Ethereum liquid staking protocol built on EigenLayer Puffer Financeannounced that it received investment from Binance Labs. Along with the investment announcement, it also began allowing users to deposit stETH, a liquid staking token issued by Lido, onto its protocol.

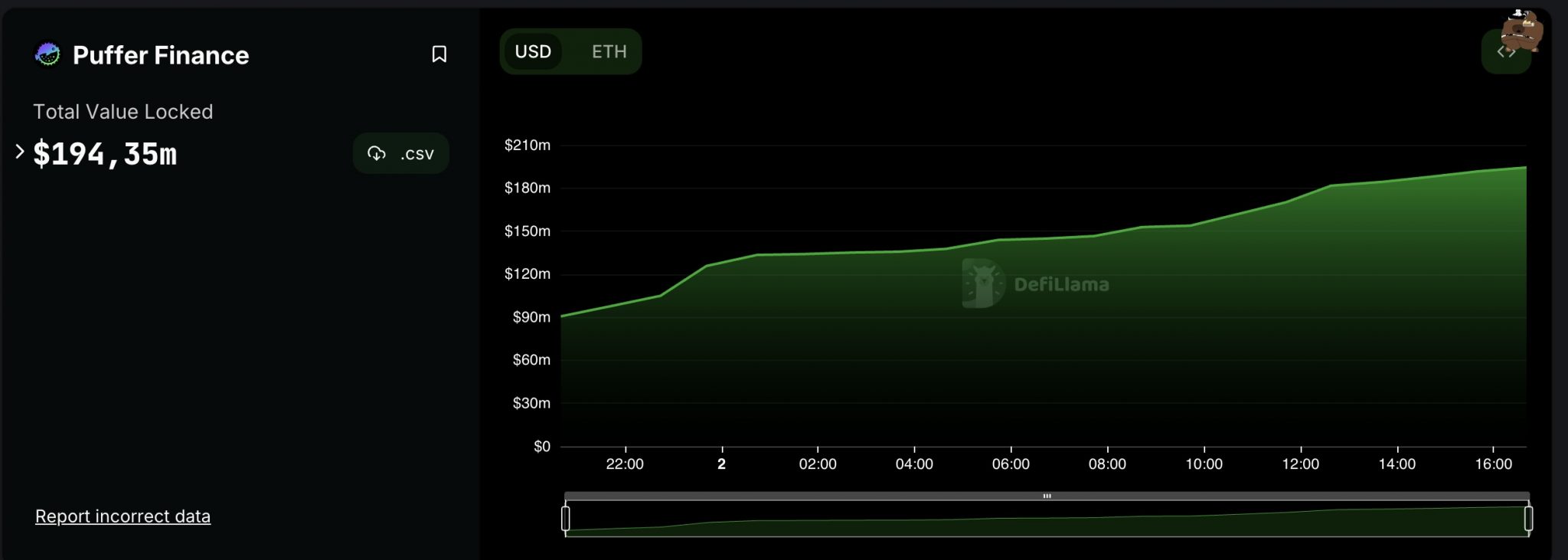

This helped Puffer Finance withdraw $194 million worth of staked ETH in 24 hours, making it the fourth largest liquid restaking protocol in the market. According to DefiLlama’s TVL data, its competitors above are ether.fi, Kelp DAO and Renzo.

Liquid restaking is repurposing liquid staking tokens such as stETH to stake validators of other networks. Most projects do not have tokens with huge growth potential. As Koinfinans.com reported, restaking has managed to attract the attention of the community lately as the Dencun upgrade on Ethereum approaches.

Hungry Puffy is here!

Quick, toss me your stETH carrots 🥕 and help make the Ethereum sea more decentralized, NOW! 👇https://t.co/35kRJHQ2WN pic.twitter.com/Q6G9CtiT2r

NEWS CONTINUES BELOW— Puffer Finance 🐡 (@puffer_finance) February 1, 2024

Puffer Finance’s goal is to diversify the validator set and reduce Ethereum’s Proof of Stake density while solving the challenges faced by individual validators.

The project targets two main types of customers: general users and individual validators who do not have enough 32 ETH to verify Ethereum.

Puffer Finance offers general users the opportunity to generate pufETH and earn profits by staking ETH. It also allows validators to run a Puffer node with just 2 ETH, instead of the 32 ETH required to run an Ethereum node. This is an advantage in the early stage of the project. It is aimed for Puffer Finance to operate at full capacity by the end of the year. During this period, users will need to lock Lido’s stETH in order to generate pufETH. The generated pufETH can be converted to ETH and rejoined by validators.

This system aims to reduce Lido’s dominance in the market and increase the amount of ETH staked as well as the amount of ETH available.

Puffer Finance attracts the attention of the crypto community, especially with its point reward system. In the crypto world, such points can be considered an airdrop token strategy.

Many projects use a point reward model that “indirectly” encourages airdrops, such as friend.tech, Blast, MarginFi, Rainbow Wallet. Therefore, it is reasonable to expect that Puffer Finance will also distribute its tokens via airdrop.

Users can earn points by depositing stETH into the protocol and earn extra points by investing stETH through EigenLayer. This system aims to expand the Ethereum ecosystem while offering users incentives for greater participation.