For Bitcoin, the forecasts and opinions of analysts draw attention. However, lately, artificial intelligence predictions have started to come. Moreover, it is very popular. Now there is a forecast for summer. Let’s have a look at the details.

Bitcoin is trying to break out of the bear market

Bitcoin (BTC) has suffered a significant drop from its all-time high price of around $69,000. This period is a reflection of the bear market. Bitcoin encountered resistance at the $30,000 level. Despite this, it gave mixed signals throughout 2023. In particular, breaking the $60,000 level is important when exiting the bear market. This level is considered crucial for Bitcoin to reach its all-time high. In this direction cryptocoin.com We consulted productive artificial intelligence (AI) tools, ChatGPT, and Google’s Bard with the question of Bitcoin’s ability to recover $60,000 this summer. The results are indeed very interesting.

According to OpenAI’s ChatGPT, the value of Bitcoin remains speculative. However, the tool did not give a definitive answer on whether Bitcoin can recover $60,000. But it provided a hypothetical situation. The AI tool noted that recovering $60,000 will depend on several factors. These include a bullish market sentiment fueled by upbeat news, increasing adoption. Also included is the renewed interest in cryptocurrencies, which will generate enthusiasm among investors.

Potential effects

The tool also highlights the potential catalysts of the bull run for Bitcoin. Accordingly, it addresses institutional investors and the potential influence of governments. Highlights are as follows:

“Major financial institutions, companies, and even governments are adopting Bitcoin as a viable asset class. This institutional adoption provides significant capital inflows into the cryptocurrency market, pushing the price of Bitcoin upwards.”

ChatGPT also highlighted the importance of a technological breakthrough, such as the implementation of an advanced blockchain solution that expands Bitcoin’s functionality and attracts more users and investors. He also acknowledged that global economic uncertainties such as inflation, geopolitical tensions or changes in monetary policy push investors to look for alternative assets, which adds to Bitcoin’s appeal. Also known for its scarcity and decentralized nature, Bitcoin is becoming an attractive hedge against traditional fiat currencies. It increases its price by meeting the increasing demand.” There is also an emphasis.

Google Bard’s view on BTC value

Google Bard expressed his optimism, stating that Bitcoin could regain the $60,000 mark this summer. The tool attributed this potential success to global economic conditions and corporate engagement as key factors. However, the tool also acknowledges that regulatory factors may affect Bitcoin’s valuation towards $60,000. Here is Bard’s comment:

“If governments start regulating Bitcoin, this could have a negative impact on the price. Ultimately, the price of Bitcoin is determined by supply and demand. If the demand for Bitcoin continues to increase, the price is likely to reach $60,000 this summer.”

In contrast, Bard highlighted the hurdles that could prevent Bitcoin from reaching the $60,000 level. In particular, he talked about the lasting effects of the bear market and potential technological developments. Bard also emphasized that emerging technologies such as quantum computing pose a risk of hacking Bitcoin. On the other hand, he pointed out that this situation has potentially eroded confidence and caused prices to fall.

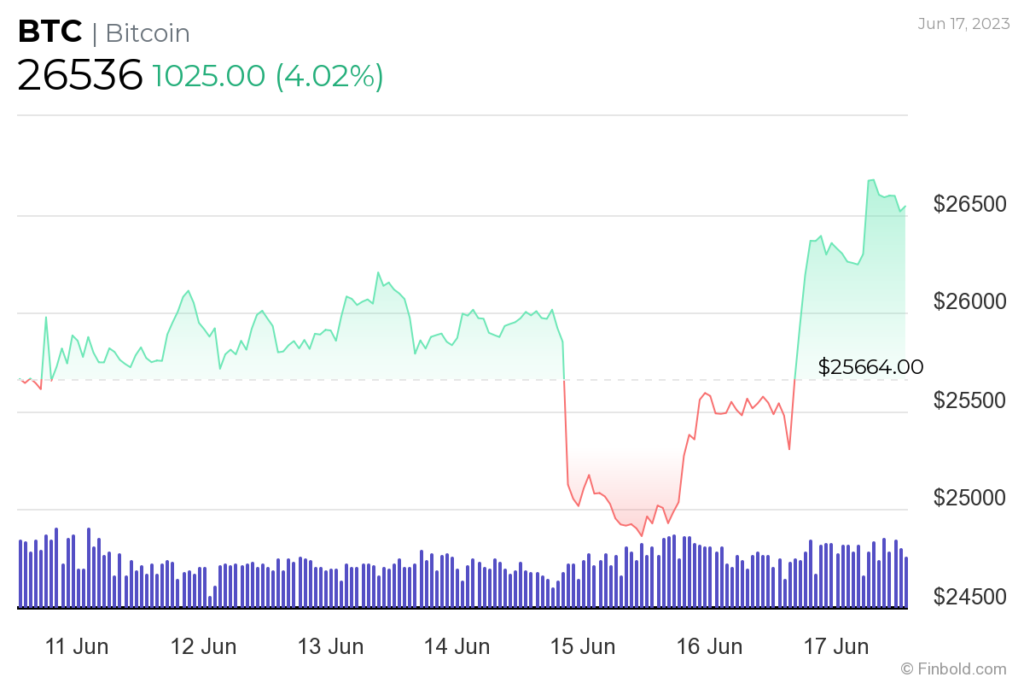

Bitcoin price analysis

At the time of writing, Bitcoin was trading at $26,536. Accordingly, this figure reflects a gain of approximately 4%. Over the week, BTC saw an increase of over 3%.

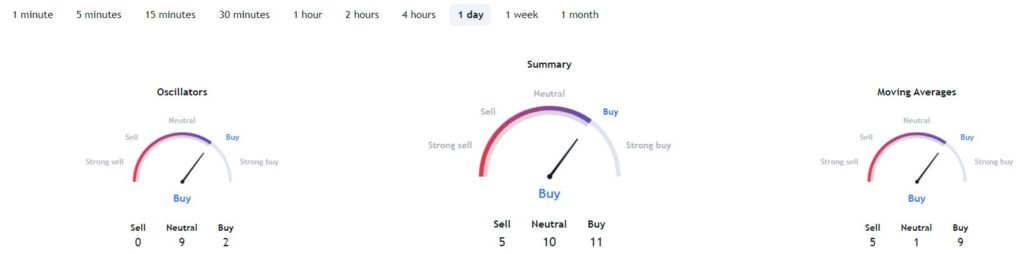

Regarding technical analysis, current market sentiment for Bitcoin is predominantly bullish. This sentiment is supported by the TradingView summary, which shows that 11 of the analyzed indicators are in line with the ‘buy’ recommendation. Also, the moving averages and oscillators support the ‘buy’ sentiment at 9 and 2 respectively.

It should be noted that the application of BlackRock, which manages trillions of dollars of funds, for a spot Bitcoin exchange-traded fund (ETF), has a positive effect on BTC. Also, the news of the application came just after pressure from the SEC. This means some breathing room for the cryptocurrency market, which is overwhelmed by the pressures.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your own research and due diligence before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. Therefore, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.