metaverse and metaverse assets have become one of the recent favorite areas of the crypto ecosystem and an incredible investment opportunity tokens for investors. However, the “Majority of Metaverse Tokens October” rally has gone through a correction phase. If these markers manage to stay at these highs, the bulls can continue their rally for December.

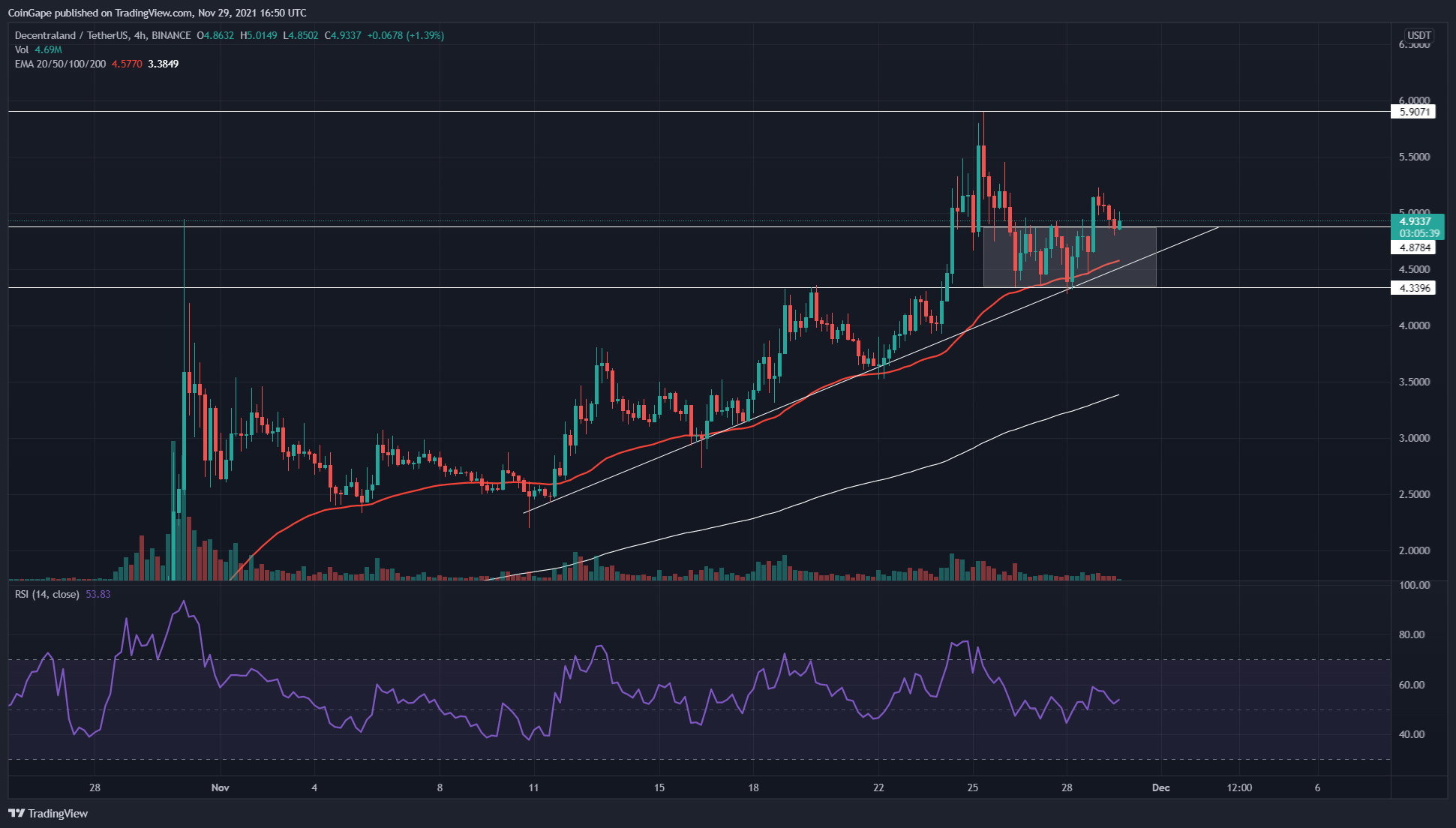

MANA/USD Chart: 4-Hour Timeframe

Decentraland (MANA)Recently, it managed to break above the all-time high of $5. The token price managed to rise a little and faced strong resistance at $5.9. Unable to break this resistance, MANA experienced a small withdrawal.

