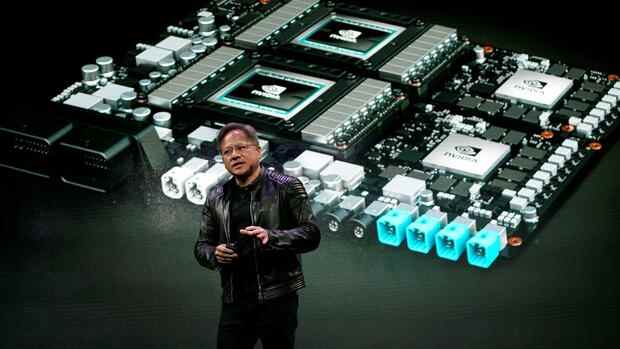

The boss and founder of Nvidia wants to enable virtual worlds with his chips. Investors believe in it.

(Photo: Reuters)

Munich In the black leather jacket and out on stage: Jensen Huang feels comfortable in the light of the spotlights. For the conditions of the chip industry, the electrical engineer from Silicon Valley is a rampage pig. Before the pandemic, the Nvidia boss always jetted to Munich in autumn to present the latest achievements of his company to customers and partners. This Tuesday, the group owner presented his new products for the second time in a live stream – this time supported by his digital counterpart.

The 58-year-old placed the avatar in a virtual children’s room – and that was no coincidence. The billionaire always explains the complex technology with almost childlike enthusiasm.

An enthusiasm with which he casts a spell over investors: Nvidia is now worth around 770 billion dollars on the stock exchange; that is more than three times as much as world market leader Intel. Since the start of the year, Nvidia has surged more than $ 400 billion, and shares made a jump on Tuesday as well.

The course has climbed by around half since the beginning of October alone. Since the beginning of the year, the increase has even been a good 130 percent. For comparison: The Philadelphia Semiconductor Index of the largest semiconductor stocks in America only gained around 30 percent in the same period.

Top jobs of the day

Find the best jobs now and

be notified by email.

There is a reason for the steep rise in the share price: like no other CEO in the chip industry, Huang has always managed to translate his announcements into action.

In the end, however, the graphics processor specialist could not save himself from orders. In the second quarter of the fiscal year, which ended on August 1, revenue shot up 68 percent year over year to $ 6.5 billion. Profits have almost quadrupled to $ 2.3 billion. Huang will present the latest results next week.

The company from Silicon Valley is by far the most valuable chip manufacturer in the world.

(Photo: Reuters)

Huang wrote a story like a management textbook. On his 30th birthday, he founded Nvidia together with two partners. With its graphics chips for computer games, the company rose within a few years to become a fixture in the semiconductor industry. In 1999, the married family man put his company on the stock exchange.

In the meantime, Nvidia has long been a serious competitor of Intel and AMD in the business with processors for data centers. Huang is also pushing his chips into cars and is relying heavily on applications for artificial intelligence. His most important customers in Germany include car manufacturers such as BMW and Mercedes.

The electrical engineer still has big plans. Since autumn 2020 he has been trying to swallow the British chip designer ARM. The deal, in which Nvidia wants to pay the ARM owner Softbank 40 billion dollars, would be the largest in the industry to date – and would significantly shift the balance of power in the semiconductor industry.

Nvidia has to worry about a billion dollar deal

The guards are therefore skeptical. The responsible British authority CMA spoke in the summer of “significant competition concerns” and therefore wants to take a close look at the deal. The EU also has concerns. It is feared that the merger “could lead to higher prices, less choice and less innovation in the semiconductor industry”.

On Tuesday, Huang said nothing about the transaction. Instead, he concentrated on the current and future sales drivers of his group. He promises quick success, among other things, with new chips for high-performance data centers.

The virtual worlds, on the other hand, will only gradually become important financially. “Metaverse” is the latest buzzword in Silicon Valley, at least since Facebook changed its name to “Meta” in October. It is about setting up a digital environment in which users can move very realistically. Huang means the same thing, but speaks of the “omniverse” that he wants to make possible with his semiconductors. This is already possible today with digital twins of real factories.

The analysts have no doubt that Huang’s business will continue to grow. According to the financial agency Bloomberg, Nvidia is rated at 66 times the annual profit expected by analysts. Of the ten values in the Nyfang + Index, only Tesla is more expensive. The stock market barometer includes Apple, Facebook and Google, among others.

Meanwhile, the online speech was well received by investors. In pre-trading in New York, the share price climbed more than four percent to around $ 322 – a new record.

More: Europe’s chip manufacturers are investing heavily – but delivery bottlenecks remain