Good morning dear readers,

Economics and popular sentiment are nowhere near as far apart as when it comes to rising salaries. The employee thinks: “Finally more money”. The national economist thinks: “But the wage-price spiral!”

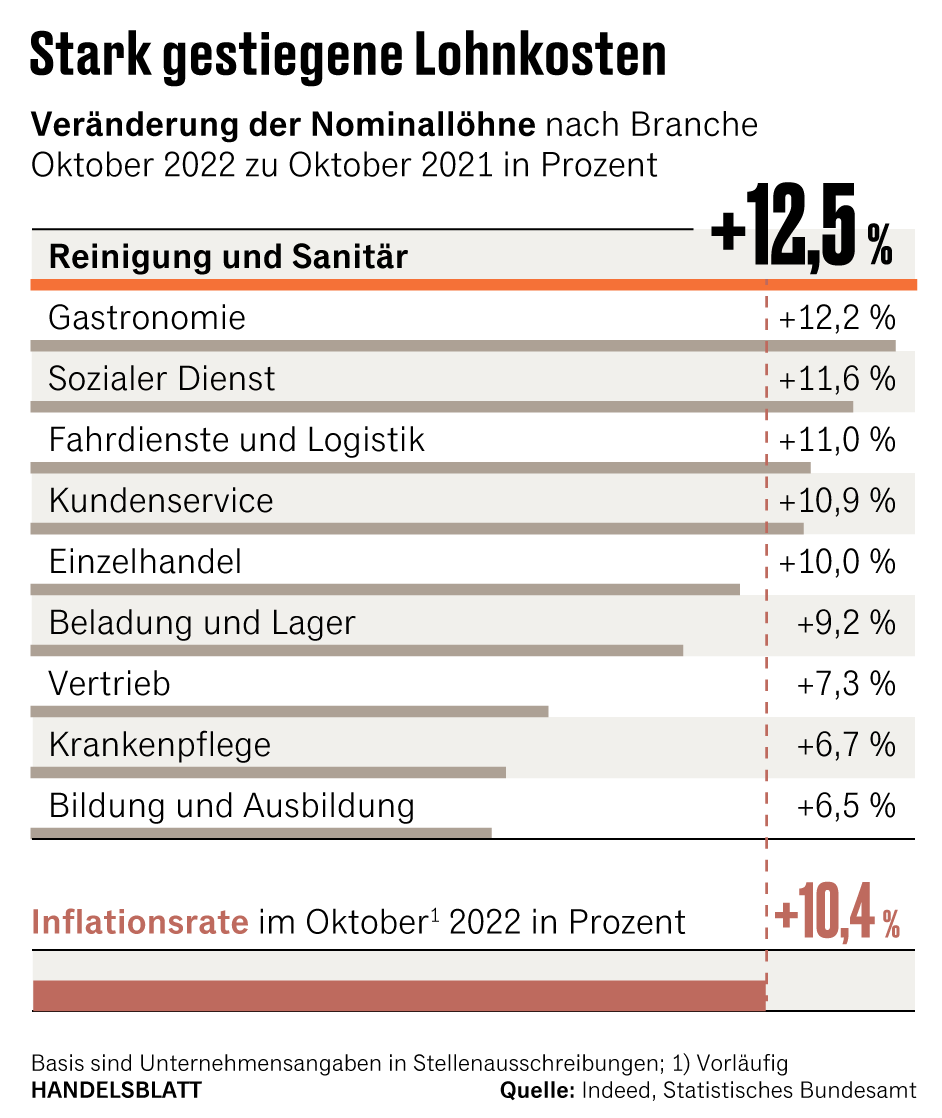

Salaries are rising, at least in nominal terms, and by a lot. Companies in Germany had to pay an average of 7.1 percent more for wages and salaries in October than a year ago. This is the result of an evaluation by the Indeed job platform and the Irish central bank, which is exclusively available to the Handelsblatt. Germany thus recorded the highest increase among the six large euro countries compared, as well as Great Britain. In France, for example, wages and salaries increased by five percent, in Spain only by 3.5 percent.

