While you’re making your payment, you may be wondering, “What is 1-2 liras?” Do you think it is justified for workplaces to charge too much money for card payments?

Unfortunately, in the current situation, cash money has not seen its former value, so we have even started to give cards to the bagel seller on the street. Almost every payment we make by credit or debit cards This situation is with us because we can cash coins It made us see it as unnecessary.

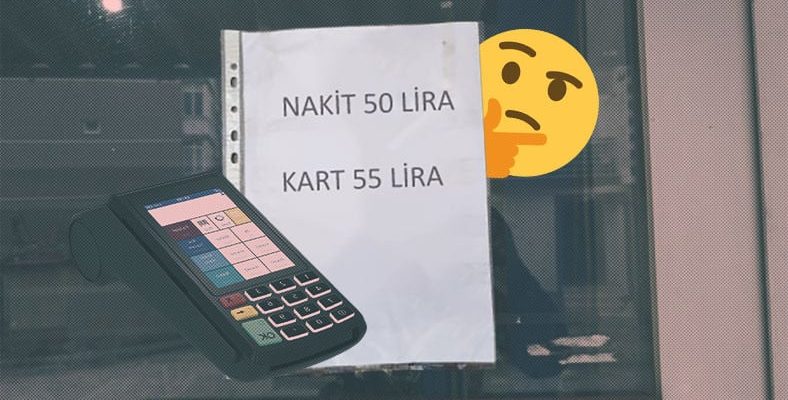

If you are a buyer, of course you can make every payment by card without having to carry cash – even if it is due to economic conditions. great convenience. But when we look at the dealer side, the card is deductions in payments welcomes us. Sellers also charge more money from buyers to reduce these deductions. So is this legal?

No, it’s not legal. Any economic crisis or situation cannot be an excuse for this.

given to businesses POS devices, allows the tradesmen to pay commissions to the contracted institution with the payment they receive from this POS. As lawyer Bahadırhan Tabak stated before, this commission amount varies from organization to organization. However, the workplace that wants to minimize this interruption, reflected the commission to the customer is happening. In other words, while the customer pays the commission debt of the workplace to the contracted organization, that money remains with the seller.

Stop and say; You may say “What is 1-2 liras worth to me? It doesn’t even have any value” and you may find this commission imposed on you to be justified, but the issue here is far beyond what we think is right or wrong. fixed by law. The law we are talking about is the Bank Cards and Credit Cards Law published in 2006.

So what is explained here?

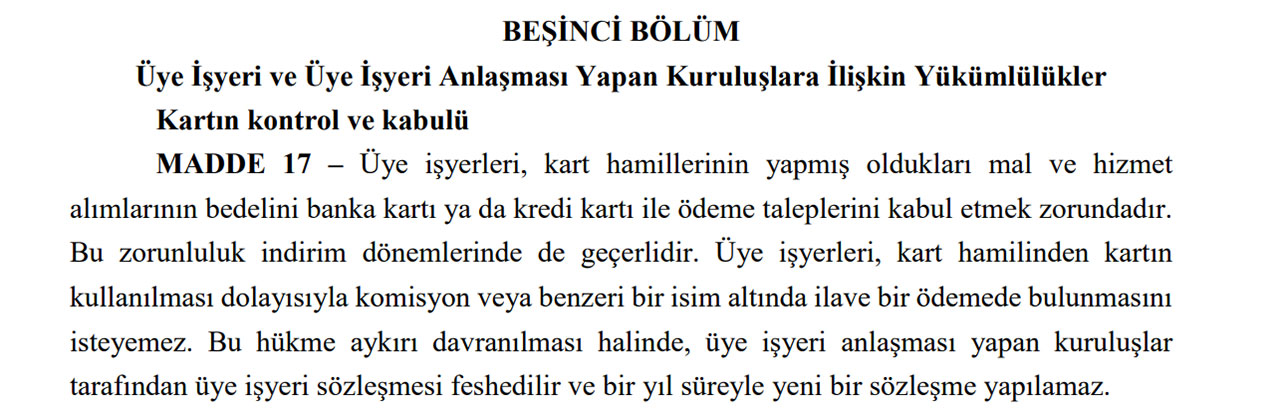

of this law Article 17explains the situation as follows:

“Member businesses accept requests from card holders to pay for their purchases of goods and services by debit card or credit card. has to accept. This obligation also applies during discount periods. Merchant merchants are under a commission or similar name due to the use of the card by the card holder. cannot ask for an additional payment. In case of non-compliance with this provision, the member workplace contract will be terminated by the organizations that have signed a member workplace agreement and a new contract cannot be concluded for one year.”

If the contracted organization that provides the POS device detects this situation, it can terminate the contract.

If this happens, there is no way to get a POS from a different organization. Because, as it is stated in the law, workplaces can get a new license for a period of 1 year. they can’t make a deal. Also, not being able to buy a new POS device is not the only problem. To the business owner judicial fine is being cut off. As we said before, you may find this justified, but when purchasing a POS device, the workplace already makes an agreement for this. This commission is then reflected to you.

It is up to you whether to prevent this or not:

To prevent this, Bahadırhan Tabak To the Consumer Arbitration Committee It says you should apply. According to Tabak, the bank that has severed its relationship with the business has no obligation to pay the consumer. In order to get your own refund, you must apply to the Consumer Arbitration Committee with evidence such as a receipt.

As we have repeatedly stated in the article, the problem is withdrawing 1-2 lira extra It’s not important whether it is or not. These amounts, which are already insignificant to us, can grow considerably at the end of the month. In this case, while putting extra unfair profit into the seller’s pocket, we are simultaneously paying off the debt to the organization. What are your thoughts about the increase in commissions and the customer paying this amount?

RELATED NEWS