The UK Financial Times reported on January 24 that the US Federal Reserve will approve its rate hike plan in March as it works on a more aggressive course of monetary tightening, and will hold its first policy meeting of 2022 this week.

Discussions on rate hikes have been going on since December. As part of the “uncertain policy of interest rate hikes,” the global stock market and cryptocurrency market also suffered sharp declines.

According to CoinGecko data, BTC fell 30.8% in 30 days to reach 35297u In the process, do we have more suitable products to use as investors to stay on the profit side?

1 – Understanding the Leveraged ETF

The answer is yes of course. Here we will introduce a trading product with 3 years of innovative experience in the cryptocurrency space: leveraged ETF.

A leveraged ETF is a permanent leveraged product that amplifies the ups and downs of the spot price. and aims to provide permanent contracts with leveraged coefficients.

The name of the leveraged ETF transaction; It is represented by “currency + leverage ratio + buy-sell direction”, for example BTC3L/3S means Bitcoin 3 is buy/sell. If BTC price goes up or down 1% that day, BTC3L or BTC3S will go up or down 3%.

In other words, leveraged ETFs are used to generate proportionally higher profits relative to market conditions, in the example above, sell positions are likewise 3% profit.

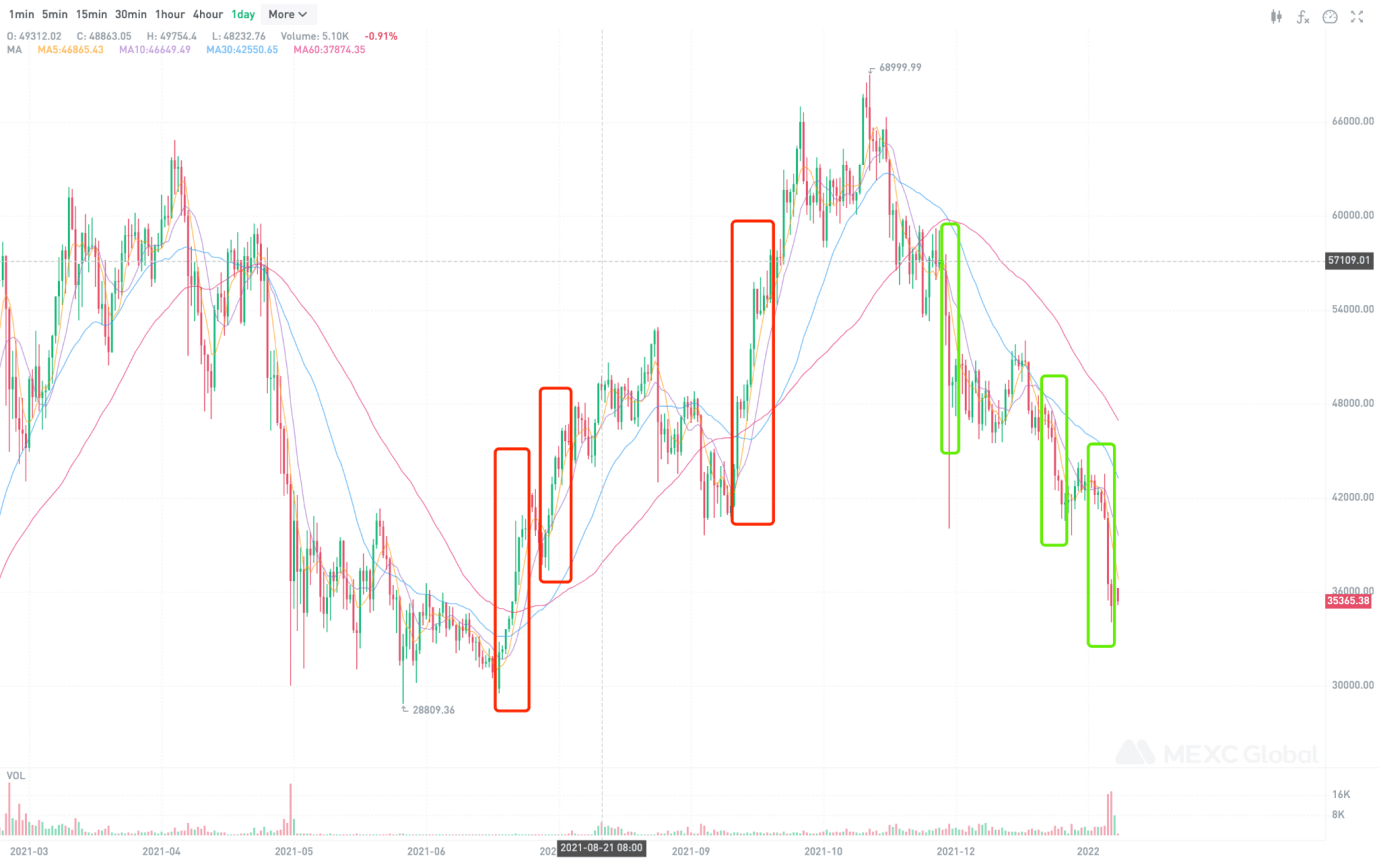

As an example, as can be seen in the chart above, BTC regressed from its high of 28890u-68999u to 35335u and the daily volatility continued. In the section marked in red, 3 times more profit can be made by buying BTC3L at a low price. Likewise, it is suitable for buying BTC3S from the area marked with green, again 3 times return can be obtained.

Overall, even if prices were to go up or down, I would prefer BTC3L more in my personal opinion, due to my personal belief and trust in the emerging crypto industry.

2. Diversification of trading currencies in leveraged ETFs

Currently, the cryptocurrency market offers buy and sell ETF products, including MEXC’s leveraged ETF and FTX, and Binance’s leveraged tokens.

Different trading platforms have different listing mechanisms and listing speeds, so the wealth and types of leveraged ETF trades available also differ.

According to the latest statistics, MEXC’s leveraged ETF offers 166 currencies and 188 trading options, making it the platform with the broadest trading categories on the internet.

It is known that the richer the trading category, the more options and the higher the chances of making profits. With its listing speed and wide range advantages, MEXC has the double advantage of starting quickly on popular projects with the possibility of leveraged ETFs based on spot performances.

