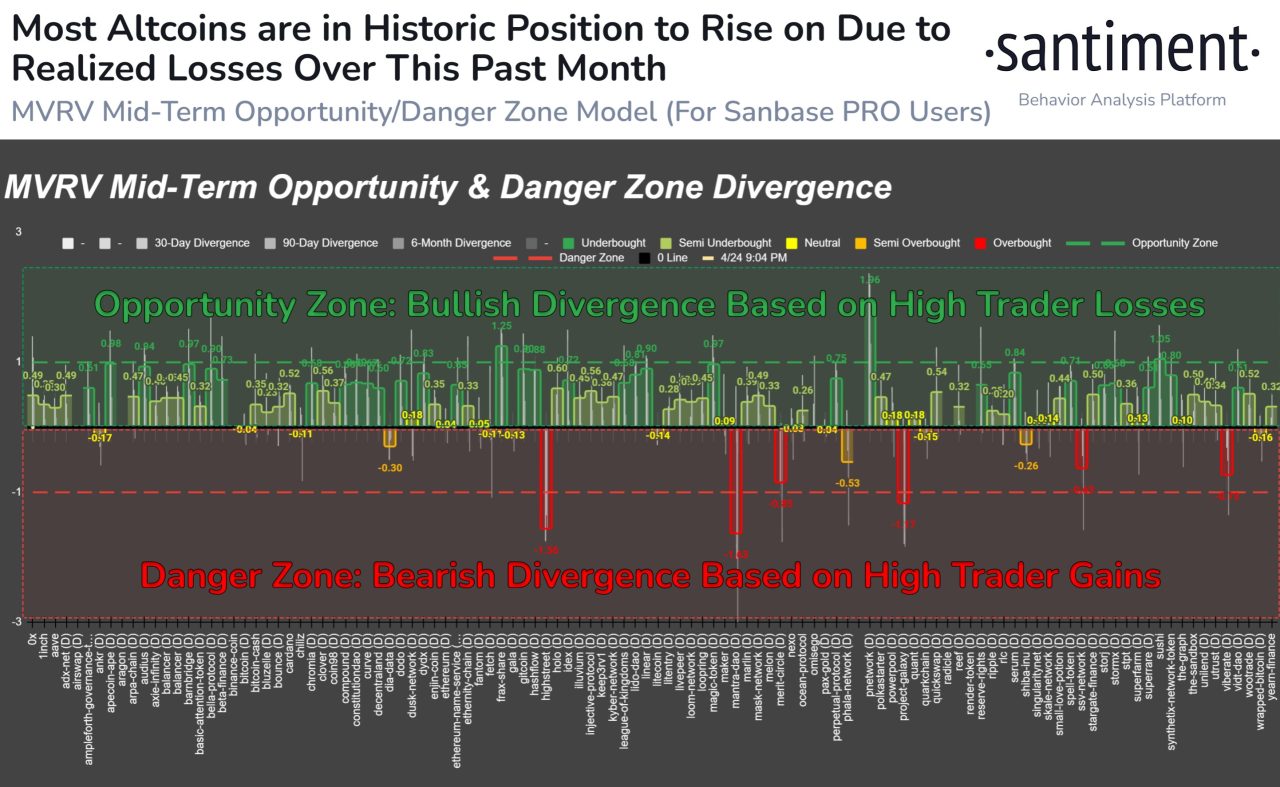

Traditionally, investors have largely focused on Bitcoin in the crypto market. However, it looks like this may change as Santiment offers a new perspective. Santiment’s report suggests that a significant shift is coming for altcoins, alternative digital assets. Based on his data, he notes that most altcoins have historically been in an “opportunity zone.”

of Santiment report, suggesting that a significant shift may be on the horizon for these alternative digital assets. According to their data, most altcoins are positioned in a historical “opportunity zone”. So, many altcoins are currently trading at historically low price levels. This indicates that these digital assets may form a suitable basis for a potential uptrend.

“Santiment’s MVRV ratio model shows that over 85% of altcoins are currently in an opportunity zone based on collective returns on 1-month, 3-month and 6-month cycles.”

Market Capitalization to Realized Value (MVRV) ratio is an important metric widely used in the cryptocurrency world. This indicator is a tool frequently used by analysts to evaluate the market condition of digital assets. The MVRV ratio compares the market value of an asset to its realized cap, which represents the total cost basis of the asset held by investors. In this way, potential opportunities for value or pressure on an asset’s market value can be better understood.

This analysis shows that altcoins are potentially growing, setting the stage for what many in the crypto community will call “altcoin season.”

“With increasing fear seeping through the crowd after all these market cap declines, it might be right to buy,” Santiment said.

These findings show the importance of the MVRV ratio when investors evaluate potentially valuable investment opportunities. However, like every investment decision, these analyzes should be evaluated carefully and comprehensive research should be conducted. Since the cryptocurrency market is often volatile and uncertain, investors must understand the risks and develop appropriate risk management strategies.

You can access current market movements here.