The US Federal Reserve Chairman was nominated for a second term by the US President.

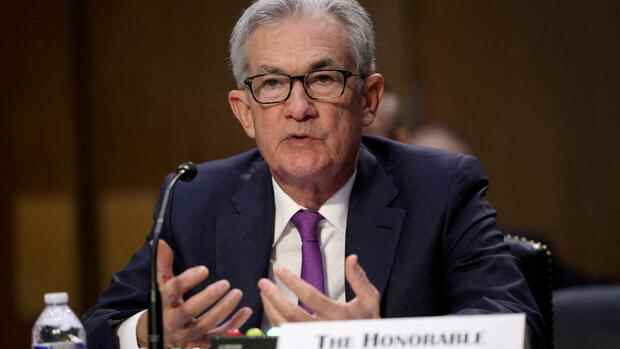

(Photo: Reuters)

Washington In view of the ever increasing prices in the US, US Federal Reserve Chairman Jerome Powell has declared war on inflation. “We know that high inflation is taking its toll,” said the Fed president in a pre-published version of a speech scheduled for Tuesday before a Senate committee.

The increased costs for food, housing and transport particularly hit the socially disadvantaged. “We will use our instruments to prop up the economy and a strong labor market, and to prevent inflation from getting stuck.”

There is speculation in the markets that the Fed could initiate a turnaround in interest rates as early as March and brace itself against the sharp rise in prices. Statements by Atlanta District Chief Raphael Bostic support this assumption.

The US Federal Reserve must fight the risk of inflation quickly and powerfully, said Bostic in an interview on Tuesday. He warned that the increased price pressure may last for a long time. “We have to react directly, clearly and aggressively.” The Fed meeting in March may offer “an appropriate opportunity” for a turnaround in interest rates.

The US inflation rate climbed to 6.8 percent in November – the highest value since 1982. Experts surveyed by Reuters expect an increase to 7.0 percent for the December data due on Wednesday. Delivery problems resulting from the Corona crisis, material bottlenecks and almost exploding energy costs are fueling inflation.

Top jobs of the day

Find the best jobs now and

be notified by email.

“The Federal Reserve works for all Americans,” emphasized Powell, who has led the Fed since early February 2018. He is committed to the principles of transparency and clear communication and actively seeks an exchange with parliamentarians: “I undertake to continue this practice if I am confirmed for another term of office.”

President Joe Biden has nominated Powell for an additional four-year term. The Republican must be re-confirmed in office by the Senate. As part of the process, he must be available to answer questions from MPs on the Banking Committee.

Fed Vice-President resigns early

His deputy-designate, Lael Brainard, will also be heard by the committee on Thursday. The long-time Fed director is to replace the current vice-president Richard Clarida. After an affair about securities transactions, this resigns prematurely. He will take off his hat on January 14th, it said on the Fed’s website on Monday.

Clarida’s term does not expire until January 31st. According to media reports, Clarida shifted its portfolio in February 2020 a day before an important announcement by Fed Chairman Powell. Most recently, media reports said that Clarida corrected its financial information at the end of December. The events join the affair of the trading activities of high-ranking US central bankers, which led to the resignation of two Fed executives in 2021.

Biden tries to ensure more diversity in his nomination practice for vacant positions on the board of directors of the Fed – that is, to allow more women and members of ethnic minorities to have a chance.

According to media reports, economics professor Lisa Cook, who was recently appointed director of the Chicago Fed, is a hot contender for one of the Fed’s leadership positions. In addition, the former Fed director Sarah Raskin could return to her old place of work. Another candidate for a director post is the African American economist Philip Jefferson.

More: Clarida’s term of office was supposed to end at the end of January. But a new report on security sales has apparently increased the pressure on the Fed vice-president