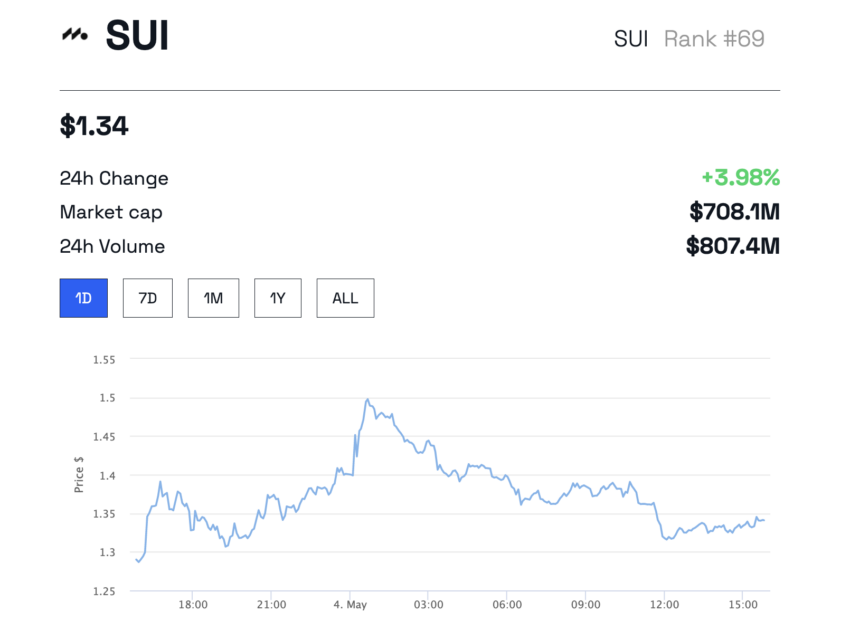

The SUI and token issuance schedule, which Turkish crypto investors also include in their portfolios, caused concerns among the community. How will the high supply affect the altcoin project? Recent data shows that a significant portion of the SUI token supply can be sold.

The SUI community is worried about a price drop!

Among the cryptocurrency community, the SUI token has been at the center of discussions since last month. cryptocoin.comAs you follow, the altcoin project has recently launched main-net. Later, the community worried about the price drop due to the token issuance program.

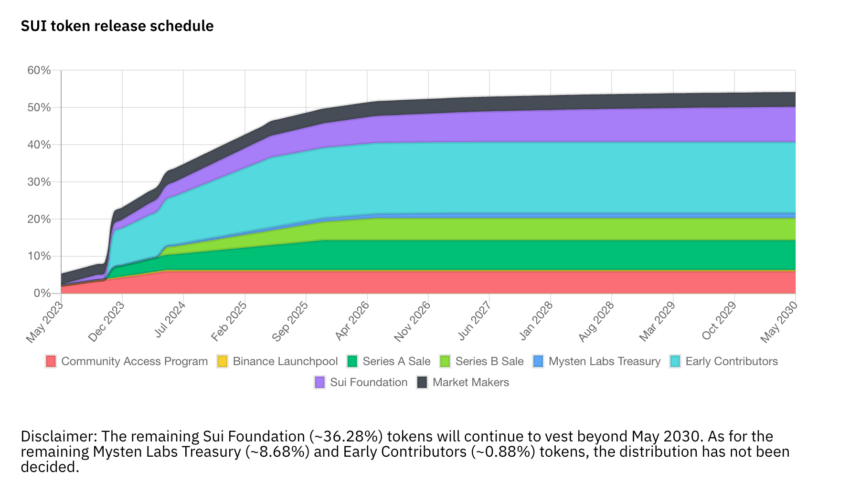

Data from Binance Research shows that currently the SUI token allocation is highly central to the Sui Foundation, early contributors and Mysten Labs Treasury. Meanwhile, these three parties hold more than 75% of the total supply.

Also, the token issuance schedule chart shows a high influx of supply from early contributors and Series A and B sales. Because from October 2023, there will be a massive increase in the circulating supply of the token. Even after May 2030, the Sui Foundation, which holds roughly 36.28% of the supply, will continue to vest the tokens.

Not touching SUI with a ten-legged pole: Community

“This is a crazy amount of early supply going into the market,” says renowned crypto analyst Miles Deutscher. A Twitter user explains the concerns as follows:

It is possible that high token emissions will lead to hyperinflation. It really opens! This lowers the value of the token. It also reduces purchasing power compared to tokens with solid emissions. This can lead to a decrease in the overall value of the network and damage to the long-term sustainability of the ecosystem.

“I love SUI but… I wouldn’t touch it with a meter pole right now,” another Twitter user says. In contrast, some community members are “looking forward to buying SUI cheaper.” Meanwhile, the altcoin price has dropped by around 40% after its main-net launch.

66% of the token supply can be sold! How will altcoin price be affected?

Recent data reveals that market makers (MMs) hold about 66% of the circulating supply. This development raises concerns among investors and traders about its potential impact on altcoin price and market dynamics. SUI has allocated about 4% of its total supply to MMs. This adds another 400 million tokens to the circulating supply. However, some observers suggest that the actual number of tokens allocated is closer to 288 million. This means that MMs have about 54% of the circulating supply.

The initial public circulation of SUI tokens was around 200 million, due to vesting programs implemented by exchanges such as OKX and Kucoin. After all, most of the circulating supply is held by MMs who must sell their holdings to hold their option positions. This concentration of MMs raises concerns about its price and potential impact on market dynamics. If a significant percentage of the supply is sold, price volatility may increase. This would potentially have a negative impact on the value of the token. The case with altcoin highlights the importance of understanding token allocation and supply dynamics when evaluating cryptocurrencies.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.