The industrial group expects higher sales for the current financial year.

(Photo: Reuters)

Dusseldorf The consumer goods group Henkel has again increased its sales forecast. The manufacturer of Persil, Pril or Pritt now expects organic sales growth of 5.5 to 7.5 percent. The Düsseldorf-based Dax group had previously assumed organic growth of 4.5 to 6.5 percent. This was announced by CEO Carsten Knobel on Tuesday as part of a capital market day.

The traditional group only raised its forecast in August. At the beginning of the year, Henkel still expected sales growth of 3.5 to 5.5 percent. This was well received on the stock exchange: on Tuesday morning, the paper rose by two percent at times.

The growth is driven by the adhesives business. In this division, Henkel expects sales to increase by ten to twelve percent, previously it was eight to ten percent.

With adhesives, the Dax group achieves almost half of its sales with around ten billion euros and even 60 percent of its profit with 1.6 billion euros – the bulk of it with adhesives that are required in the industry. The adhesives are used, for example, in the automotive and electrical industries as well as in the construction industry. Henkel is considered a leader in the adhesives sector.

Top jobs of the day

Find the best jobs now and

be notified by email.

>> Read more: Electric Cars: How Adhesives About the Success of VW and Tesla decide

In the consumer goods business with detergents, cleaning agents and cosmetics, however, Henkel did not adjust its forecast. In these areas, the group wants to achieve its sales targets in the upper range of the forecast, as CFO Marco Swoboda told analysts and investors.

Henkel did not change its profit and margin targets. The group had already corrected this downwards in the spring. Like all consumer goods manufacturers, Henkel is struggling with rising raw material and logistics costs. This year, the group expects two billion euros in additional costs, last year it was one billion euros more than initially calculated. So far, the group has partially succeeded in passing on the costs, it said.

