Crypto expert Dominic Basulto is assessing whether Bitcoin (BTC) can reach $100,000. The expert also examines the realism of the $50,000 predictions for Ethereum. Meanwhile, the crypto community expects a serious boost for SHIB by the end of June. A crypto analyst, on the other hand, predicts a collapse in the ETH / BTC parity.

Can Bitcoin reach $100,000?

Bitcoin is still nowhere near its all-time high of $68,789, which it reached in November 2021. However, a growing number of analysts are still saying that BTC will surpass the $100,000 mark in 2024. While this price trajectory may sound crazy, there are three compelling reasons for it to happen.

The main argument about Bitcoin is that it functions as “digital gold” and is a good store of value, especially in volatile economic conditions. Indeed, the correlation between Bitcoin and gold increased in 2023. There is another path to the magical $100,000 price level. This includes the long-term growth story around corporate adoption. After all, Bitcoin is much more than a store of value. It is also a form of payment and a potential substitute for various building blocks of the modern financial system, including the US dollar. Finally, there is a technical phenomenon known as halving. This event happens every four years and the Bitcoin community is eagerly awaiting.

So, there are several paths that the Bitcoin price could take to reach $100,000. While the price target may sound absurd, especially given the current macroeconomic environment, the potential is certainly there. Of course, there are also wildcard factors like the Securities and Exchange Commission (SEC) that could take action to regulate Bitcoin at any moment. Also, not to forget the Federal Reserve, which has demonstrated its ability to hit the price of Bitcoin by simply raising interest rates. However, I remain bullish on Bitcoin both in the short and long term. While it is certainly a volatile digital asset, it has a long history of market-beating performance dating back nearly a decade. From my point of view, it is no longer important whether Bitcoin will reach a price of $100,000, but when.

Can Ethereum reach $50,000?

Given Ethereum’s performance this year, some investors are now recalibrating. It also sets more aggressive price targets for the token. Finally, New York-based investment firm VanEck has set a dizzying $50,000 price target for Ethereum by 2030. Considering the current price of Ethereum, this represents a return of more than 25x. So how realistic is this?

VanEck is very aggressive in its growth assumptions for Ethereum. For example, VanEck currently forecasts revenue to increase 50x for the “metaverse, social and gaming” category in a bull scenario. Considering that the Metaverse investment thesis has completely collapsed in the last 18 months, it seems wrong to count on massive growth in this category. Also, it seems short-sighted to me not to take into account the potential to break the dominance of Tier 1 opponents. Moreover, it is important to keep in mind the risk of regulation. If the SEC decides that Ethereum is a security, it will pose a major risk to Ethereum’s business model.

Simply put, a $50,000 price prediction is too aggressive. Remember: The all-time high price for Ethereum is below $5,000. Also, Ethereum has shown real weakness in breaking past $2,000 this year. However, I am still in an uptrend on Ethereum both in the short term and the long term. Ethereum is a highly diversified crypto with exposure to every sector of the Blockchain world. But I’m recalibrating my expectations for Ethereum to keep it as realistic as possible.