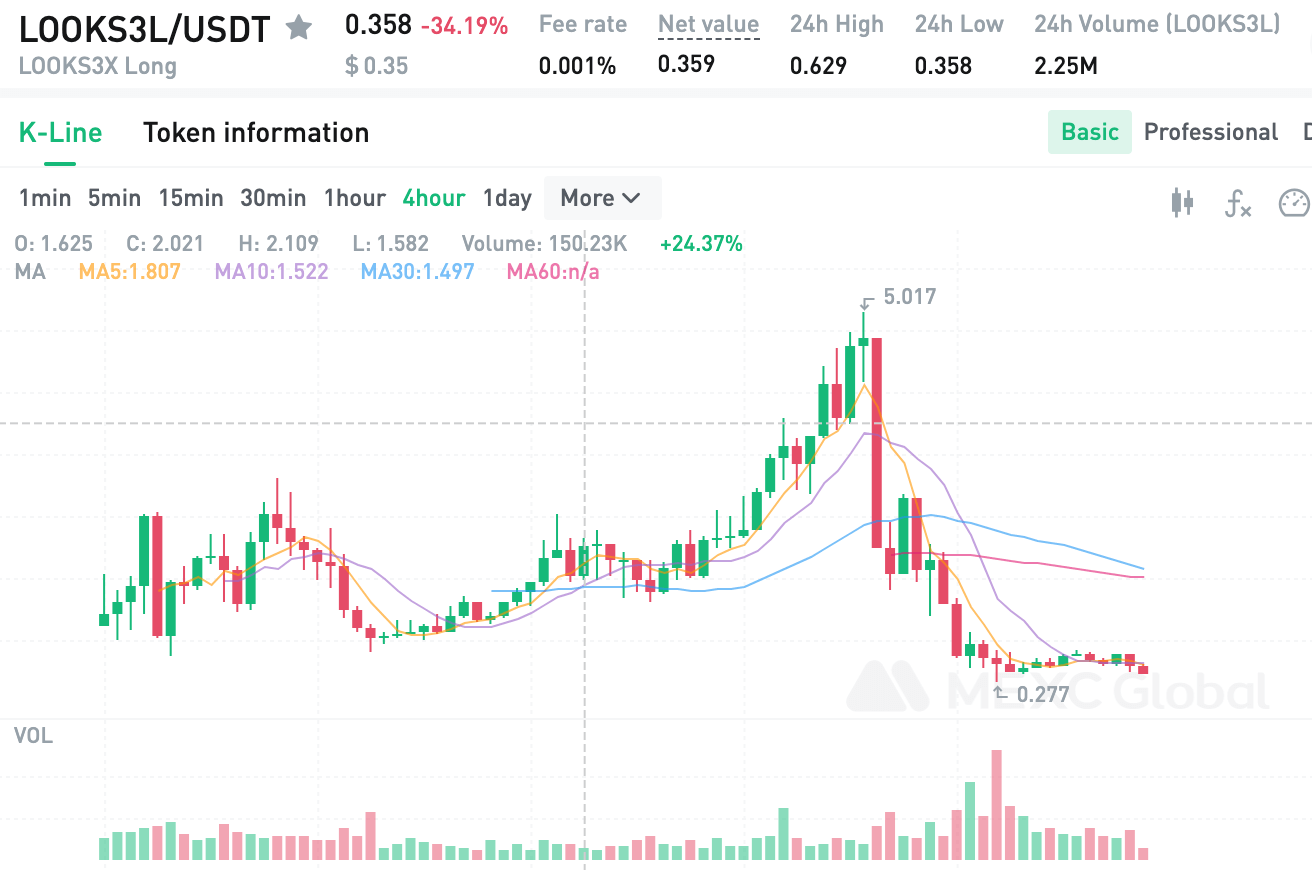

While major currencies like BTC are flat and bearish, online projects like LOOKS can give us more options.

The earning route is as follows: If spot LOOKS is purchased on January 10 at 1.67u, a 324% profit is made when the price reaches 7.09u.

But we don’t just want to make more profit, we also avoid taking higher risk like in contracts. In this case, a leveraged ETF is a good option.

On January 15th, LOOKS3L reached a low point. If currently purchased at 0.759u, compound interest can ideally make a profit of 558.7% when it reaches the top of 5u, regardless of wear and tear.

Here the spot price of LOOKS is 7.09u, for now we have to wait and see and then seize the opportunity to buy LOOKS3S to make a profit.

3. Advantages and Risks of Leveraged ETFs

With leveraged ETFs, you can do simple trades just like spot trades, which can increase your income, no need to occupy as well, At the same time, there is no need to occupy a portion of the position as margin to raise or lower the mandatory par price, capital usage rate is high and there is no liquidation rule. Therefore, the return on ETF trades is higher than on spot and the risk is lower on contracts.

The second advantage is that leveraged ETFs have a compounding effect. Due to the rebalancing mechanism of leveraged ETFs, in a constantly rising/falling market, the daily profit will be automatically transferred to the position and reinvested to earn compound interest, so the profit will be more than spot leveraged or contract products of the same multiplier.

Here is a summary of the product benefits of leveraged ETFs. But when we choose a trade, we must first understand the most basic premise, its risks.

Although leveraged ETF products are efficient in terms of risks and returns, movements or volatility in the market can introduce certain capital wear and tear costs. Therefore, leveraged ETF products are more suitable for the unilateral market.

Additionally, while leveraged ETFs greatly reduce the risk of liquidation, however, there may also be a risk of liquidation and a tendency for the net worth of the product to return to zero in case of other extreme fluctuations or dual fluctuations such as sustained rapid rise and sustained decline.

Therefore, regardless of the advantages of leveraged ETF, an innovative financial derivative, the risk of volatility is inherent in the cryptocurrency market, so investors should still be cautious.

Note: The above is for personal sharing only, not investment advice.

Disclaimer: This is a sponsored promotional post. KoinFinans.com cannot guarantee the accuracy of the content on this page provided by the relevant company and cannot be held responsible for any damages that may arise regarding the products and services on this page. Readers should do their own research before taking any action.