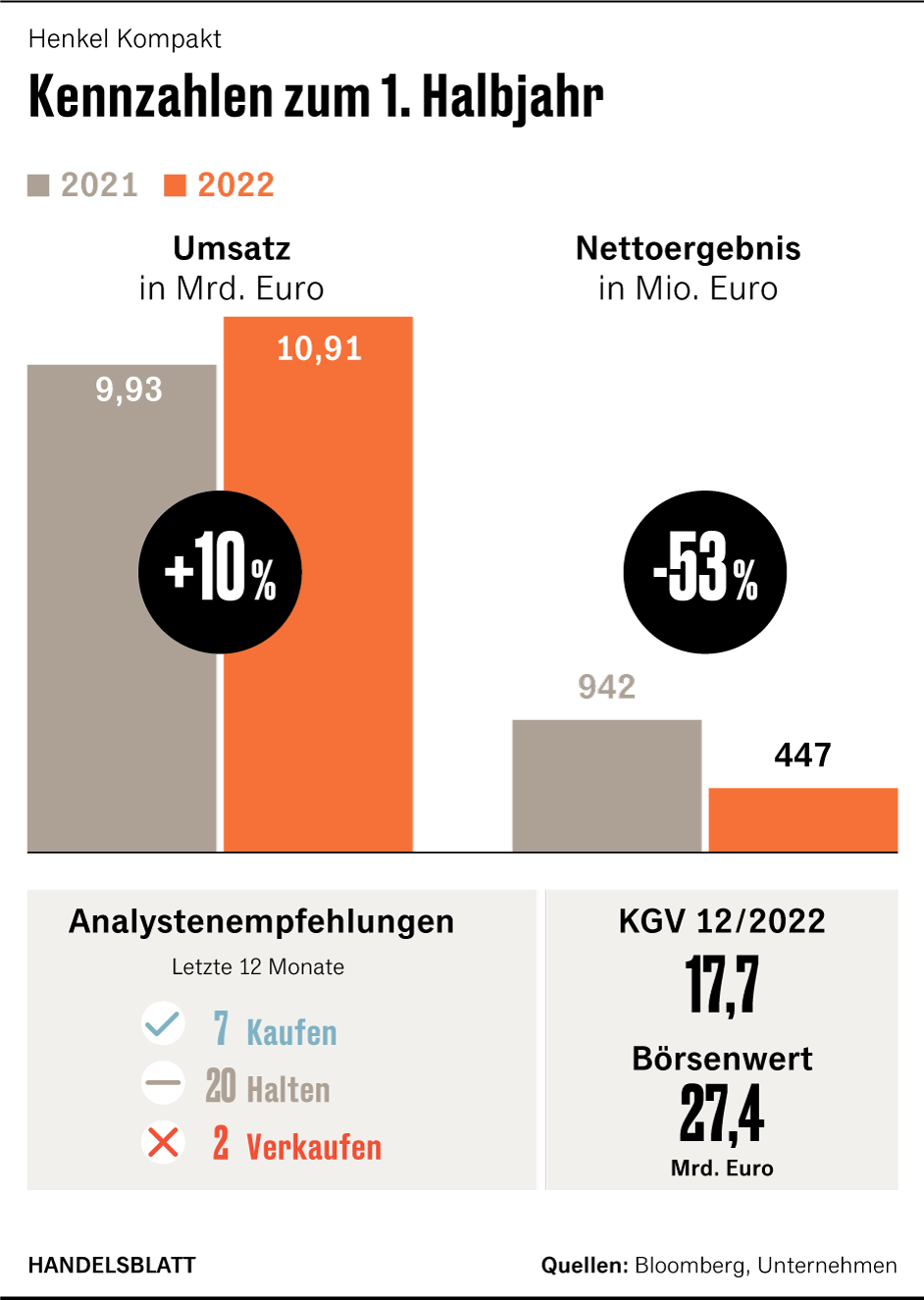

This weighs on earnings: In the first half of the year, Henkel achieved net earnings of 447 million euros, which was 53 percent below the same period of the previous year. The sales growth of ten percent in the first half of the year was mainly explained by price increases.

Group restructuring succeeds faster than planned

CEO Knobel also announced that the restructuring of the group was ahead of schedule in most regions. The management merged the ailing cosmetics business (“Dial”, “Syoss”) with the better-performing detergents and cleaning agents sector and its well-known brands such as Persil and Pril. After the conversion, Henkel will stand on two pillars of roughly the same size – the adhesives division and the consumer goods business known as “Consumer Brands”.

Henkel initially wanted the conversion to be completed by early 2023. Now there are already changes in top management this autumn: Wolfgang König, who has been responsible for the cosmetics division up to now, will also take over the management of the detergents and cleaning agents business from October. The manager Bruno Piacenza had been responsible for this division since 2011. He is retiring from the board at the end of the month.

The manager is responsible for the new Henkel division.

(Photo: Henkel)

König has been a member of the Henkel Management Board since June 2021. The manager has more than 25 years of experience in the consumer goods industry. Most recently, he held a managerial position at the US food manufacturer Kellogg, which is known for its breakfast cereals.

Restructuring should make the group more powerful – analysts are skeptical

CEO Knobel wants to make Henkel more powerful with the conversion. Analysts have repeatedly criticized that the cosmetics business is too small and not profitable enough compared to that of competitors like L’Oréal. Henkel is primarily active in the lower-margin consumer goods business. More money can be made with high-quality face creams that Henkel does not have in its portfolio.

That is why Henkel intends to part with poorly performing brands in the cosmetics business with sales worth around 200 million euros by the end of the year or to discontinue them altogether. This is how Knobel wants to increase the margin. The top manager intends to invest the resulting increase in proceeds in existing brands in order to strengthen the relevance of the Henkel portfolio and thus be able to push through price increases more easily in retail.

Company observers and industry experts are skeptical about these plans. For them, the merger is just a defensive measure with advantages on the cost side, which does not immediately lead to increasing sales. With the conversion, Henkel also wants to reduce costs and, as a first step, cut around 2,000 jobs worldwide. In Germany, 300 jobs are initially affected.

More: Price increases in the supermarket: These products will probably become even more expensive.