The new CEO prescribed the company a tough restructuring course.

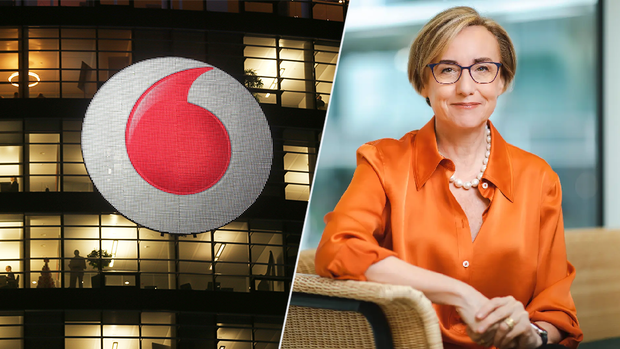

Hamburg,London The new Vodafone boss Margherita Della Valle took over a company in crisis in April. For the past fiscal year, she had to announce bad numbers again.

According to a company statement, customers are fleeing, especially in Germany – Vodafone’s most important market; the particularly relevant service sales (minus 1.6 percent) fell here, as did profit (minus 6.1 percent).

Things were similarly bad in the UK, Spain and Italy, where profits also fell. In Turkey and Africa, however, Vodafone was able to post strong growth.

Overall, however, that didn’t help much: the adjusted profit (Ebitda after leasing costs) of the entire group fell in the past financial year, which ended on March 31, by around 3.3 percent compared to the previous year from 15.2 to 14, 7 billion euros.

To get back on the offensive, Della Valle now plans to first cut costs and focus more on customer needs. Her priorities are “customers, simplification and growth,” she was quoted as saying. The prices that Vodafone had already increased should also continue to rise.

Planned job cuts

Della Valle also plans to cut 11,000 jobs worldwide over the next three years, Vodafone announced on Tuesday. That is more than ten percent of all employees.

“Our performances weren’t good enough,” said Della Valle. “We will simplify our organization to regain our competitiveness.”

In Germany, a net reduction of around 900 full-time positions is initially planned, as the local Vodafone boss Philippe Rogge had already announced in the Handelsblatt at the end of March. That number doesn’t increase with Tuesday’s announcement.

Rogge leads Vodafone’s most important single market, which accounts for around a third of total sales. In view of Rogge’s restructuring plans, Della Valle spoke of a “turnaround” for the German company.

Rogge recently had to struggle primarily with the quality problems of Vodafone’s cable network. The British in Germany lost landline connections in the last six quarters, 84,000 cable customers fled in the last three months alone.

investments in infrastructure

Rogge had already announced that he would take countermeasures with investments in infrastructure. For example, the capacity of the individual lines is to be further increased by so-called node splits, thanks to which fewer customers have to share a line. In the most recent quarter, Vodafone Germany only had 10.6 million cable contracts.

Della Valle, Vodafone’s former chief financial officer, initially took over the management of the group on an interim basis at the turn of the year and was appointed regular CEO last month. Her predecessor Nick Read had already resigned at the end of 2022.

The German business has been worrying the British group for a long time.

(Photo: dpa)

For the current financial year, the company expects the inflow of funds (free cash flow) to drop by around a third to EUR 3.3 billion. Analysts had previously expected 3.6 billion euros.

According to the information, group sales increased by 0.3 percent to 45.7 billion euros last year. Net debt fell year-on-year by around eight billion to 33.38 billion euros. Vodafone sold its national company in Hungary in 2022. The British also took in 4.9 billion euros with the sale of shares in their radio tower company Vantage Towers, which also works with 1&1 in Germany.

Vodafone also wants to “strategically” review the Spanish market. The British are under considerable pressure there from local competition from Telefónica and Orange. According to media reports, financial investors – including the US private equity firm Apollo Management – have expressed interest in a takeover. The market value of the subsidiary is said to be around four billion dollars.

Fusion speculation in the UK too

The group was already under considerable pressure from investors under ex-boss Nick Read. The state telecom group of the United Arab Emirates has gradually increased its stake and now has a stake of around 13 percent in Vodafone. The US investor John Malone and his Liberty Group recently joined the British and took over five percent.

In Great Britain there has been speculation for months about a merger of the British mobile phone business with rival Hutchison and its brand Three. The new, joint company would form the country’s largest mobile operator.

The Vodafone share had recently reached its lowest level in 20 years due to the poor business development.

More: No more “Giga”: This is how the new boss wants to rebuild Vodafone Germany