Recent data has revealed that retail investors holding Bitcoin (BTC) have reached an all-time high and continue to increase.

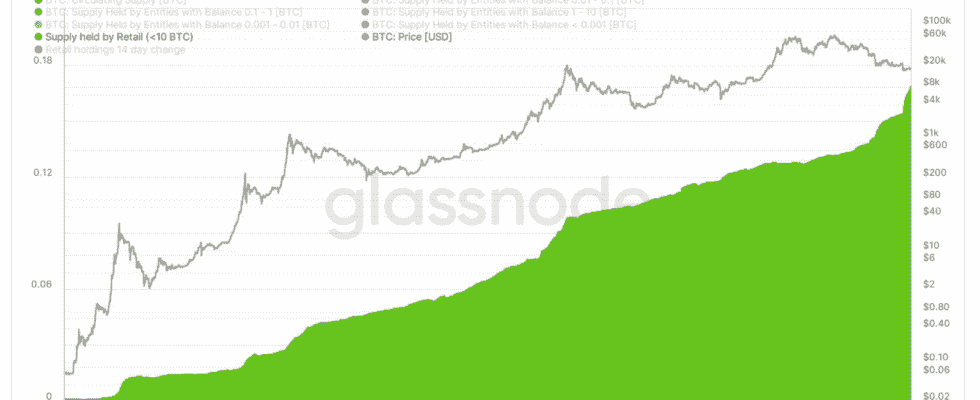

On-chain analytics platform glassnode approximate total circulating supply of Bitcoin, according to data provided by 17%is now in the hands of retail investors. In the aforementioned data “retail” investors, identified as 0-10 BTC holding small investors represents. This figure is in early 2020. %12It started to increase exponentially in 2022 when it was below .

Among other periods when retail accumulation is intense, 2013 from the end 2014 the process up to the beginning and 2017 There are endings. These periods are every time for Bitcoin. end of bull market/beginning of bear market indicates the period. Today, the increase in these data in the deepest points of the bear market differs from the previous data.

In addition, the number of “different” retail addresses holding Bitcoin has steadily increased over the process. Busted in commenting on data Reflexivity Researchrenowned analyst Will Clemente shared in the tweet“It’s not perfect yet but for a 12-year existence it’s solid and definitely heading in the right direction” he said. A Glassnode chart shared by Clemente shows the percentage of Bitcoin supply held by retail investors. Climbing steadily since 2011 confirmed that.

in November 2020 Bloomberg In a report shared by, all wallets found were only %2of all Bitcoin 95%It was alleged that he controlled the But this report was wrong. The aforementioned data provided by Bloomberg did not take into account the difference between individual and wallet addresses, including exchange addresses that can hold Bitcoin on behalf of thousands or even millions of different users.

on the other hand IntoTheBlock The data provided by Bitcoin revealed that the dominance of the single whale on Bitcoin was broken over time. 100 BTCSingle wallet addresses above . 69.5% level in 2022 59.8% decreased to levels.