In the bear cycle or crypto winter, it managed to maintain its strength to some extent. Avalanche (AVAX) announced on September 27 that it has formed a partnership with leading altcoin Chainlink (LINK). According to the shared post, Chainlink will help AVAX grow in the NFT, GameFI and Defi industry.

Considering the developments, will both altcoins be able to profit from the crypto winter?

Avalanche Labs, chainlinkHe noted that the Avalanche network has seen tremendous growth due to reasons such as the price feed of . The blockchain also provided about $550 million worth of security.

As Avalanche Labs points out, one of the main growth areas has long been identified as DeFi. With the help of Chainlink’s price feed, the Avalanche team was able to stake liquidity and improve DeFI growth in terms of DEXs.

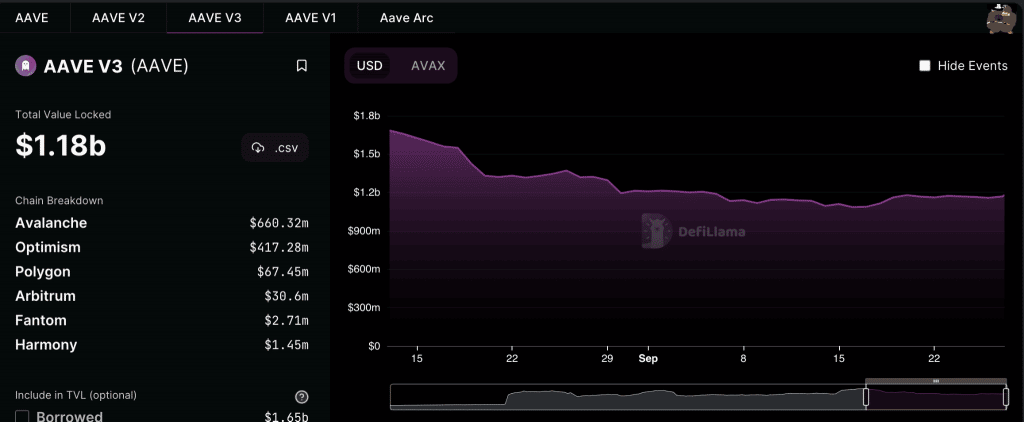

In addition, projects such as Aave, BenqiFinance and Trader Joe have announced that they are integrating Chainlink systems to develop the Avalanche protocol. However, this development did not affect their TVL (locked total value) much.

As shown in the image below, AAVE’s TVL has been flat throughout September and even stood at $1.1 billion at press time. Trader Joe’s DEx hasn’t performed that well either. Thus, TVL was recorded at $145.44 million and has lost 6.24% since the beginning of September.

On the other hand, it can be seen that AVAX performs well in the NFT field. The NFT community uses Chainlink’s VRF tools to improve their growth. AVAX’s NFT volume has also witnessed some growth since last month.

Also, on September 24, NFT sales volume reached the all-month high of $1.62 million. Therefore, it is possible to say that Chainlink plays a big role in amplifying the sound of AVAX.

All the positive developments experienced did not find much response in the price of the local token AVAX.

Advances in Avalanche Network

AVAX’s popularity on social media waned a bit in August. Its popularity on social media has lost 25% in the last 30 days, according to statistics. The outlook for AVAX price, on the other hand, was bearish throughout the month.

In addition to the information mentioned above, the volume of AVAX has also witnessed a decline. Trading volume was $327 million at the start of the month. However, at press time, it was listed at $234.72 million.

Despite multiple factors against AVAX, the price per token exceeded all expectations, gaining 4.13% in the last 24 hours. AVAX was trading at $18.12 at press time.

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.