As the Bitcoin price is stuck in the $30,000 region, “miners are actively selling their Bitcoin reserves.” The CryptoQuant report says ‘this is not a random event’ and could lead to bottoms.

Miners liquidate their reserves: Bitcoin price prepares for bottom test

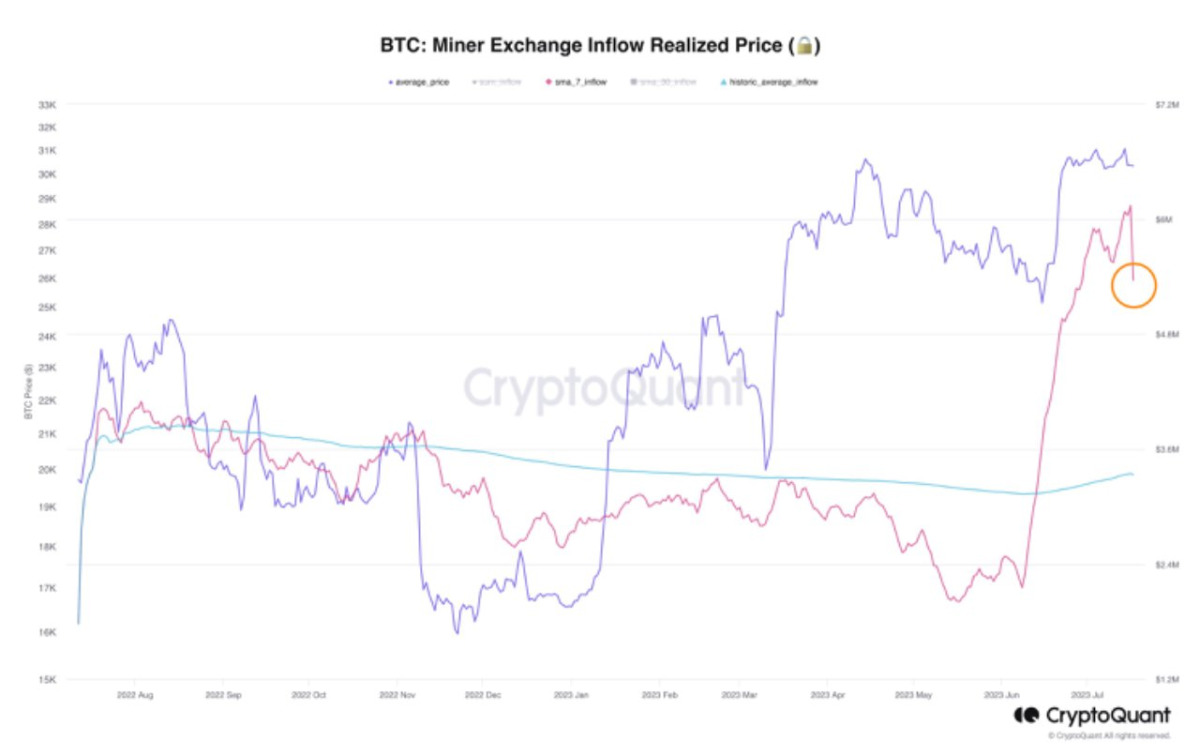

Crypto analytics firm CryptoQuant has warned that Bitcoin is facing renewed selling pressure as miners actively sell their BTC reserves. According to the report, miners have been draining their reserves since July 6. These sales push the balance into negative territory and put downward pressure on the market.

According to CryptoQuant, if the selling pressure from miners continues unabated, the Bitcoin price could potentially test the $27,000 to $25,000 range. This prediction is supported by the occurrence of a regular bearish divergence in the percent change histogram.

