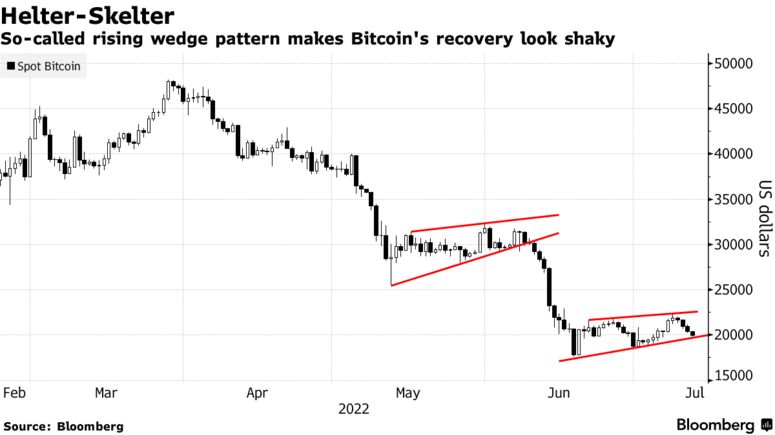

According to a new report by Bloomberg, bitcoin A bearish wedge pattern for its price suggests that the leading crypto asset could lose further. When this pattern is accompanied by a decrease in trading volume, it is assumed that the downtrend will continue for a while.

A similar formation had previously occurred in the “second quarter”. Announcing the 40% drop in Bitcoin price, which brought it down to around $17,600, the formation had previously shown a frightening forecast. With its poor performance, Bitcoin recorded its worst quarter performance in more than a decade.

After Bitcoin managed to gain some ground last week, Sunday’s sell-off gave bulls hope for an eventual recovery. Earlier today, the pioneer cryptocurrency It fell as low as $19,600.

Koinfinans.com As we reported, if the current ascending wedge pattern ends, Bitcoin will likely converge to Scott Minerd’s extreme bearish price target of $8,000. To achieve this goal, it will need to surpass another 59% of the top cryptocurrencies.

The Bloomberg MLIV Pulse survey showed that Bitcoin is likely to drop to the $10,000 level, according to most retail and institutional investors. Concerns over the US Federal Reserve’s monetary tightening remain the main reason behind this persistent downward pressure.

The former BitMEX CEO doubled down on his $1 million price prediction, which was too good to be true, after the euro started approaching parity with the dollar. The former CEO had previously stated that the Bitcoin price could reach this target by 2030.

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.