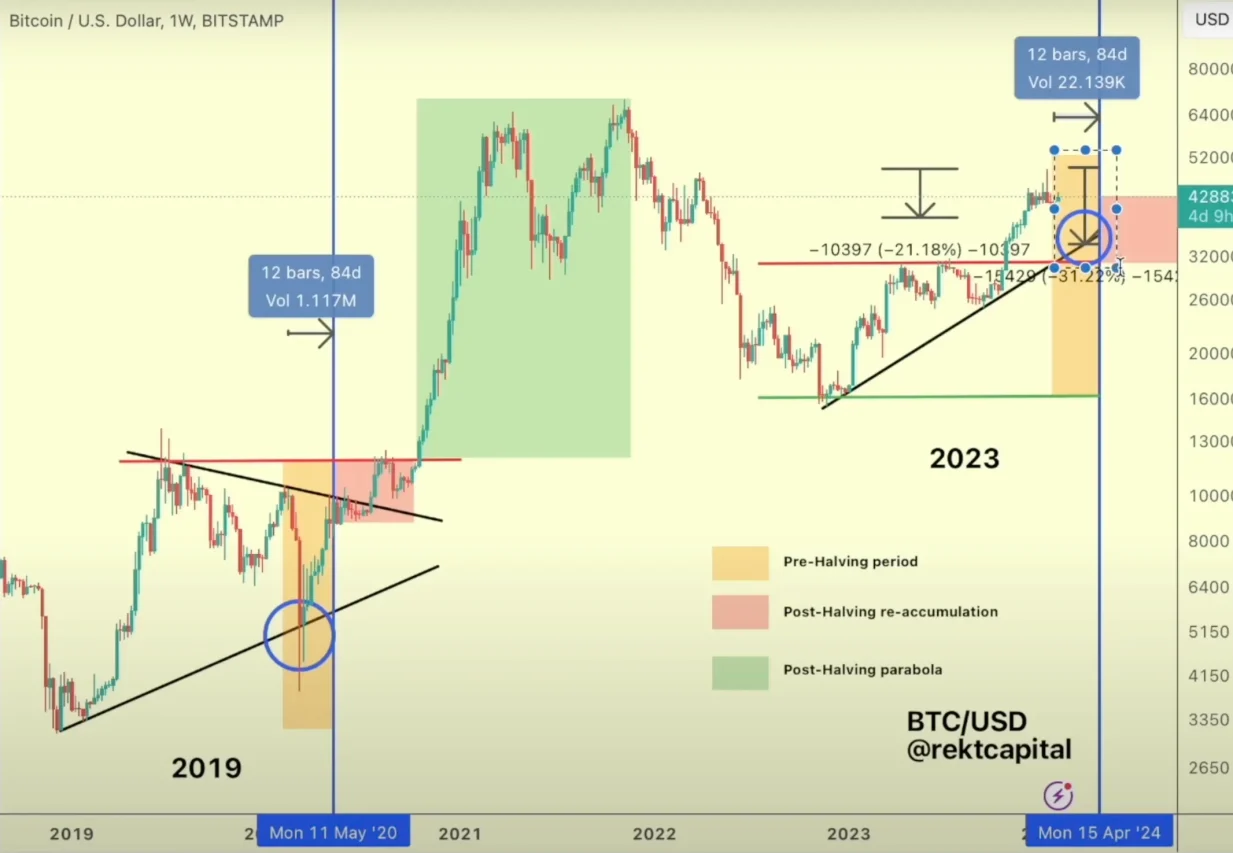

According to the chart shared by the analyst, Bitcoin may rise to $ 50,000 levels towards the halving event. The analyst also believes that Bitcoin could revisit the $38,000 level in the next two weeks.

“But the next two weeks will be quite interesting because there is still downside potential below this reaccumulation range as we saw in 2016. in 2016, [aşağıdaki grafikte] You may see downward movements in the reaccumulation range for a few weeks. So, if this is any indication, what if we get some sustained downward wicking within the reaccumulation range even this cycle, or perhaps we could still get a downward divergence below that reaccumulation range.”

The analyst also thinks there is a small chance that the reaccumulation range will break and Bitcoin will fall below $38,000.

“There is a possibility of any downside divergence below this range in the current cycle… There are very specific conditions that Bitcoin must meet to break below $38,000…

“But as long as this reaccumulation range continues, we may only experience a 21% pullback from the highs, and history tells us that this reaccumulation range will likely continue until the halving.”

The analyst suggests that the “worst case scenario” for Bitcoin’s decline would be around the $32,000 level this cycle.

In summary, Rekt Capital’s analysis shows that both bullish and bearish scenarios for Bitcoin are possible in the near term. Investors should carefully evaluate market conditions and make their decisions taking into account analyst recommendations. Bitcoin’s future performance will depend on both the halving effect and other factors.

Bitcoin is trading at $43,001 at the time of writing this article.

You can follow the current price movement here.