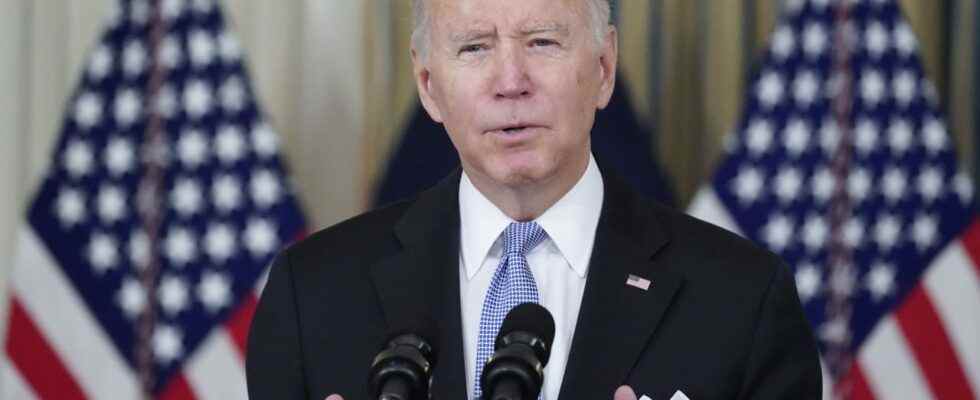

Inflation in the US is at its highest level since November 1990. Prices rise and rise and rise … That becomes a problem for President Joe Biden (78): The Republicans accuse the Democrats of doing nothing to counter inflation.

Goods and services cost 6.2 percent more in October than in the same month last year, as the Department of Labor announced in Washington on Wednesday. The price hike affects many categories, particularly energy, rentals, groceries, used cars and new cars.

Experts had expected inflation of 5.8 percent, after there had already been an increase of 5.4 percent in September compared to the same month last year. IN COMPARISON: In Germany, the inflation rate climbed to 4.5 percent year-on-year in October – according to the Federal Statistical Office in Wiesbaden, the highest value since 1993.

“Inflation seems to be out of control”

Thomas Gitzel, VP Bank’s chief economist, is surprised: “Inflation seems to be out of control. Actually it was to be assumed that the apex of inflation is already behind us, but far from it. ”

He sees the decisive aspect in the level at which the inflation rate stabilizes in the long term: “The inflation risks continue to increase. It is less important whether the inflation rate falls, it will fall significantly in the coming year – but where it will come to a halt. The longer the inflation rates remain high, the greater the risk that goods will also become more expensive that normally turn out to be quite sluggish. “

According to Gitzel, it is still “a latent danger”. He assumes that prices for consumers will be noticeably cheaper in 2022.

Will the key interest rate turnaround in the US in 2022?

Nevertheless, President Biden has a money problem: With the latest figures, US inflation is moving even further away from the medium-term target of the US Federal Reserve (Fed) – which is two percent.

▶ ︎ The Fed sees the increased inflation as a transitional development determined by corona factors. Critics have long complained that this perspective has less and less vigor the longer the inflation rate remains high and the greater the deviation from the Fed’s target.

This is also how LBBW analyst Clench sees it: “In view of these figures, it is becoming increasingly difficult for the US Federal Reserve to attribute the acceleration in inflation solely to special and catch-up effects. By the end of next year at the latest, the Fed is likely to be forced to abandon its hesitant stance and initiate a policy rate reversal. “

► Bastian Hepperle from Bankhaus Lampe: “The drivers are high prices for energy, food, rents and increased costs for companies, which are increasingly passing these on to their customers. This transfer process encompasses more and more goods, since the problems on the supply side in particular do not resolve quickly. The inflation outlook will therefore remain clouded for the time being. “