Dusseldorf Anyone who believed that the German economy would overcome its phase of weakness in the spring and return to its path of growth could very well be mistaken. Economists surveyed by the financial data service provider Bloomberg are expecting moderate growth in Germany again from the current second quarter. But a lasting recovery is by no means certain.

A new study by the ECB assumes that the rapid rate hikes by the central bank will not only dampen inflation, but also the economic output in the euro area. According to the research, the interest rate turnaround has likely reduced inflation by half a percentage point in 2022. The dampening effect in the years 2023 to 2025 is expected to be around two percentage points on average, according to the central bank’s economic report published on Friday.

With regard to economic growth, the braking effect is likely to be strongest in the current year, the ECB expects. On average, growth will be dampened by two percentage points in each of the years 2022 to 2025. The “dampening effect on GDP growth will probably be strongest in 2023”.

There is no country-specific analysis. However, it can be assumed that the German economy, which is particularly closely interwoven with other national economies, will feel this braking effect very clearly. Assuming trend growth of around one percent in Germany, a noticeable decline in economic output as a result of the tighter monetary policy by no means seems impossible.

A look at the past confirms this forecast, as previous rounds of interest rate hikes in Germany have always ended in recession. On average, five quarters elapsed between the first interest rate hike and the onset of the recession. The interest rate hikes that began in July 2022 are therefore likely to hit the economy hard from this fall.

There were early signs of a faltering upswing

The first indications that the spring upswing that many economists were forecasting or at least hoping for would be very bumpy at best were already evident in March. Retail sales fell 2.4 percent in real terms from the previous month. Measured against the same month last year, the real decline was even 8.6 percent.

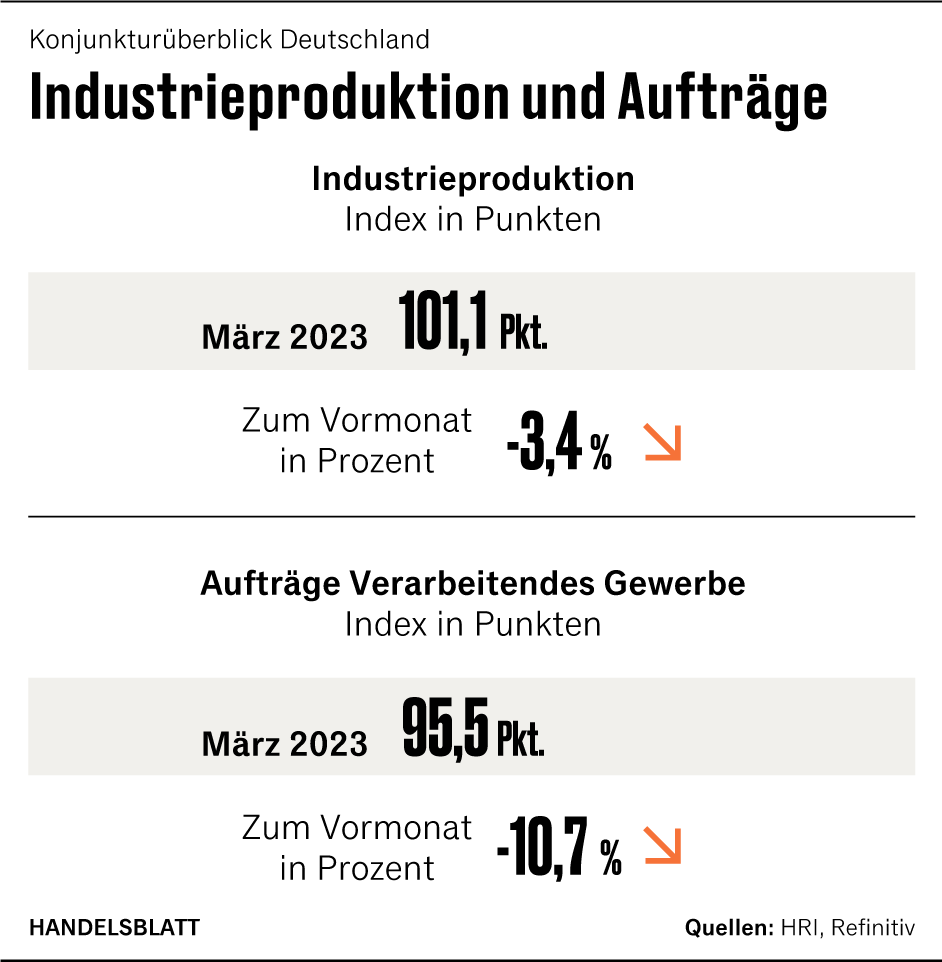

New registrations of passenger cars by private owners fell by 4.5 percent in April after falling by 8.2 percent in March. Industrial production collapsed by 3.4 percent in March and was thus at the level of summer 2013. There is no rapid improvement in sight. At minus 10.7 percent, incoming orders in March recorded the sharpest decline since the peak phase of the corona pandemic in April 2020.

According to a rule of thumb, around a third of the orders are processed immediately, a third in the following quarter and a third later. In addition, the slump in building permits continued at an increasing pace – the decline in March was 29.6 percent compared to the same month last year and was thus as severe as it was 16 years ago.

