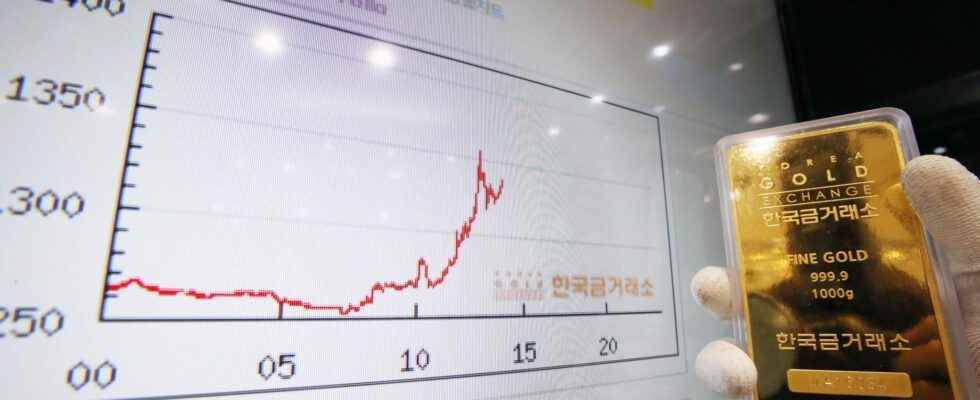

Despite the recovery in Treasury yields, the gold price was held at $1,750. The pullback of the dollar and the risk appetite have now formed the bottom of the gold price. Credit Suisse strategists and analyst Dhwani Mehta made important predictions for gold. cryptocoin.com We have compiled these estimates and their details for you.

Credit Suisse strategists: Gold price is looking at these levels!

Gold started the week on a strong footing and broke the $1,750 psychological barrier amid a surge in US Treasury yields. Rising inflation expectations require the Fed to tighten monetary policy sooner than expected, which will cause interest rates to rise in the markets.

Meanwhile, market sentiment remains generally calm amid uncertainty over China’s Evergrande and new volatility in US-China trade that has capped the decline in gold prices. According to experts, the depreciation of the US dollar also contributes to the increase in gold prices. While the gold price now offers no clear direction, broader risk appears to be on the downside, according to strategists at Credit Suisse. Credit Suisse strategists made the following comments on the subject:

Although the downside pressure appears to be increasing, there could only be a significant bearish, trend change below $1,691/77 and later support is seen at $1,655/60 after $1,620/15. Only a break above $1,834 could feed a deeper recovery to $1,860, then $1,917. Gold has likely outpaced the rise in real yields, but we still see room for 10-year US real yields to rise further to retest the highs seen earlier this year. This indicates that XAU/USD will remain under pressure. The bottom of the USD is likely to prove a headwind as well.

Dhwani Mehta sets levels that investors should watch

Gold analyst Dhwani Mehta has identified levels that investors should watch. Here are the analyst’s comments and the levels he noted for the gold price:

Gold is testing critical support requests at $1,749, according to the technical consolidation detector. Gold could then be tested at $1,744. $1,739 will be the confluence of the S3 one-day pivot and the 61.8% Fibonacci one-week. On the other hand, there is a strong resistance near $1,754, where the 23.6% Fibonacci weekly reading coincides with the one-hour SMA50 and one-day SMA10. The next upside target is $1,759, with the daily Fibonacci level of 38.2%. Next, the previous day’s high at $1,764 may cast doubt on the recovery momentum.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Disclaimer: The articles and articles on Kriptokoin.com do not constitute investment advice. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.