Frankfurt The aviation industry has overcome the worst crisis to date – triggered by the corona virus. The airline association Iata assumes that global capacity in 2023 will reach almost 88 percent of the pre-crisis year 2019. While the airlines in North and Latin America are already flying as much as four years ago, the European airlines will probably reach 98 percent.

Bringing up the rear in Europe is Germany, where, according to estimates by the industry association BDL, a maximum of 88 percent of normal capacity is reached. Nevertheless, business is also booming in this country. Lufthansa earns a lot because of the high ticket prices.

But how long will it stay like this? European aviation is facing major upheavals, as these five charts show.

One challenge is the lack of business customers. This market has since recovered somewhat. But the realization is gaining ground that the old level will never be reached again on short-haul routes. According to the business travel analysis published a few days ago by the VDR association, there will be fewer business trips “as an answer to the global demand for more sustainability in all dimensions”.

In a survey of VDR members, 69 percent stated that they had already reduced the number of business trips. 21 percent intend to do so. On routes within Germany, 64 percent rely on the train instead of the plane, and another 19 percent want to switch.

Alex Irving of Bernstein Research estimates that the number of business trips by air on short-haul European routes will level off at 50 to 60 percent of pre-crisis levels.

>>Read also: Will private jets soon be banned from taking off?

This affects the large network airlines such as Lufthansa, British Airways or Air France and KLM. They have historically made a good living from business travel, which has high margins. Low-cost airlines such as Ryanair or Wizz Air, which mainly cater to private travelers, have an advantage here.

2. Increasing competition on long-haul routes west

On the other hand, business with flights between Europe and North America is going very well for the network companies. In the first quarter of this year, Lufthansa sold more capacity in this area than in any other traffic region – measured in terms of the number of seats per kilometer flown.

And at good prices. According to the interim report, so-called unit sales rose by 33.6 percent in the first quarter of the current year. They were almost 25 percent above the pre-crisis year of 2019.

But competition from the west is growing. US airlines are expanding their offerings or, like Jetblue, have just entered intercontinental traffic. There are also takeovers. Lufthansa rival IAG (British Airways, Iberia, Aer Lingus, Vueling) has snapped up Spanish Air Europa, which flies to destinations in Latin America, among others. At the same time, IAG has its eye on the Portuguese TAP. Lufthansa is also interested in them.

>> Read also: US airline Jetblue is expanding in Europe

TAP is also about the growing Latin American market. Expansion in this region is important for Lufthansa. Data from 2022 shows how underrepresented Europe’s largest airline group is here. He is much more attached to the Asian business than the two rivals. But it is precisely there that the risks for Lufthansa are increasing.

3. There is a risk of overcapacities for long-distance destinations in the east

In Asia there is a risk of high overcapacities in the coming years. The two Indian airlines Air India and Indigo alone recently ordered 970 new aircraft. According to company management, Turkish Airlines wants to buy 600 aircraft. In addition, there is the new airline Riyadh Air from Saudi Arabia.

All of these providers are targeting passengers in the East. Lufthansa boss Spohr is convinced that there will be enough left for his group. It will take a long time for all of these planes to be delivered, but at the same time there are many people who have never flown, the manager argues. But Bernstein analyst Irving sees a risk in Asia’s overweight at Lufthansa.

4. Climate costs are changing market forces

The figures, which the experts from SEO Amsterdam Economics and the Royal Netherlands Aerospace Center recently calculated on behalf of the European aviation industry, are likely to frighten many aviation managers. Companies and institutions will have to raise 820 billion dollars between 2018 and 2050 in order to be able to fly in a climate-neutral manner.

For example, the EU stipulates that companies must increase the quota for adding the much more expensive synthetic fuel SAF over the years. At the same time, the number of emission rights allocated free of charge is falling, so the airlines have to buy more of them.

This hits the low-cost providers first. You advertise with low prices, additional costs have an impact immediately. Analyst Alex Irving estimates that Ryanair alone will have to pay around 1.4 billion euros more annually from 2027 if the airline wants to meet the climate policy requirements.

On the other hand, the large network companies such as Lufthansa can partially compensate for the additional costs through the high-margin long-haul routes. They have a different problem for this: Competitors outside of Europe have to bear far fewer additional costs because the EU can only enact climate rules for its member countries. This allows these rivals to offer cheaper tickets.

5. The consequence is a consolidation

The competitive and cost pressure in European aviation will therefore increase significantly. The example of the USA shows the consequences of such a development. There, in 1978, Jimmy Carter’s government at the time decided to deregulate air traffic. Until then, authorities determined ticket prices and routes.

