According to crypto analyst Rakesh Upadhyay, after the Bitcoin (BTC) price plunged below $52,000 and altcoins began serious austerity, it is clear that the bears have almost extinguished all signs of bullish momentum. The analyst states that Bitcoin and Ethereum have fallen from their respective overhead resistance levels, indicating that the bears continue to sell in the rallies. The analyst states that the bulls have repeatedly failed to push Dogecoin (DOGE) above the 20-day EMA ($0.22) over the past few days, indicating that the sentiment remains negative. The analyst examines the charts of the top 10 cryptocurrencies to find out if the Bitcoin correction will pull the entire crypto industry down. we too cryptocoin.com We have compiled Rakesh Upadhyay’s analysis for our readers.

An overview of the crypto market

A new study out of Australia shows that the Ethereum Improvement Proposal (EIP) 1559 upgrade makes Ethereum a better store of value than Bitcoin. The report states that the annual rate of increase in Ethereum’s supply since EIP-1559 has been 0.98% compared to the 1.99% increase in Bitcoin supply.

According to the report, demand for Ethereum is growing following the growing popularity of Non Fungible Tokens (NFTs), decentralized finance (DeFi), and Metaverse-related altcoins. Several analysts remain bullish on Ether and expect it to rise to a range between $6,000 and $10,000.

On-chain analytics firm Glassnode says high open interest in the derivatives market and long-term selling holders could prolong Bitcoin’s decline. Open interest leverage on options and futures could cause a jolt to all-time highs, according to the analyst.

BTC, ETH, BNB, SOL and ADA analysis

Bitcoin (BTC)

Anlist states that the bulls failed to keep the Bitcoin price above the 20-day exponential moving average (EMA) ($57,905) on November 30 and December 1, indicating that the bears were fiercely defending the 20-day EMA.

The bears will now attempt to push and sustain the price below the 100-day simple moving average (SMA) ($54,485) and the November 28 intraday low of $53,256.64. The analyst states that if they are successful, BTC could drop from the psychologically critical support of $ 50,000 and points to the following levels:

This is an important boost to consider. Because if it is broken, the selling can gain momentum and BTC can drop to $ 40,000.

The analyst states that the downward sloping 20-day EMA and the relative strength index (RSI) in the negative zone indicate that the path of least resistance is to the downside, noting the following levels:

Contrary to this assumption, if the price rebounds from the 100-day SMA and rises above the 20-day EMA, it will show accumulation at lower levels. BTC could then rise to the 50-day SMA ($60,750).

Ethereum (ETH)

Ethereum dropped from $4,778.75 on December 1, suggesting that the bears are aggressively guarding the all-time high of $4,868. Ether price retreated to the 50-day SMA ($4,319) on Dec.

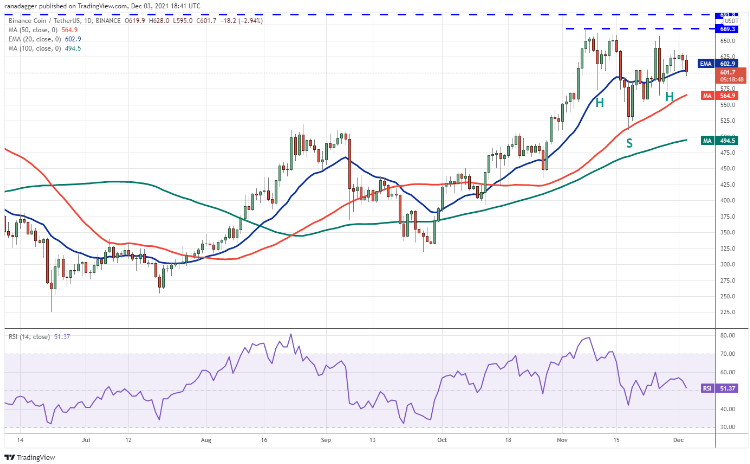

Binance Coin (BNB)

The analyst states that the bulls tried to push Binance Coin (BNB) again above the overhead resistance at $669.30 on Dec. 1, but failed, indicating that the bears continue to pose a tough challenge to the higher levels.

Left (LEFT)

According to the analyst, Solana (SOL) broke above the resistance line of the symmetrical triangle and closed on December 1, but the bulls were unable to sustain higher and the bears pulled the price back to the triangle on December 3.

