Famous Bitcoin (BTC) on-chain analyst Willy Woo recently made some interesting statements about the potential impact of Bitcoin Spot ETFs on the cryptocurrency market.

Woo suggests that we are likely on the verge of approval for a Bitcoin spot ETF.

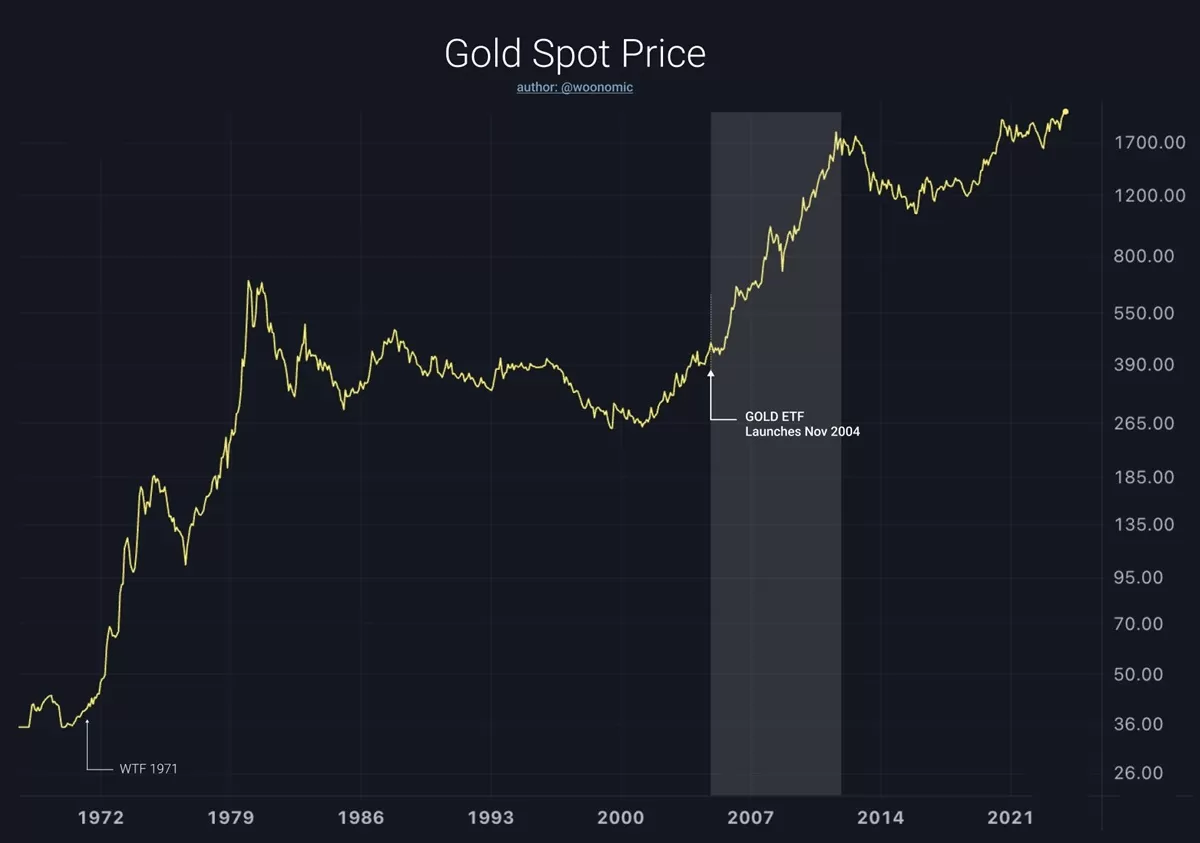

Drawing parallels with the SPDR Gold Trust, the first commodity ETF, Woo points out that this ETF provides a simple way for investors to include gold in their portfolios. Following this product launch, gold experienced an eight-year rally from 2005 to 2012, without a single down year, according to Woo.

However, one of Woo’s followers questioned this analogy, arguing that buying Bitcoin is already quite accessible. The follower said, “I see this analogy all the time, in fact, if someone or an institution wants to own BTC right now, they can easily do so. Yes, an ETF would be a little less hassle, but it would be a lot less hassle than what would be required to buy physical gold against a gold ETF.” said.

ETFs are known as financial instruments created to provide product exposure to institutional investors who often have difficulty purchasing and storing the actual product.

In contrast, Woo argued that buying Bitcoin is more complicated than buying gold for the average person:

“For normal people, I think buying BTC is much more complicated than buying gold: For gold, you buy a gold bullion coin from the local dealer and put it in your vault. In Bitcoin, buy a hardware wallet, learn the private keys, back up the keys securely, learn how the addresses work, learn how the exchanges work, buy BTC, send it to the wallet address, do not lose the keys.”

*This is not investment advice.

For exclusive news, analysis and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android And iOS Start live price monitoring now by downloading our applications!