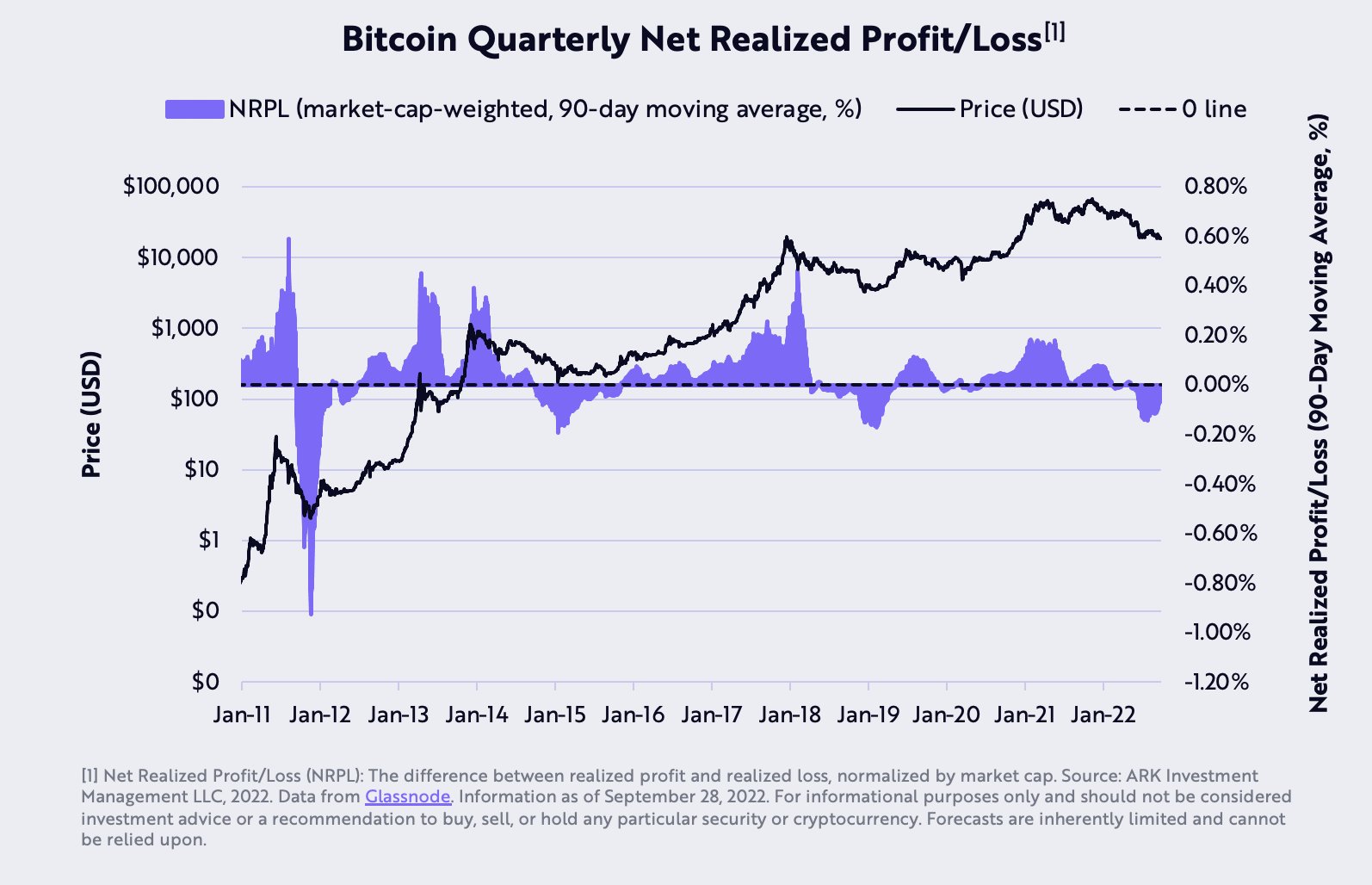

Yassine Elmandjra, analyst at American investment management firm Ark Invest, claimed that the cryptocurrency market is in the process of completing its capitulation based on Bitcoin’s Net Realized Profit/Loss ratio.

Koinfinans.com As we reported, this indicator is used to determine whether the Bitcoin price has bottomed out or is still in the middle of a long bear market. The metric calculates the net profit or loss made by all pending holders of the coins.

Bitcoin’s short-term cost base has fallen below its long-term cost base for the fourth time in history. According to Elmadjra, this is another indication that the market has likely reached a cyclical bottom. indicator.

For now, bitcoin The price is stuck between $19,000, which represents the investor cost base, and $23,500, the 200-day weekly moving average. For the time being, there seems to be a battle between the strong holders of Bitcoin and a negative macro environment.

In addition, a strong dollar is putting pressure on world currencies and large European banks, so there is strong uncertainty in the markets. Also, it seems likely that the US Fed will continue to raise interest rates.

Elmandjra says that the decision on both sides will have a huge impact on the movement of Bitcoin price in the medium term. According to the analyst, the miner surrender appears to be complete as the period of massive hash rate compression has ended.

The biggest cryptocurrency managed to reclaim $20,000 on Tuesday, but this latest price surge was fueled by the biggest S&P 500 rally since 2020.

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.