Contrary to popular belief, the overall economic stagnation that has now lasted for a total of three years is no longer leaving the labor market unscathed. According to the Federal Employment Agency, the usual spring revival failed to materialize this year. In April, the authority registered 2.586 million unemployed, 276,000 more than in the same month last year. Seasonally adjusted, the number of unemployed rose by 24,000 compared to the previous month, including refugees from Ukraine by 15,000.

The main reason why unemployment is not rising more sharply is that companies are now hoarding staff in view of the demographic development. According to surveys, companies keep their employees even in times of crisis because they may not find new ones when things pick up again.

But hoarding staff cannot work forever. If companies lose confidence in Germany as a business location and if, in view of the high energy prices, the relocation of production facilities is considered, there is hardly any reason to retain existing staff.

The chemical industry calculates that the sector can be climate-neutral by 2050. But this would require 500 billion terawatt hours of green electricity per year – this corresponds to the current total electricity production in Germany, which currently comes mainly from fossil fuels.

It is also highly uncertain whether the auto industry, which is so important for Germany as a location, will manage the transformation. The very low market valuation of the still (!) highly profitable industry shows that the financial markets consider a decline to be possible, if not probable. The German car manufacturers VW, BMW and Mercedes are only valued at five to six times their expected annual profit on the stock exchange, while the entire Dax is valued at 14 times and Tesla at 42 times.

In addition to the long-term consequences of the targeted decarbonization and the effects of the interest rate hikes on the real economy, the German economy is again threatened with great tremors in the coming winter as to whether gas reserves will be sufficient. The stores are currently 70 percent full. But nobody can make reliable forecasts about the temperatures in January and February.

“The coming winter can be challenging again,” confirms Veronika Grimm. “High gas prices or bottlenecks would be possible.”

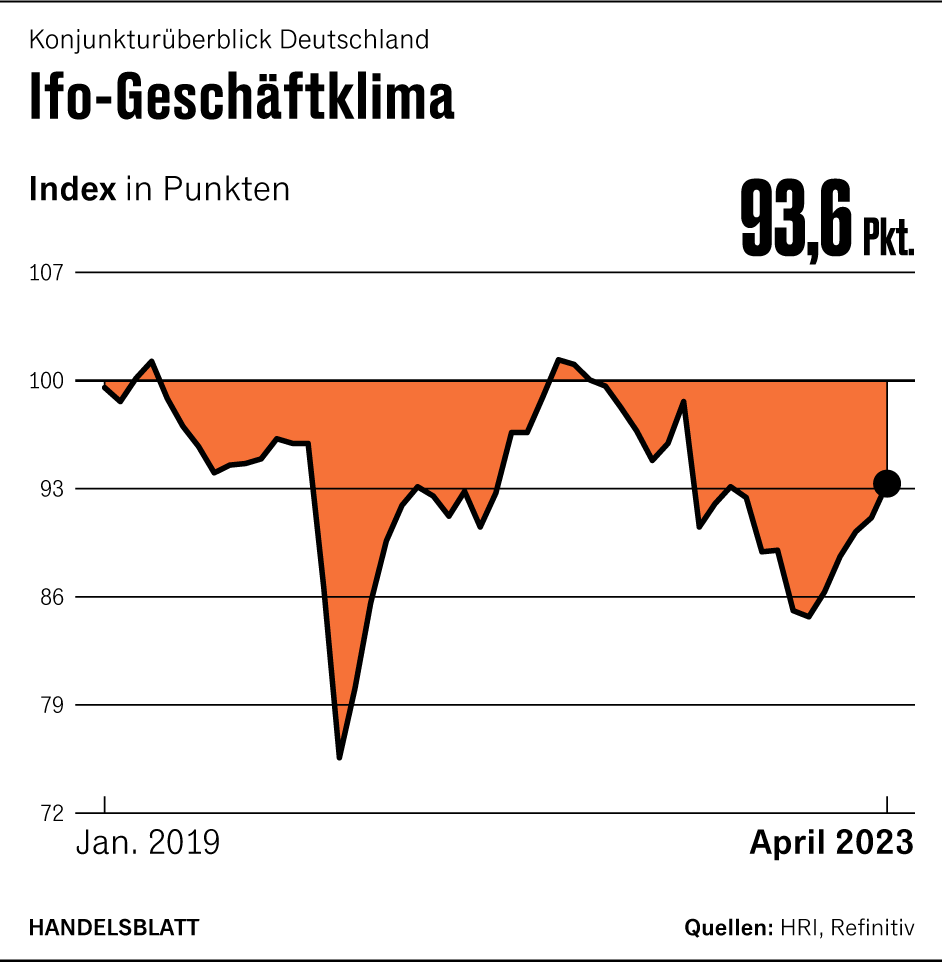

Given the many warning signals, it is no wonder that the ZEW economic barometer for May fell at an accelerated rate for the third month in a row. The index is back in negative territory for the first time since last December. “The financial market experts expect the economic situation, which is already not good, to deteriorate over the next six months,” says ZEW President Achim Wambach. “As a result, the German economy could slip into a recession, albeit a slight one.”

More: Producer prices with the smallest increase in two years