Jurrien Timmer, Fidelity’s global macro director, shared his views on Bitcoin (BTC), the leading crypto asset struggling close to the $20,000 level.

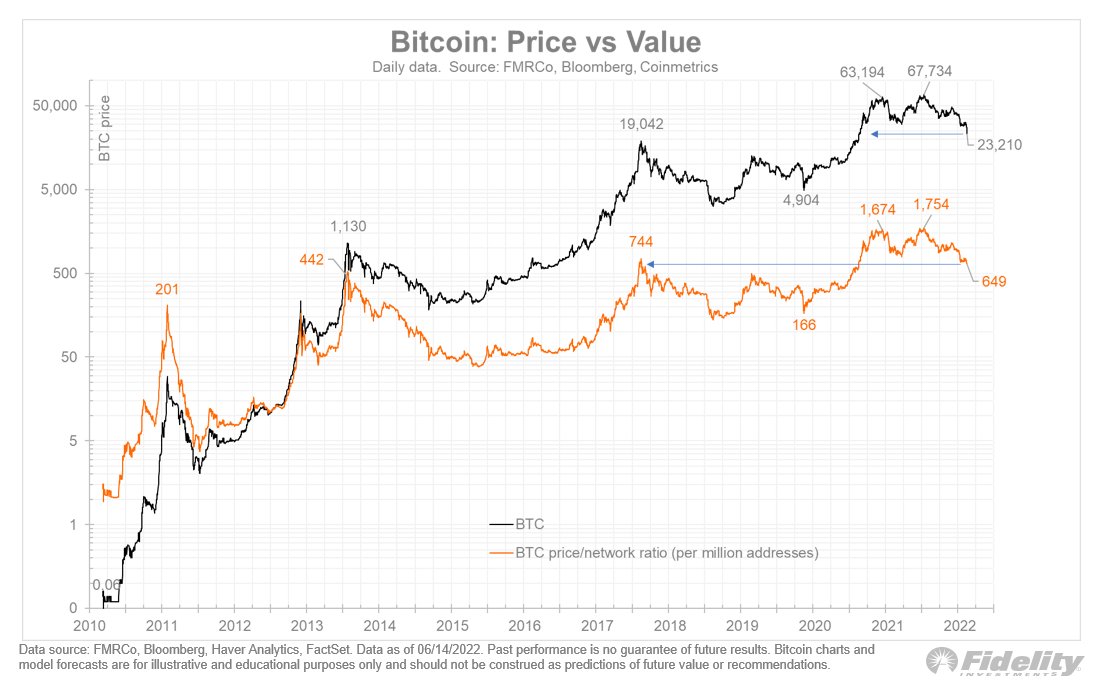

Timmer told his 126,000 Twitter followers that BTC is currently significantly undervalued, given the Bitcoin price-earnings ratio. The P/E ratio is a valuation ratio used to measure the price of a stock relative to its profit. The analyst calculates a company’s earnings by the number of users on the Bitcoin network. compared.

“Is BTC cheaper than it looks? If we consider a simple “price-to-earnings ratio” metric for BTC as the price-to-network ratio, it has returned to the 2017 and 2013 levels, even though the BTC price only returned to late 2020. Valuation is often more important than price.”