There is more money in those sectors in which employees tend not to drive to work in Porsches. In the areas of cleaning, gastronomy, social services, logistics and customer service, wages have recently grown faster than inflation.

Top jobs of the day

Find the best jobs now and

be notified by email.

The reasons:

- Raising the minimum wage to twelve euros

- Increasing shortage of labor in general

- Higher wage demands due to rising prices

But the statistics also show: For many employees there was a nominal increase in salary, but in view of the inflation of 10.4 percent recently, they still have less to live on in real terms. This probably also explains the relaxed reactions of economic researchers. Michael Hüther, head of the employer-related Institute of German Business, says with a view to a wage-price spiral: “The data does not give that.”

According to Hüther, the wage rounds in the metal and electrical industry as well as in the public sector are decisive because of the large number of employees there. Only when these deals are consistently above inflation is there a risk that wages and prices will mutually inflate. The IG Metall demands around eight percent more wages, Verdi and the civil service association want to obtain 10.5 percent more from the federal and local governments.

The last polling stations in Alaska and Hawaii are closing in these hours for the general and governor elections in the United States. After several hours of counting in many states, there is still no clear trend in the midterm elections. Neither the Republicans, who were previously slightly favored in polls, nor the Democrats, who control both the Senate and the House of Representatives, have so far been able to clearly win the “Midterms”. So far, there is no sign of a landslide victory for either party, and a final decision could take weeks.

Republican Ron DeSantis has already had great success in Florida. The 44-year-old clearly won the governor election in the populous state. DeSantis is said to have ambitions for the US presidency.

The cryptocurrency crisis has already led to a number of bankruptcies in recent months. Now it is also giving billionaire Sam Bankman-Fried a painful defeat: the founder of the crypto exchange FTX has to sell large parts of his company, as he announced yesterday. This had become necessary in order to stop a “bank run” and thus a liquidity crisis. FTX is the third largest crypto exchange in the world and is now to be taken over by market leader Binance. However, the US business of FTX, which is run as a separate company, is excluded from the takeover, emphasized Bankman-Fried. According to industry insiders, this could be important to placate US regulators.

The FTX takeover led to a new sell-off in the crypto markets. Bitcoin fell over 10 percent Tuesday night to $18,499. This also caused problems for the crypto exchange Coinbase. She reported failures in various countries. Coinbase’s share price fell more than 14 percent in New York trading.

(Photo: Bloomberg/Getty Images)

As the wails swell from the crypto-catacombs, Warren Buffett’s stock market adage comes to mind: “When the water goes down, you’ll see who’s not wearing their trunks.”

Are you one of those people who behave like a well-tempered liberal during the day and turn into a royalist of the right blood on certain nights? Then you’ll probably be sitting in front of the TV tonight “binging,” as they say in less royal circles, to the new season of The Crown on Netflix. The new episodes of the successful series deal with the most embarrassing years of the British monarchy, with the divorce of today’s King Charles III. from his first wife Diana as a highlight.

The fact that the Windsors have recovered from this disaster gives hope even to turnaround candidates like Galeria Karstadt Kaufhof.

I, for my part, won’t be sitting in front of the television with a pint of Pimm’s tonight, because above the crown is an even more sacred duty: working on the next morning briefing.

I wish you a royal day!

Best regards

Her

Christian Rickens

Editor-in-Chief Handelsblatt

hp: If you first think of the machine and vehicle manufacturer of the same name from Emsland when you hear the term “Krone”, then this date is of interest to you: On December 1st and 2nd we would like to discuss the future-oriented topics of German industry with you, together with top-class minds from business and politics. We have reserved ten presence guest tickets for Morning Briefing readers for the Handelsblatt Industry Summit. Simply register here with the access code 37D2201416GEPR.