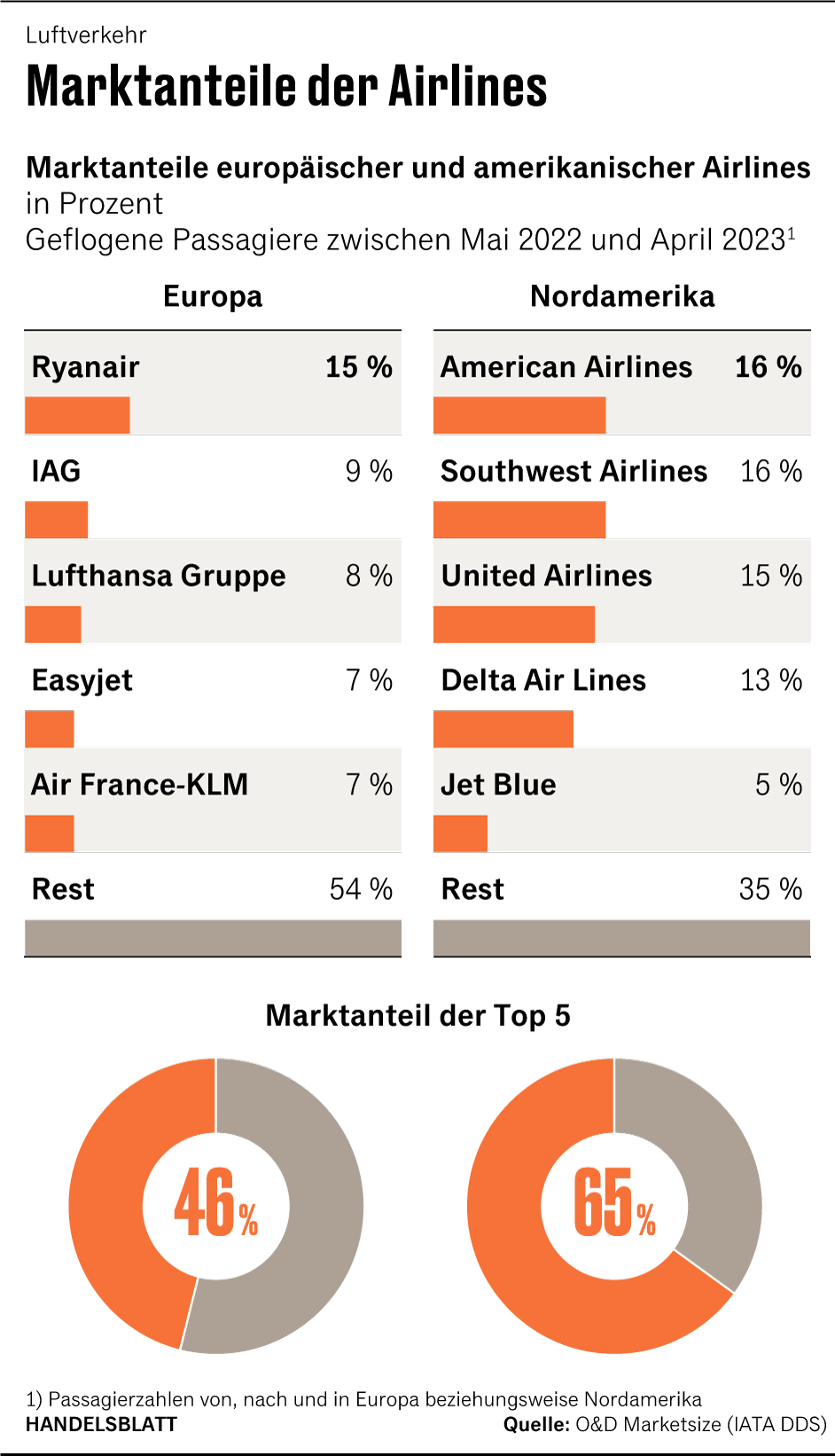

The decision led to several waves of consolidation. What used to be 25 airlines became the three major providers Delta Air Lines, American Airlines and United Airlines. Together with the low-cost provider Southwest, they dominate the main markets in North America. If you add Jetblue, the five largest US companies in North America have a market share of 65 percent.

In Europe, the top five only have 46 percent. Having your own airline is seen by many politicians as an important factor in a country’s development. That prevented consolidation. In view of the challenges, however, this policy can hardly be sustained.

Lufthansa boss Spohr and Ryanair boss Michael O’Leary agree on one point despite all the competition: Similar to North America, there will only be three large network airlines and one large low-cost provider in Europe in the long run.

More: Eurowings Discover is to become profitable with a new name