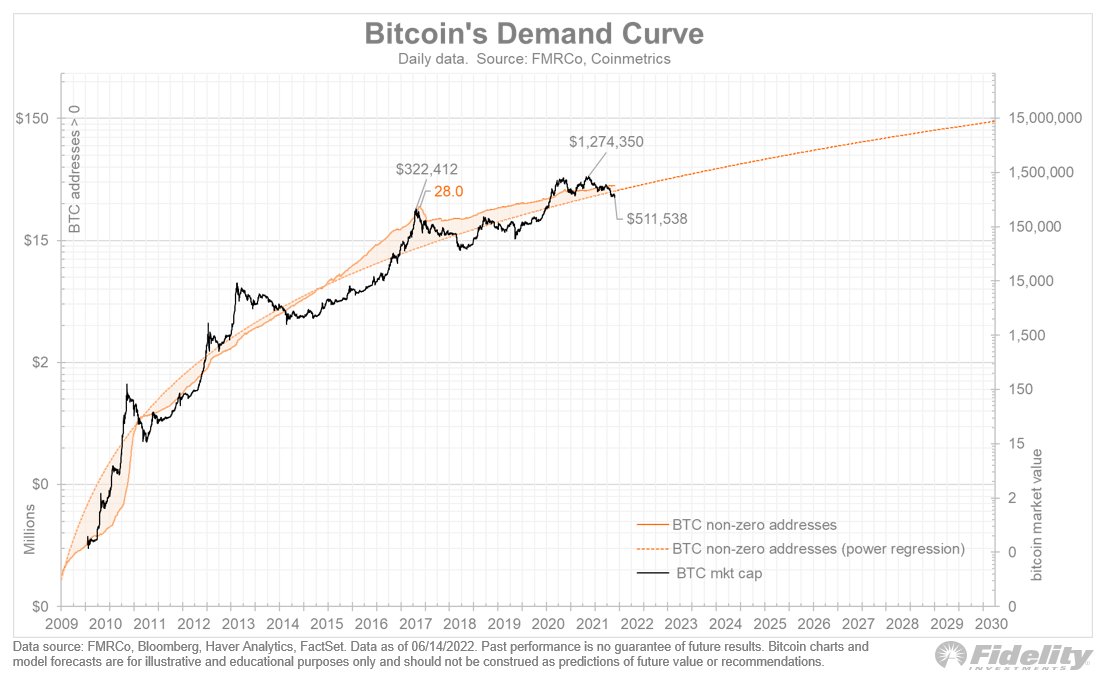

As we mentioned at Koinfinans.com, Timmer also drew attention to a metric that compares the number of Bitcoin addresses with non-zero balances to the BTC price. Historically, Bitcoin appears to have been above and below the price demand curve.

“Another way to highlight this is to consider Bitcoin’s non-zero balance addresses along with price. The price is now below the network curve.”

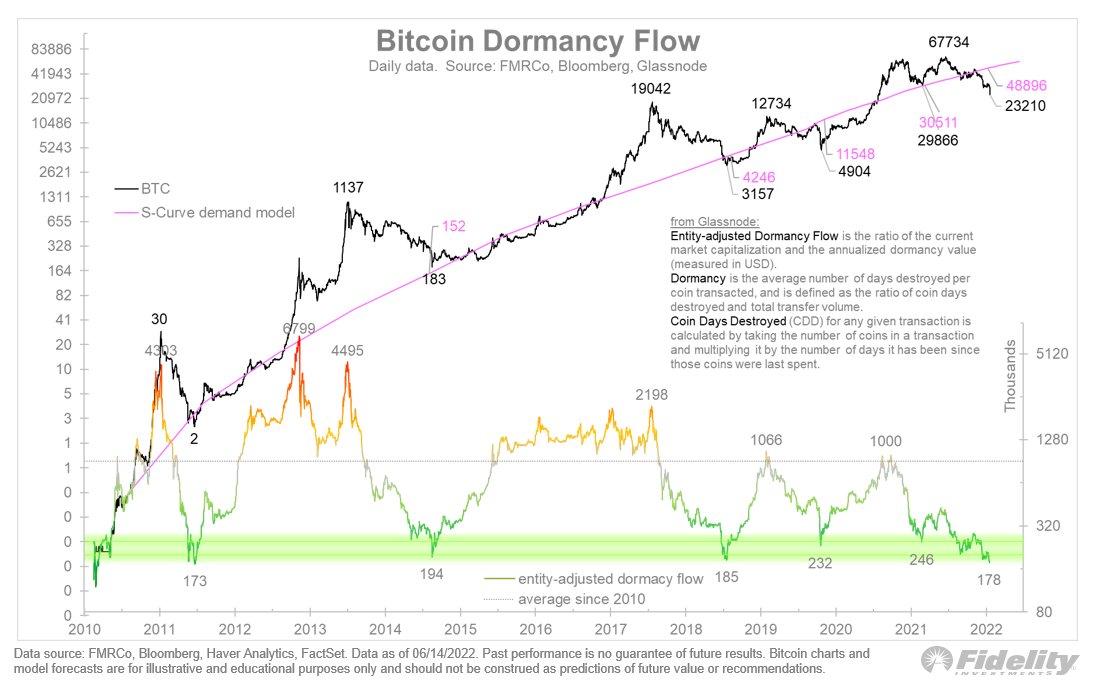

While making his prediction, the macro analyst also examined Bitcoin’s dormancy flow (Dormancy Flow indicator), which measures the average number of days that coins are left untouched. Looking at the chart shared by Timmer, Bitcoin’s dormant flow is at levels not seen in more than a decade before BTC embarked on parabolic rallies.

“The next chart shows how technically Bitcoin has been oversold. Glassnode’s sleep flow indicator has now reached levels not seen since 2011.”

You can check the price movements here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.