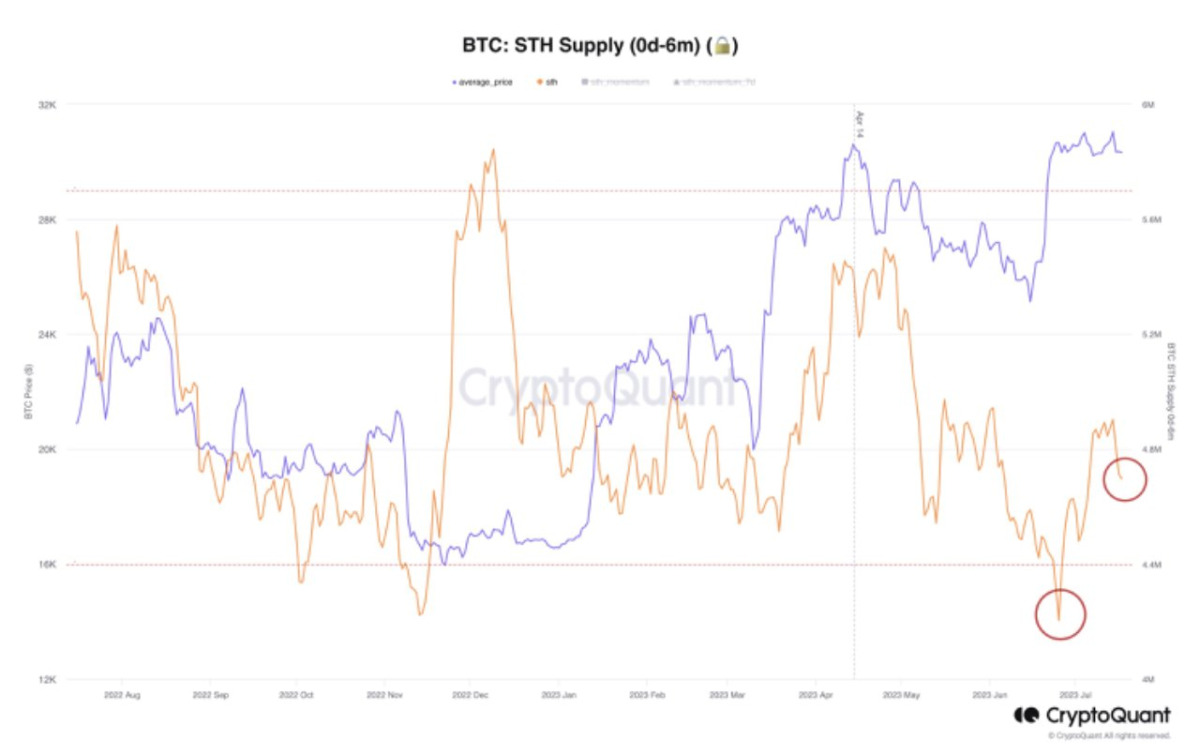

Short-term traders force price to stay in a tight range

In the report dated July 17, CryptoQuant said that the BTC price stuck in the $30,000 region has speculative roots. These investors have been selling since the Bitcoin price broke the critical resistance.

CryptoQuant contributor Axel Adler said, “This group is actively selling Bitcoin reserves. Thus, it creates a significant pressure on the market. “This shows that short-term investors are actively liquidating their holdings, thus locking in profits.” The investor group in question STHs are wallets that hold funds for six months or less.

For Adler, miners are gearing up for the next Bitcoin halving in 2024. This indicates another factor affecting price performance today. “Miners are actively selling their Bitcoin reserves,” Adler summarizes, adding:

This is not a random event; We saw the highest sales last year. This is linked to the upcoming halving event, where the Bitcoin mining reward has been cut in half. Miners need liquidity to invest in new equipment to stay competitive.

Bitcoin price is actually pretty stagnant

Bitcoin volatility remains at its lowest in terms of historical context. CryptoQuant reveals a clear slowdown in trading activity since April. This is because traders taking profits continue to wait for a more significant breakout.

Data from TradingView shows that the historical volatility index of Bitcoin is 14.77 as of July 18. This is well below its 2023 peak.

“All these factors together make up the current picture of the Bitcoin market where the price seems ‘tucked’ in a narrow range,” Adler says. “However, as always with cryptocurrencies, changes can happen very quickly. For this reason, investors should closely monitor on-chain metrics to be aware of market changes,” he adds.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.