In the 3rd quarter report of Genesis, which has been providing Bitcoin trading services to institutional investors in the USA since 2013, important determinations were made regarding Bitcoin and altcoins.

In the report, which shared information on the company’s buying-selling, borrowing and lending services, the change in the crypto money interests of institutional investors was also mentioned.

The report highlighted that while interest in Bitcoin futures-based ETFs is strong, further institutionalization has significantly reduced Bitcoin monetization opportunities.

“Due to the shift towards institutionalization, the opportunity to monetize the differences between Bitcoin price in the spot and futures market has been significantly reduced.”

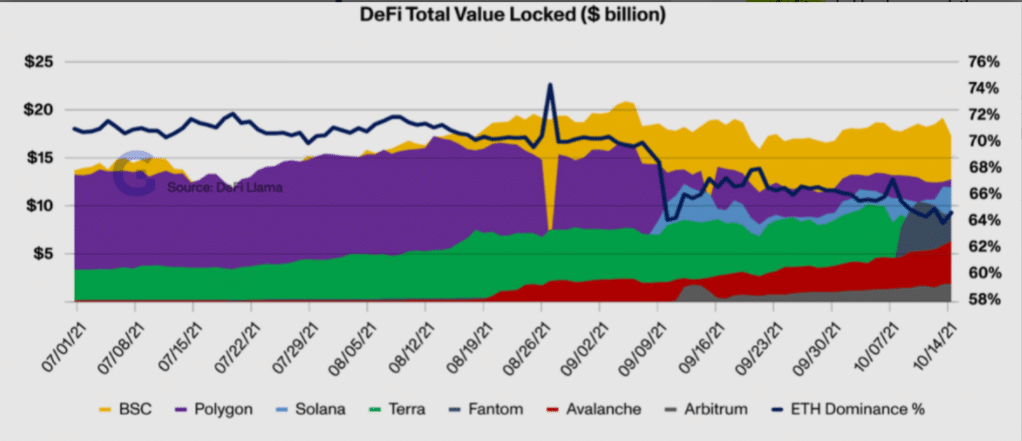

In the report, it was stated that the interest in decentralized finance (DeFi) and layer 1 projects increased, and the increase in activities was noted. It is stated that Genesis has launched binary options on Solana, Luna and DYDX to meet this demand.

“As the sub-rotation scenario returns to capitalizing on Bitcoin and Ethereum towards the end of Q3, the adoption of L1s created more opportunities to diversify portfolios.”