One of the leading analytical companies of the crypto world IntoTheBlockAccording to Lucas Outumuro, head of research, on-chain some indicators suggest that the current downtrend of the crypto market may not be as brutal as past bear markets.

Sharing a new analysis, Outumuro admits that “it’s getting harder and harder to pretend we’re not in a bear market.”

Outumuro noted that the total crypto market cap has dropped 57% compared to its all-time high of nearly $3.07 trillion last November, with key indicators falling less than previous bear markets.

“As a high portion of demand comes from speculation, it is normal for transaction fees to drop drastically as trading sentiment declines in bear markets. However, staying higher indicates higher demand.

bitcoin, daily transaction fees averaged over $500,000 in May 2022 compared to $130,000 in May 2018. Ethereum and other crypto assets reflect the same pattern of less pronounced declines in on-chain activity than previous bear markets.”

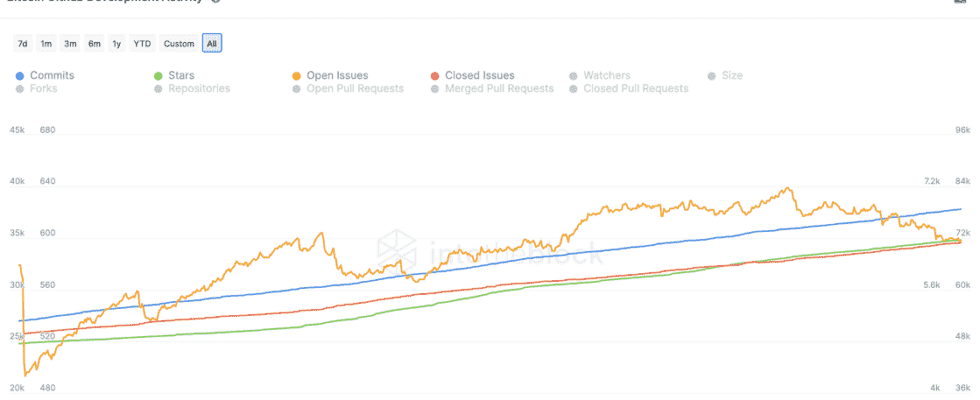

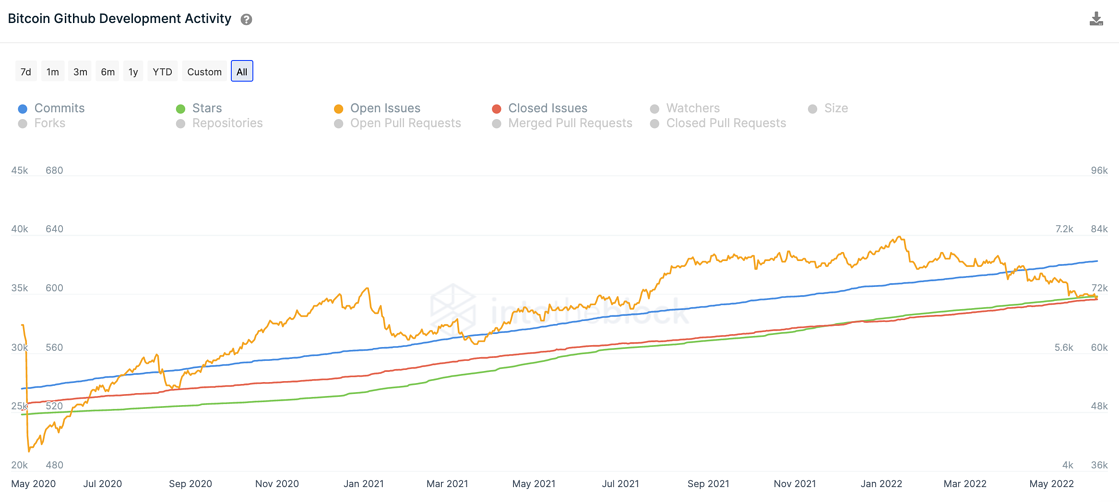

According to Outumuro, both Bitcoin (BTC) and Ethereum (ETH) show consistent progress in development activity despite the recent bearish trend.

“Commitments to the Bitcoin network have increased by over 50% over the past two years as developer efforts have continually improved. This has been one of the few leading indicators for growth in crypto as it is an open source ecosystem and relies on developers contributing globally for the continuous improvement of these networks.”

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.