The US Bureau of Economic Analysis (BEA) has released November data for the Personal Consumption Expenditure (PCE) Price Index, the Fed’s preferred measure of inflation.

- US Personal Income +0.4% in November; (Exp. +0.3%)

- US Personal Spending +0.1% in November; (Exp. +0.2%)

- November PCE Core Price Index +0.2% MoM; +4.7% per annum

- November PCE Price Index +0.1% MoM; +5.5% per annum

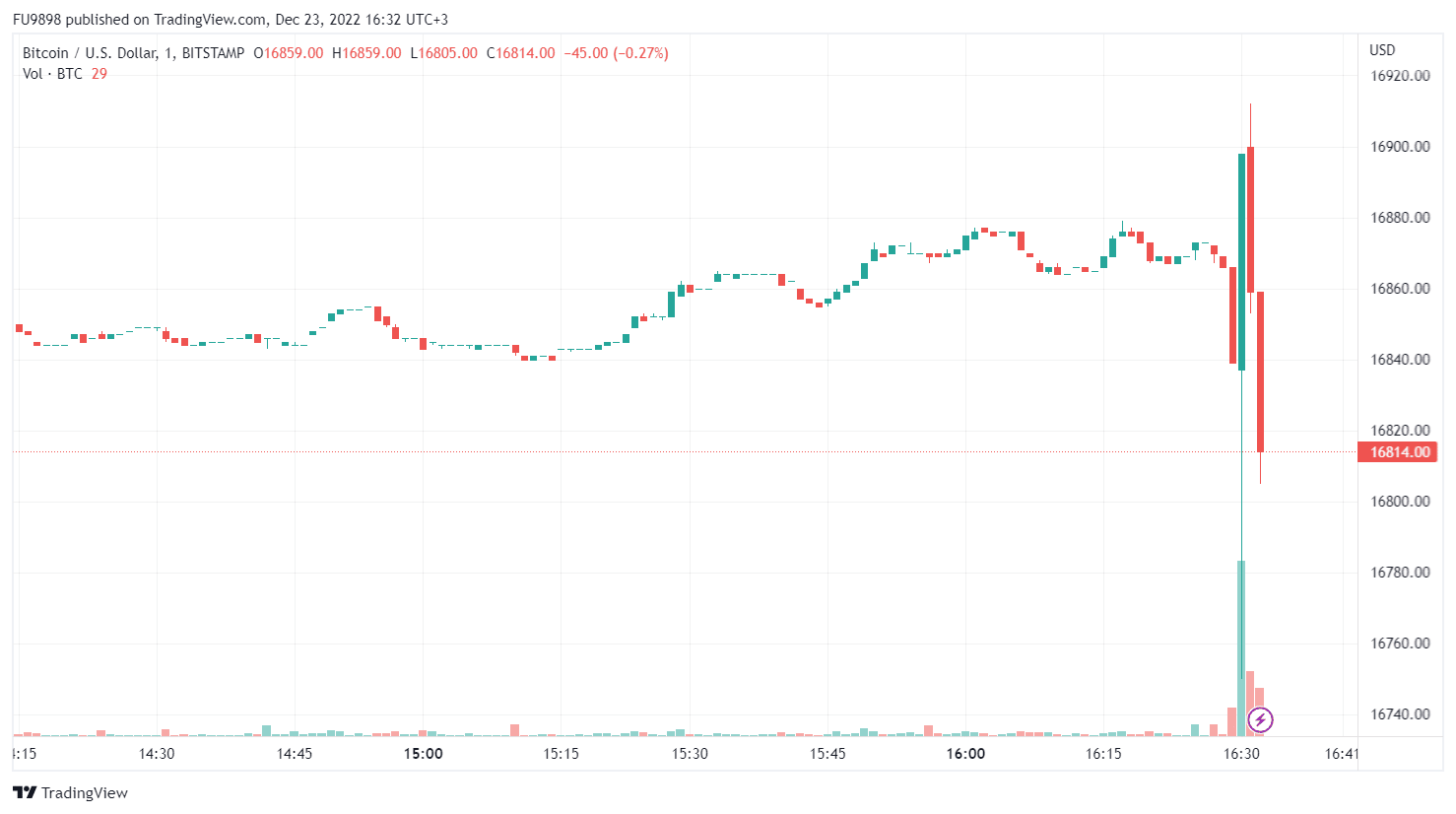

bitcoin His graph reacted to the announced data as follows:

What are the other developments in the FED and the markets this week?

Germany’s Bundesbank will release its monthly report during European trading hours.

Stock markets in the US before the holidays will operate during normal hours, but bond markets will close an hour earlier than usual. Both markets will be closed on Monday, December 26.

On Thursday, the BEA revised its annual GDP growth for the third quarter to 3.2% from the previous forecast of 2.9%. Upbeat data helped the US Dollar gain strength against its rivals in the US session.

Also, Wall Street’s main indexes suffered heavy losses, helping the US dollar hold its place as a safe haven.

The US Dollar Index, which closed Thursday with a modest rise, is moving sideways just below 104.50 in the European morning. The 10-year US Treasury yield remained flat at around 3.7%, while US stock index futures were little changed during the day.

Bitcoin is struggling to find direction as it continues to move up and down in a narrow channel just below $17,000. Ethereum traded around $1,200 for the third day in a row on Friday.

*Not investment advice.

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android and iOS Start live price tracking right now by downloading our apps!