SHIB poised to end June with 64% gain

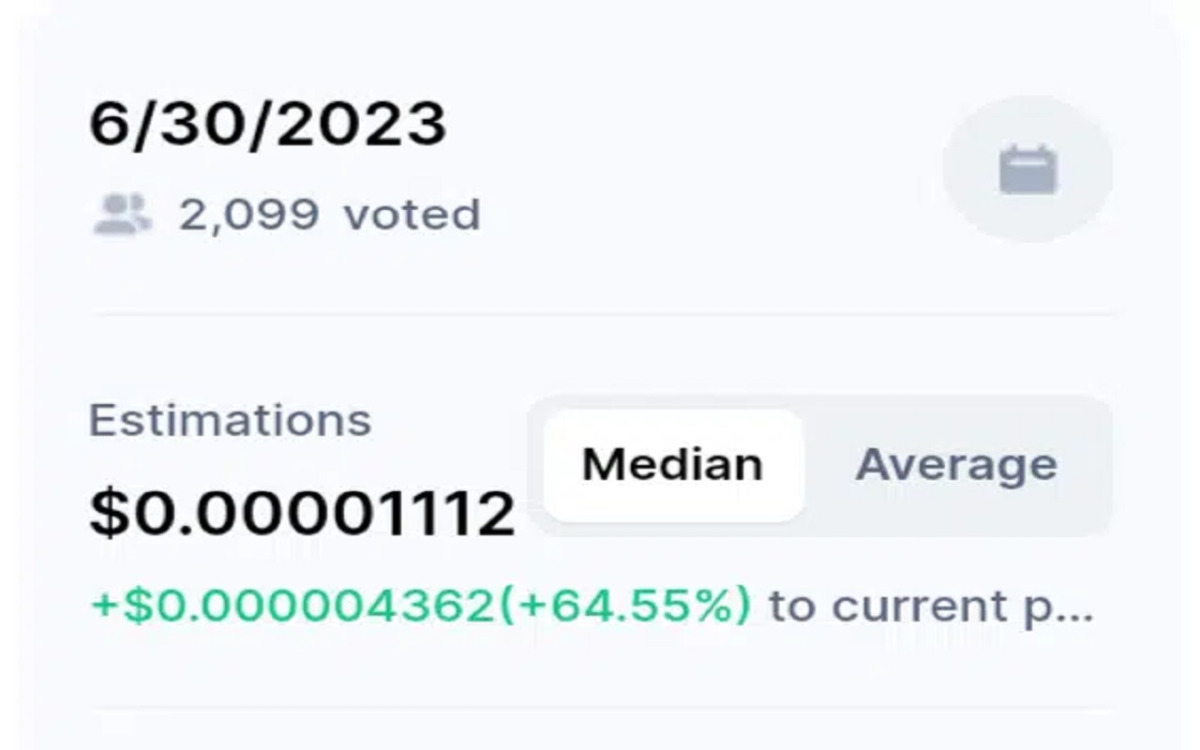

cryptocoin.comShiba Inu (SHIB) fell below psychological support of $0.00001 on May 6th. The asset has since failed to recover the $0.00001 level. However, the CoinMarketCap crypto community predicts that SHIB will end June with $0.00001112. This shows that it can make a gain of 64% from its current value.

It’s worth noting that the Shiba Inu has continued to record lower highs and lows since dropping below $0.000010 on May 6. SHIB lost the $0.000009 level on May 12, less than a week after dipping below $0.000010. The altcoin held above $0.000008 until the recent market crash from the SEC.

Recent turbulence in the market has pushed SHIB below two psychological support levels: $0.000008 and $0.000007. At the current price of $0.00000678, SHIB is a long way from the much-loved $0.000010 zone. However, these forecasts in CMC suggest the Shiba Inu will once again rise above the region.

Bcoin (BTC)‘yto opposite a possible Ethereum (ETH) collapse

Widely followed crypto analyst Benjamin Cowen warns of a possible Ethereum collapse against Bitcoin as altcoin markets continue to show signs of weakness. The analyst predicts that the ETH/BTC pair will drop more than 45% from its current value of 0.066 BTC. Thus, he predicts Ethereum will decline to $1,650. According to Cowen, the ETH/BTC pair will witness a deep pullback. However, a recovery rally is possible later this year. In this context, the analyst makes the following assessment:

As I understand it, all we see in the ETH/BTC pair is a series of lower highs, at least in the short term. There is an element here that perhaps it’s time to think an uptrend is more likely somewhere below (at 0.036 BTC). And maybe we can start speculating about some kind of recovery here.

Cowen also sees no chance of a rally for ETH/BTC until he completes the corrective move. However, he still states that the ETH/BTC parity is an oscillator. He thinks he should go back here (0.019 BTC level). Regardless, the analyst is waiting for the pair to likely bounce back in the short term before understanding its eventual trajectory.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.