The token price declined to a good support level of $4.33 and after showing triple bottom support from this level, the price regained the $5 resistance again. The price is currently retesting this level to check for proper support, which should help the token retake the $5.9 resistance.

Moreover, the technical chart shows that MANA price has received strong dynamic support from the ascending trendline and 50 EMA lines, maintaining the uptrend for this token.

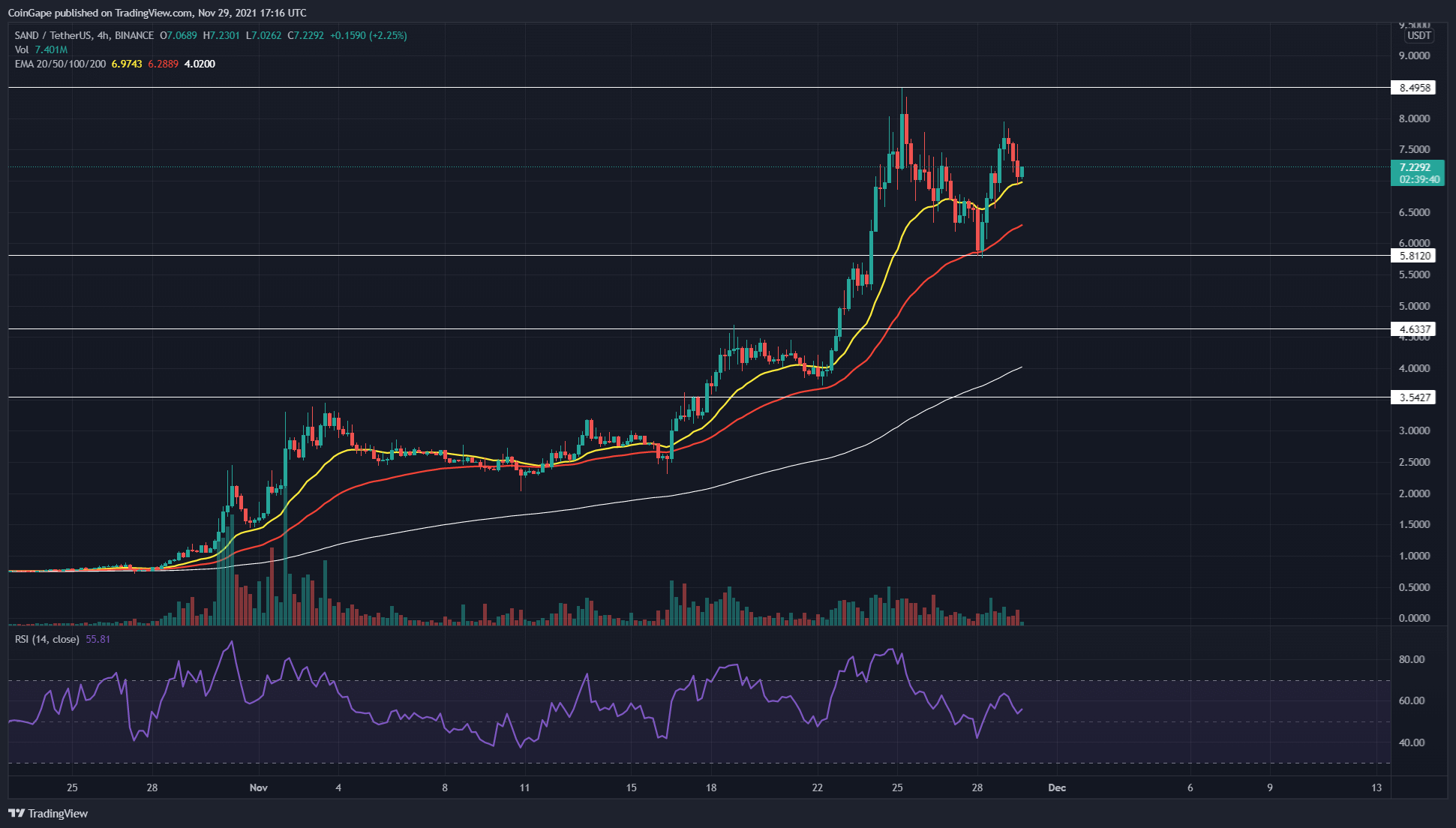

SAND/USD Chart: 4-Hour Timeframe

The Sandbox (SAND) The token price has risen notably on its chart, taking it to an all-time high of $8.5. After a strong rejection from this resistance, the token entered a pullback phase that brought its price down to $5.81.

