Monero (XMR), has become the most preferred crypto asset, especially by hackers using ransomware. A new study published by CipherTrace has revealed the trend in ransomware in 2021. The study titled “Current Trends in Ransomware” talks about the increasing trend of ransomware in the crypto ecosystem.

Monero is the New Favorite of Ransomware Hackers

CipherTrace analysts have detected a growing pattern in recent ransomware attacks. Many groups have been found to use privacy coins like Monero (XMR). It is thought that groups tend to use these coins for their increased anonymity compared to Bitcoin.

The report sheds light on the same issue as this example:

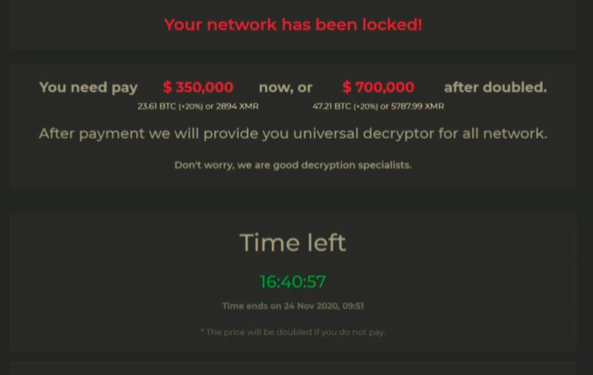

“DarkSide (the hacker group behind the US Colonial Pipeline attack) accepts both BTC and XMR but charges a 10-20% higher price for payments in BTC. This can be seen in the image below with a note saying “(+20%)” for BTC, below “$350,000” and “700,000”. In other cases, CipherTrace analysts only observed +10% premiums.”

Recently, a group called Everest Ransomware was also alleged to have hacked the US government. After an unsuccessful negotiation, the group decided to sell the data for $500,000 in XMR alone.

With the increase in efforts to prevent security breaches, new trends have emerged. Double extortion has drastically increased where attackers threaten to spread encrypted data. Between 2020-2021, the number of such attacks increased at least 5 times.

What’s the Latest on the XMR Front?

Monero has been on the rise since the end of February. Despite the failure of flagship currencies like Bitcoin and Ethereum to maintain their highs in 2022, XMR price continued to rise.

According to Bloomberg, many XMR holders have started withdrawing from major exchanges. The movement was later called “Monerun”. According to a post on the token’s private subreddit, the move away from exchanges is designed to create an intentional short-term jam.

According to a post shared by Reddit user “bawdyanarchist”, “The Monero community has a loose consensus that many exchanges do not hold all the XMR customers buy.”

According to the Reddit user, the pullback is aimed at forcing these exchanges to buy real tokens, and the goal in this move is to push the price of Monero much higher.

The rise of the Monero price is clearly visible on the price chart, with it reaching its highest figures since November 2021. XMR has managed to surpass $275 twice in its bull run and it looks set to push the resistance line above $300 in the coming weeks.

The RSI value also suggested bullish activity where the index value has consistently remained in the overbought zone. The value was fixed at around 70 at reporting time, which represents a large demand for the currency. It looks ready for more bullish waves as we complete April.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.