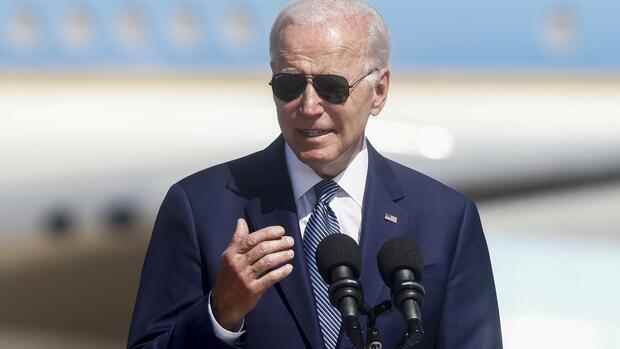

Powerless in the face of inflation.

(Photo: Bloomberg)

Denver The price increases, they just won’t let up. In June, inflation in the US climbed to 9.1 percent – significantly higher than economists had expected. This not only increases the pressure on the US Federal Reserve (Fed), but also on US President Joe Biden.

Because inflation has long since become a political problem. Americans are paying more and more for gas, rent, and groceries, and instinctively blame the president for that.

Only one in three Americans still believes Biden is doing a good job, according to a New York Times poll. There is a risk that he will become a victim of the Fed twice: in the parliamentary elections in the fall because of the prices and in the presidential election because the Fed had initiated a recession by then by reacting too late and therefore all the more harshly to the high prices. With the US politically divided, therefore, there is a lot at stake on any catastrophic inflation figure.

The Democrat had announced that he would put a “laser focus” on fighting inflation. But the government can do little. Biden’s economic advisor Brian Deese called on Congress on Wednesday to finally implement long-planned legislative initiatives.

Billion investment package is stuck

The Democrats want to invest $52 billion to bring semiconductor production to the United States. In the medium term, this would reduce the shortage of chips, which has led to higher prices for cars and many other electronic devices. But the necessary majorities are missing. The same applies to the incentives for real estate developers to create more affordable housing.

Even if the President were able to push through his plans, it would take years for the effects to be felt. Instead, Biden has to rely on monetary policymakers. Unfortunately. After all, the Fed helped put the US in this position.

And the Fed’s tools aren’t exactly voter-friendly. It will have to continue raising interest rates significantly. An increase of a full percentage point at the next meeting at the end of July is now being discussed. This will cause prices on the stock markets to collapse further and will probably also significantly increase unemployment.

All the same, the recent fall in energy costs could ease the inflationary pressure somewhat in the coming months. But by then it will be too late for the Democrats to win back voters.

Top jobs of the day

Find the best jobs now and

be notified by email.

More: New risks for the markets – star economist Mohamed El-Erian fears three scenarios