Companies in the S&P 500 index, which lists the largest 500 companies in the USA, have lost billions of dollars in the last 24 hours. So what is the reason for this incredible decline?

While the effects of the Russia-Ukraine war continue to hit the whole world, the United States and European countries broke their own inflation records in the last two months. While the decision to increase the interest rate was taken to prevent inflation, these news follows a general downward curve caused.

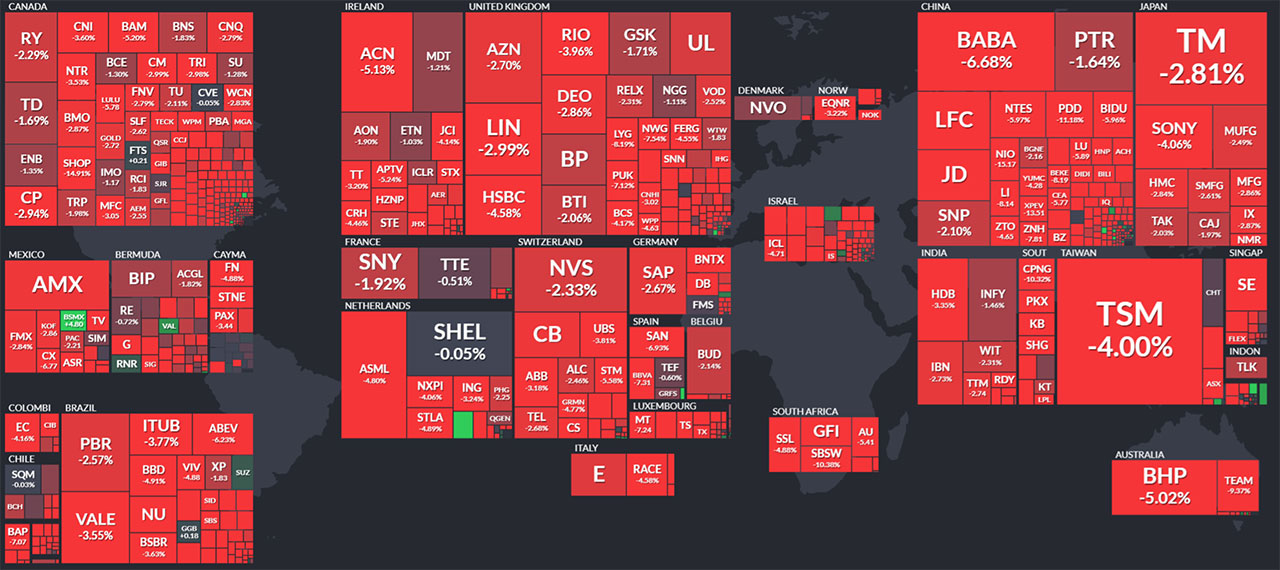

In the past 24 hours, there have been major crashes in the value of almost all of the 500 largest US-based companies. S&P 500 index, down 3.56% on the day. While the company closed, the share value of many giants such as Apple, Amazon, Google, Microsoft and Tesla fell by close to 5% or more. The table of the 500 largest companies in the USA was as follows:

The world’s most valuable companies are losing value

The last 24-hour decline of the 10 most valuable companies in the S&P 500 (by index weight)

- Apple: 5.57%

- Microsoft: 4.36%

- Amazon: 7.56%

- Tesla: 8.33%

- Google (Alphabet): 4.75%

- NVIDIA: 7.33%

- Berkshire Hathaway: 2.48%

- Meta (Facebook): 6.77%

- UnitedHealth Group Incorporated: 2.54%

- Johnson & Johnson: 1.91%

The total loss experienced by these companies, which we have only listed, in 24 hours: 620 billion dollars

The last 4 weeks showed the worsening of the situation.

The decrease experienced by the same companies in the last 1 month

- Apple: 10.45%

- Microsoft: 10.79%

- Amazon: 29.04%

- Tesla: 19.98%

- Google: 17.24%

- NVIDIA: 27.33%

- Berkshire Hathaway: 7.58%

- Meta (Facebook): 10.16%

- UnitedHealth Group Incorporated: 4.45%

- Johnson & Johnson: 0.48%

Companies all over the world, not just the United States, are bleeding:

So why are the markets falling?

The dream in the last 24 hours is that the US Federal Reserve (FED) with the decision to raise interest rates by 50 basis points. triggered. Since this decision was an expected decision, even though sales came before the announcement, sales increased with the announcement. The decision of the US Federal Reserve to increase interest rates was the largest rate hike decision made in more than 20 years.

One of the biggest reasons why the FED’s decision led to sales in the markets, a risk-free investment It was an increase in the yield on the “US 10-year bond.” Bond yield of 0.5% in August 2020, increased to 3% today. As this return increased, giant investors who wanted to earn risk-free income began to exit the markets.

RELATED NEWS