Cardano (ADA)

The analyst says Cardano (ADA) recovered quickly on Dec 2, but hit a wall at the 20-day EMA ($1.72) and the failure of the bulls to break through the overall hurdle may have attracted heavy selling from the bears.

XRP, DOT, DOGE, LUNA and AVAX analysis

Ripple (XRP)

According to the analyst, the failure of Ripple (XRP) to break above the psychological level at $1 and sustain it indicates that the bears are selling aggressively on minor rallies. The analyst says that the XRP price has dropped and the bears will now try to push the price towards the strong support at $0.85.

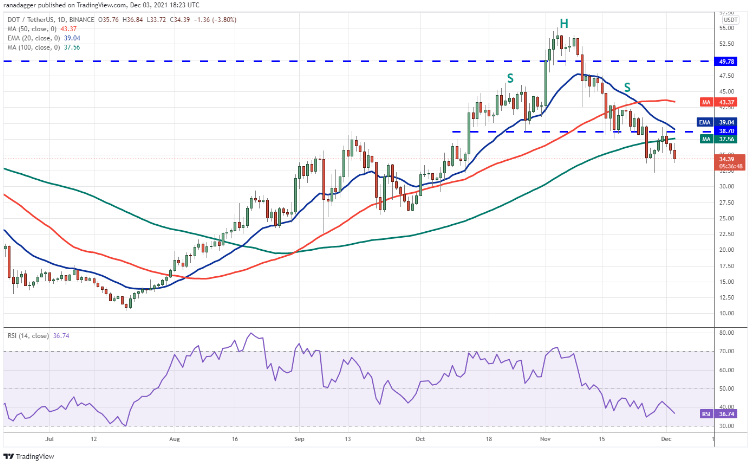

Polkadot (DOT)

The analyst states that Polkadot (DOT) bounced back from the breakout level of the H&S pattern at $38.70 on November 30 and dropped below the 100-day SMA ($37). The bears will now try to push the price towards strong support at $32.21.

Dogecoin (DOGE)

Bulls have repeatedly failed to push Dogecoin (DOGE) above the 20-day EMA ($0.22) over the past few days, suggesting that the sentiment remains negative and the bears are selling on rallies.

The analyst states that the 20-day EMA is sloping down and the RSI is below 36, indicating that the path of least resistance is to the downside, pointing to the following levels:

DOGE could drop to the critical support at $0.15 if the bears sink the price below $0.19. On the other hand, if the price rises from the current level or bounces back to $0.19 and rises above the 20-day EMA, it will indicate a strong accumulation at the lower levels. DOGE could then rise to the 50-day SMA ($0.24).

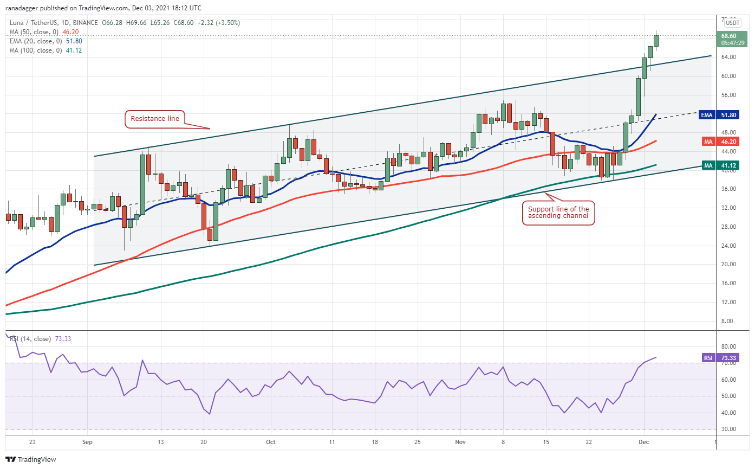

Terra (Luna)

The analyst states that Terra (LUNA) gained momentum by breaking above the moving averages on November 28. Strong buying by the bulls pushed the price to an all-time high on Nov. 30, marking the resumption of the uptrend.

Avalanche (AVAX)

The analyst reminds that Avalanche (AVAX) dropped from the 61.8% Fibonacci retracement level to $129.26 on December 1. According to the analyst, this may have caused traders who pulled the price below the 20-day EMA ($109) on Dec. 2 to book profits.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Disclaimer: The articles and articles on Kriptokoin.com do not constitute investment advice. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, asset or service in this article.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.