The token price got enough support from this level and showed a V-shaped recovery on this chart. Trying to continue this uptrend, the token could retest the overhead resistance level of $8.5 soon. Also, crypto traders can use the dynamic support level of 50 EMA lines to sustain a strong rally in this token.

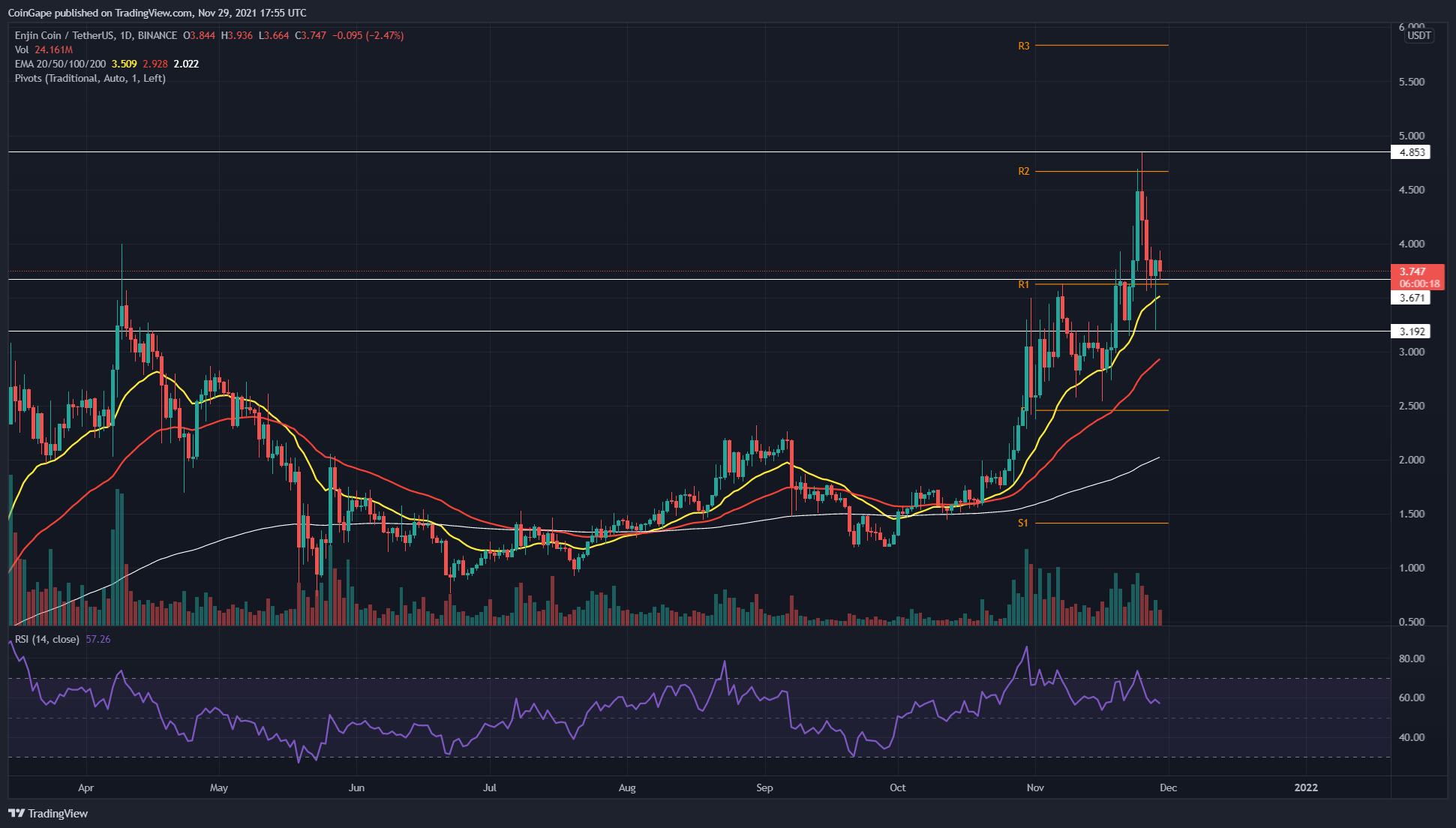

ENJ/USD Chart: 4-Hour Timeframe

Enjin (ENJ) The token price showed on November 23 that it was an excellent long-term opportunity for traders, when the price made a definite break out of the $3.6 neckline of the ‘cup’ and the trading pattern on the daily timeline chart. ENJ price traded at $4.8 before returning to that level for a retest.

If the price stays above the neckline, these traders may consider placing their funds in this token for a long trade. Also, the 20 EMA lines continue to provide dynamic support to the bullish rally.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.