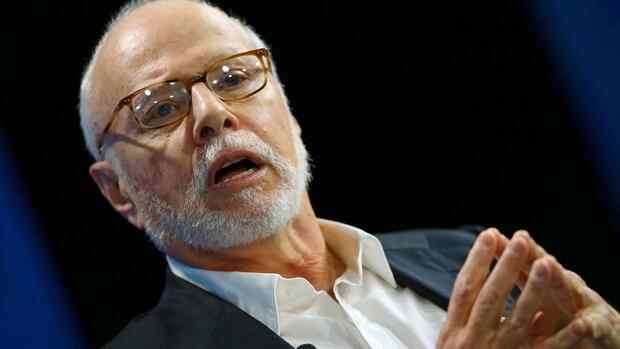

Dusseldorf Paul Singer is known to German companies as tough, patient and successful. Be it the merger of the real estate groups Deutsche Wohnen and Vonovia, the redevelopment of the industrial icon Thyssen-Krupp or the difficult integration of Monsanto with the chemical and pharmaceutical company Bayer – Singer is involved everywhere with his hedge fund Elliott Management.

Another, successfully completed chapter is now Rocket Internet. The start-up incubator of the Samwer brothers wants to go off the stock exchange and in autumn 2020 presented the shareholders with a buyback offer of 18.57 euros per share. The offer, criticized by experts as being far too low, called Singer onto the scene. His hedge fund gradually acquired around 20 percent of the shares.

Now he has reached his goal: Rocket pays Elliott, at 35 euros, almost twice as much as originally planned. The deal is to be decided at an extraordinary general meeting at the end of January, the company said on Tuesday. The shares listed in the free trade soared by almost 24 percent to 33.4 euros.

The offer is below the 40 euros that were expected in financial circles after Elliott’s entry. It is still good business for Singer: In a year or more, experts have calculated that he will have made a profit of a good 200 million euros. “In view of the short time, that’s a great return,” says Christian Röhl from the German Association for Protection of Securities Holdings (DSW).

Top jobs of the day

Find the best jobs now and

be notified by email.

The 77-year-old singer can also be satisfied for other reasons. His hedge fund receives special treatment compared to other existing shareholders and can sell its shares as a whole due to the agreed transfer of so-called tender rights. Rocket Internet now has almost 90 percent of the shares.

Other existing shareholders receive a quarter of their shares, however, much fewer tender rights. Only when free shareholders forego do they get a chance. “Overall, this is an extremely disadvantageous procedure for small shareholders that would definitely be worth a legal review,” says Daniel Bauer, Chairman of the Protection Association of Investors (SdK).

Rocket Internet: Much criticism of the retreat

With the agreement, Rocket Internet draws a line under a controversial deal. The company’s withdrawal from the stock market brought a lot of criticism. Rocket had determined the average price for the past six months.

Critics complain, however, that the rate was very low due to the pandemic. Shareholder advocate Christian Röhl says that Rocket Internet “talked badly” its shares. At the IPO in 2014, 42.50 euros were achieved. According to calculations by Deutsche Bank, the intrinsic value of the holding company was well over EUR 30 per share.

The annual general meeting last October became the stage for the billing. The virtual session lasted more than five hours, and CEO Oliver Samwer had to ask himself numerous, sometimes harsh, questions. “That was a forced transaction at the expense of the shareholders – as the agreement with Elliott now shows,” says corporate governance expert Christian Strenger.

The company is headed by Oliver Samwer, founded by him and his brothers Marc and Alexander Samwer. Previous holdings included the current Dax members Delivery Hero, Hello Fresh and Zalando.

Rocket is still invested in numerous companies such as the cleaning agent Helpling, the apartment agent Nestpick or the digital forwarding company Instafreight. But Samwer wants to start fewer companies and transform himself into a venture capitalist.

Unequal treatment of shareholders

“Outside of the stock market, Rocket Internet can take a longer-term approach to long-term strategic decisions regardless of moods in the capital market,” Rocket Internet justified the delisting at the time. The complexity of business activities and legal requirements are also reduced, “which frees up administrative capacities and reduces costs.” In addition, Rocket Internet has meanwhile brought the subsidiaries with high capital requirements to the stock exchange and therefore requires less financial leeway.

But for Rocket Internet things are not quite over yet. There is a threat of lawsuits from disappointed and former shareholders.

The expert for corporate law, Julia Redenius-Hövermann, sees in the agreement an unequal treatment of the shareholders. Last autumn, the course average over the past six months was taken as the basis. Apparently the company value would now be used. “There is an urgent need for reform regarding shareholder protection in Germany,” said the professor at the Frankfurt School of Finance & Management.

More: German firms are becoming a major target for hedge funds