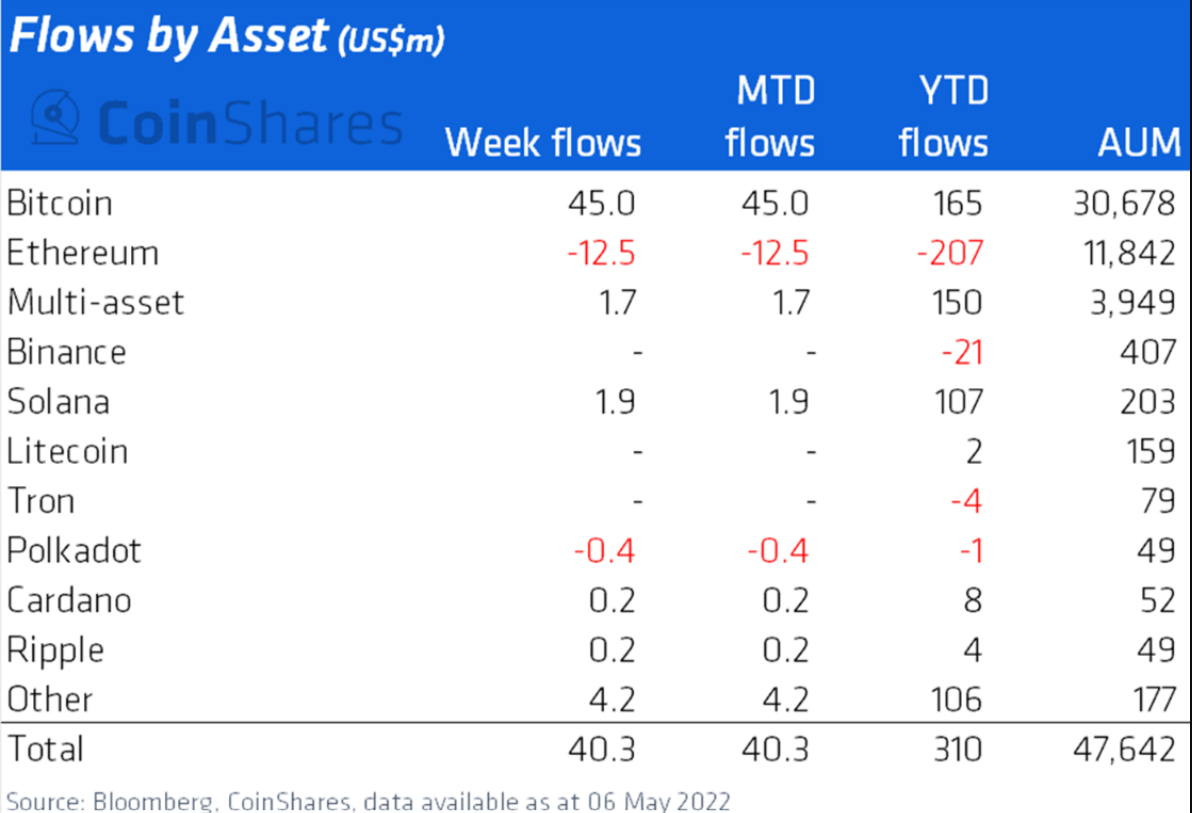

CoinShares, a prominent crypto asset manager, said that institutional investors Bitcoin (BTC) He said that he made purchases by taking advantage of the bottom of the market and as a result of these purchases, digital investment products have been entered in the first week since the beginning of April.

In the latest edition of its Digital Asset Fund Flows Weekly Report, CoinShares found that institutions are investing $45 million in BTC products despite the market crash.

“Bitcoin had $45 million in inflows, making it the primary digital asset where investors displayed more positive emotions.

Short Bitcoin witnessed the second largest weekly inflow on record, totaling $4 million. AUM [yönetim altındaki varlıklar] has now reached a record level of $45 million.”

Judging by the other graphics; Overall, North American investment products saw much more activity than European products.

“The flow was proportional in investment products; While North America experienced inflows of 66 million dollars, Europe saw a total outflow of 26 million dollars…”

Institutional investors turned to these 3 altcoins instead of Ethereum

Ethereum (ETH) rival smart contract platform Left (LEFT)last week had the most notable inflows of all altcoins, with a total of $1.9 million.

Last week, in a Crypto Outlook report, Bloomberg analyst McGlone said: Solana’s (LEFT) He made statements that he had outstripped other so-called “Ethereum killers”, which should result in SOL taking its place among the top five crypto assets by market cap.

“The maturation of cryptocurrencies may finally invite Solana into the top five… Solana at number seven seems to be solidifying and remains Ethereum’s biggest competitor, especially in the face of the countless so-called ‘Ethereum killers’ that have pumped and spilled over the past few years.”

Alongside Solana, multi-asset investment products that invest in multiple digital assets are witnessing $1.7 million in inflows. XRP and Cardano (ADA) Focused investment products each experienced an inflow of $ 0.2 million.

In the past week, Ethereum-focused products continued to underperform, bringing total annual outputs of ETH to over $200 million.

“However, the negative sentiment regarding Ethereum remains, with a total of $12.5 million exits last week. This 12.5 million exit has brought total exits from year-to-date to $207 million.”

You can check the price movements here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.