The market is trying to get over the impact of the collapse of the FTX cryptocurrency exchange. Major cryptocurrencies like Bitcoin (BTC) are consolidating without strong price action signals in either direction. At the same time, altcoin prices experienced high volatility. Along this line, several altcoins have come to the fore lately despite the prevailing bear market. These projects drew strong buying pressure. Altcoins have come into the limelight because of their narratives, along with a particular focus on specific use cases. So, which altcoins should we pay attention to this week? Here are the coins to watch out for, according to analyst Justinas Baltrusaitis…

The first altcoin on the analyst’s list: Aave (AAVE)

The decentralized finance (DeFi) lending protocol has experienced a surge in value, triggered by events such as the token’s listing on Robinhood. The token also benefited from the launch of Yam Finance, an experimental DeFi protocol whose native token is YAM. In particular, Aave is a platform that facilitates interest payments and cryptocurrency deposits. It allows users to borrow and lend different cryptocurrencies. Also, crypto expert Michael van de Poppe warned that there could be a break between Aave price and fundamentals in the future.

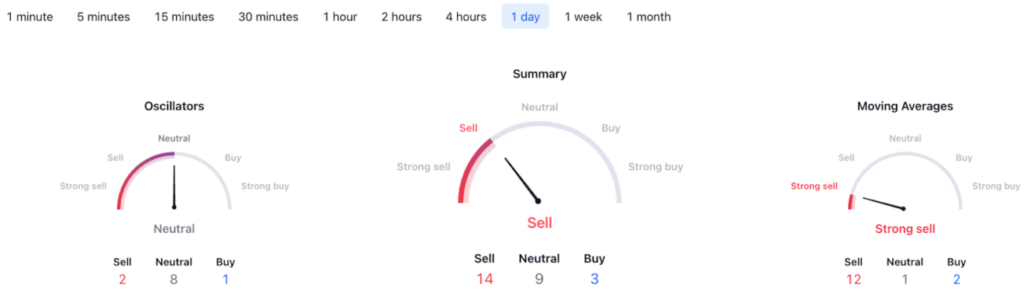

Meanwhile, the token is currently worth $61. It was up about 5 percent on a weekly basis. However, Aave’s technical analysis remains bearish. A summary of AAVE’s daily technical analysis was in line with ‘sell’ at 14. However, the moving averages mainly focus on a “strong sell” at 12. At the same time, the daily indicators of oscillators are neutral.

The second coin to watch out for: XRP

XRP continued its buying pressure amid the positive developments in the lawsuit between Ripple and the US Securities Exchange Commission (SEC). As the matter approaches a conclusion, the Ripple team has achieved a few wins. cryptocoin.com As we reported, legal experts predict that the regulator may lose the case. Overall, the court ruling in favor of Ripple is seen as bullish for XRP.

At the same time, the XRP community is expressing bullishness that the token will end the year on a positive note. For example, according to a survey by the CoinMarketCap community, XRP will be trading at $0.4 until December 31, 2022. Currently, the token is trading at $0.38. However, the bullish trend of the community was not reflected in the technical analysis. Moving averages and oscillators point to selling for the coin, according to the analyst.

Altcoin star of the week: Trust Wallet Token (TWT)

TWT took advantage of the FTX crisis, which saw liquidity concerns spill over into the crypto space. Notably, after the collapse of FTX, most investors chose to transfer their crypto assets to self-custody wallets as a precautionary measure. Trust Wallet became a critical target after gaining the support of Binance CEO Changpeng Zhao. It even gained tokens last week as exchanges took action to publish proofs of reserve in an attempt to stop the exit of assets in self-storage wallets.

The coin posted record gains of over 90 percent on a weekly basis. At the moment, TWT was trading at $2.06, gaining over 18 percent. Interestingly, the technical analysis of TWT is level 14 in the analysis tools below. That is, it points to “buying”. Moving averages and oscillators continue the uptrend.

Prospects for Chiliz (CHZ)

The fan token network rose in parallel with the FIFA World Cup. The Chiliz (CHZ) network allows sports teams to develop fan tokens for participation and incentives. However, the Chiliz community on CoinMarketCap continues its bearish trend. The community predicts that the token will trade on December 31, 2022 at an average price of $0.2035. Currently, CHZ is trading at $0.2, gaining over 12 percent in seven days. According to the analyst, neutrality prevails in the technical analysis summary of the token. In general, the moving averages give a “buy” signal.

Last coin on the list: Polygon (MATIC)

Despite taking a hit from the prevailing market uncertainty, MATIC’s value has seen small positive gains. It featured the token in the middle of the bear market. The token’s rise can be attributed to the continuing signs of Polygon going mainstream. One notable adoption is Meta’s use of the Polygon mesh. Thus, allowing users to showcase NFT on Instagram. . At the same time, the network saw an increase in the number of protocols launched. Currently, Polygon is trading at $0.87 with small gains of about 2 percent in seven days.

From a technical analysis perspective, the moving averages for MATIC point to selling. Altcoins’ movement will also depend on other factors, including how the overall market is performing. Aside from the collapse from the FTX crisis, the crypto space still faces the threat of prevailing macroeconomic factors.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.