Bitcoin and altcoin focused asset investment products have been experiencing a significant change in the past week. Accordingly, it witnessed an impressive inflow of $21 million for the first time in six weeks. These investments come in response to a combination of factors, including positive price momentum, concerns about U.S. government debt prices, and recent quagmires surrounding government finances. It was noteworthy that these entries took place at the weekend, especially on Friday.

Bitcoin dominates inflows

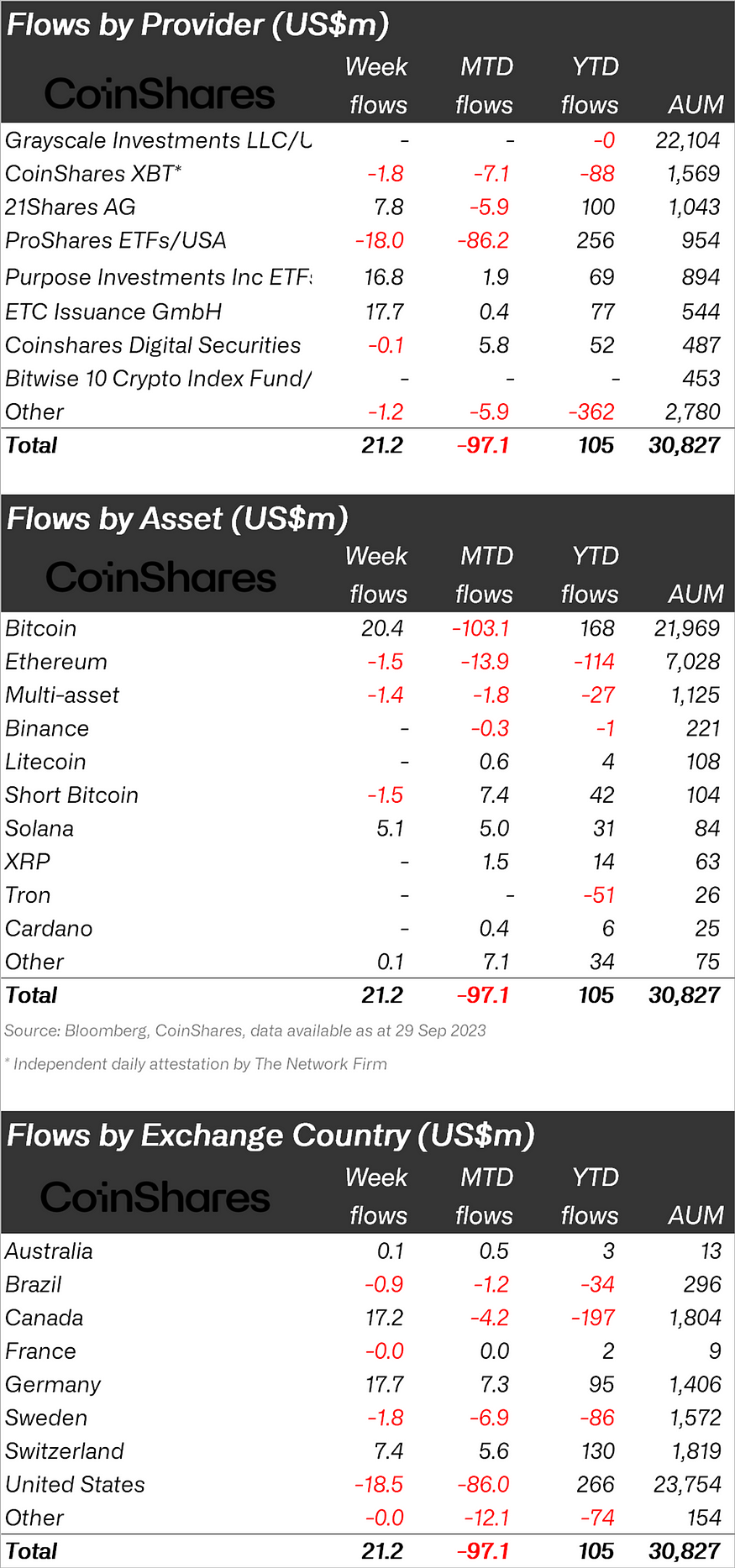

Bitcoin led the way, contributing the majority of these inflows, with a total of $20 million. On the other hand, short-focused Bitcoin investments continued to see $1.5 million worth of outflows last week. These ongoing outflows in short-focused Bitcoin investments have reached $85 million since April.

On the other hand, altcoin Solana is one of the shining investment products this week. Accordingly, Solana, the rising star of Bitcoin and the money market, continues to dazzle investors. Solana spent its 27th week with a positive investment sentiment, with an inflow of $5 million. Impressively, Solana broke out in just four weeks this year. Accordingly, it has strengthened its position as one of the most preferred altcoins in 2023.

Ethereum’s struggle continues

Meanwhile, Ethereum faced another challenging week. Accordingly, it experienced a total outflow of 1.5 million dollars in its seventh week in a row. Unfortunately, Ethereum has found itself among the less preferred altcoins lately. This situation stands out as a striking situation in the Bitcoin and cryptocurrency markets.

A noticeable trend of regional divergence continues in the Bitcoin and cryptocurrency markets. The United States witnessed a total outflow of $19 million last week. On the other hand, Europe and Canada experienced inflows of $23 million and $17 million, respectively. This regional discrepancy highlights varying sentiments and investment behavior across different markets.

Blockchain stocks face a sell-off

There is a parallel development to broader sales in the technology sector. Accordingly, an outflow of $8.4 million was seen in blockchain-focused stocks. This correction reflects volatility in technology-related investments.

It should be noted that despite recent price increases and investment inflows, transaction volumes remain relatively low in both the Bitcoin and altcoin-focused digital asset investment products market and the broader cryptocurrency market. Additionally, when we look at cryptokoin.com, the cautious stance of investors in this developing environment also draws attention.

To be informed about the latest developments, follow us Twitter’in, Facebookin and InstagramFollow on . Telegram And YouTube Join our channel.