Former Coinbase chief technology officer Balaji Srinivasan said the US government will once again run its mints and US DollarHe thinks it will devalue his .

Koinfinans.com As we reported, Srinivasan told 895,200 Twitter followers that the US is in the midst of a “fiat crisis” as well as a financial crisis. says.

“Everything went bankrupt. Banks, commercial real estate, blue states. I also hear rumors about insurance. The printing of money will be on a historical scale. Just like the desire to get out of oppression.”

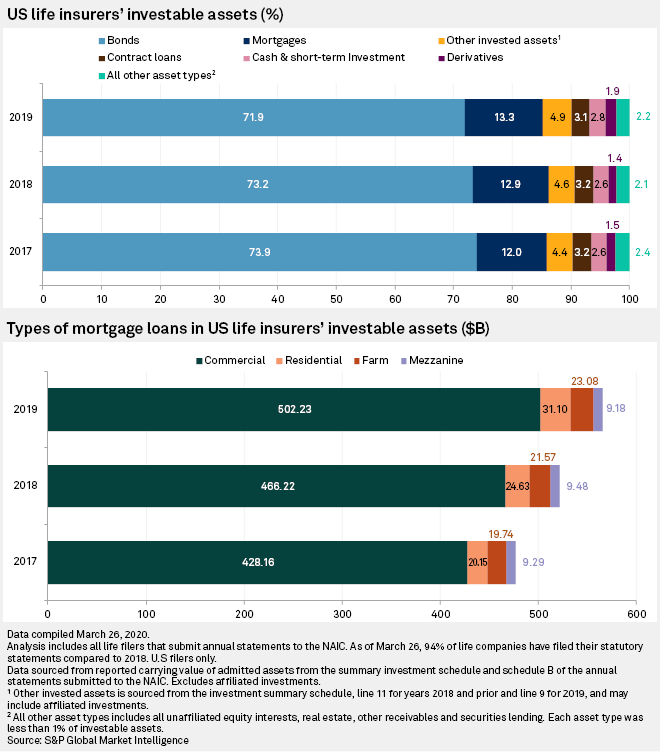

Taking a closer look at the state of the insurance industry bitcoin The (BTC) bull says insurers, like banks, are holding devalued government bonds amid a series of rate hikes issued by the Federal Reserve last year.

NEWS CONTINUES BELOW“As for insurance… you know all those ‘safe’ assets that insurers keep to reimburse you? Most of them are in bonds where the Fed has depreciated.

Remember, insurers hold ‘safe’ assets such as bonds and mortgages. So what about these safe assets? In an era of unprecedented, surprise rate hikes?

NEWS CONTINUES BELOW

Looking at the former Coinbase executive’s chart, bonds accounted for over 70% of US insurers’ portfolios in 2019.

Srinivasan says the lesson to be learned from the crises would be to distrust the US government.

“This is not just a financial crisis. This is a fiat crisis. All invoices are due. Only a few fragments were made public. But in retrospect it will become clear: do not trust the US government.”

After the angel investor made a seriously bold Bitcoin prediction last month crypto- began to attract the attention of investors. Srinivasan said that amid the meltdown in the banking industry, Bitcoin seemed poised to explode to $1 million in less than 90 days.