Closely followed analyst PlanB claims that the cryptocurrency Bitcoin (BTC) is currently on its way to trillions of dollars in expansion to challenge the world’s largest asset classes. The claims made by PlanB increase the belief that the digital asset can undergo a significant transformation and revolutionize the financial world. Here are the details.

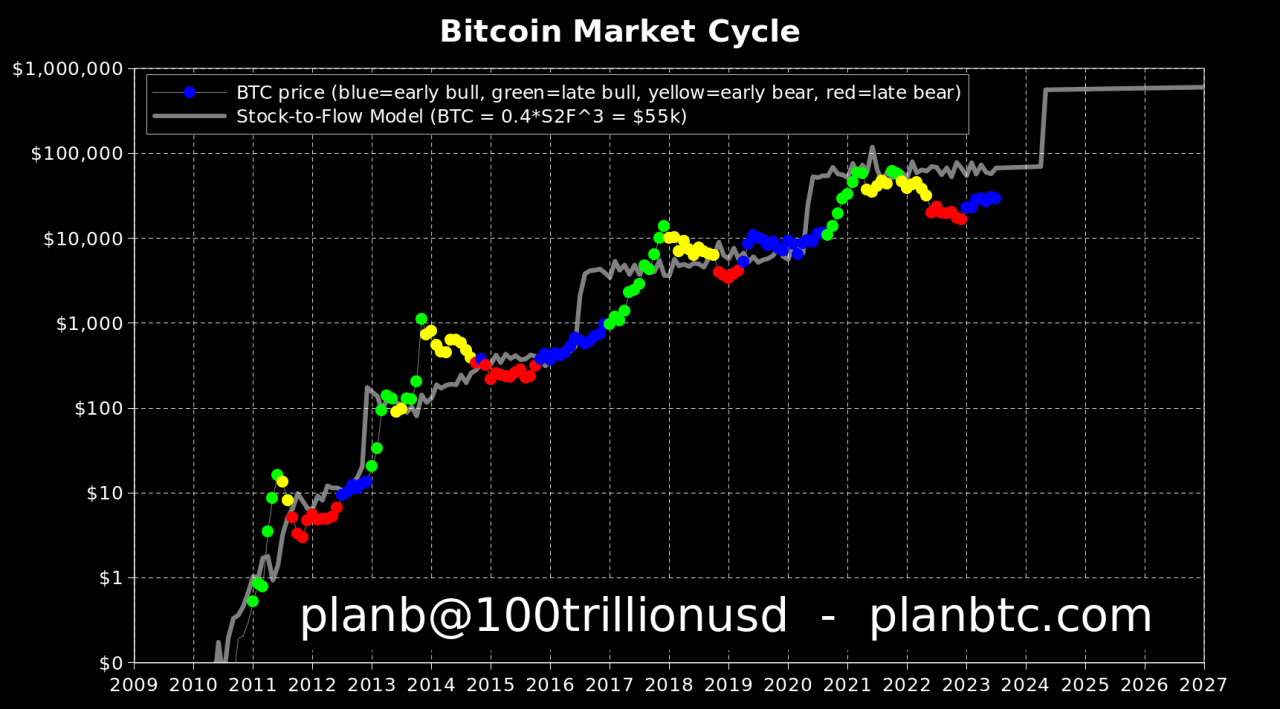

Popular analyst says that Bitcoin is currently in the early stages of the bull market. told. According to the analyst, this is an opportunity for big players like BlackRock to accumulate BTC while the price is low.

“one. stage early bull market (blue). Of course BlackRock wants to buy cheap (BTC) just before ETF approval and phase 2 mature bull market.”

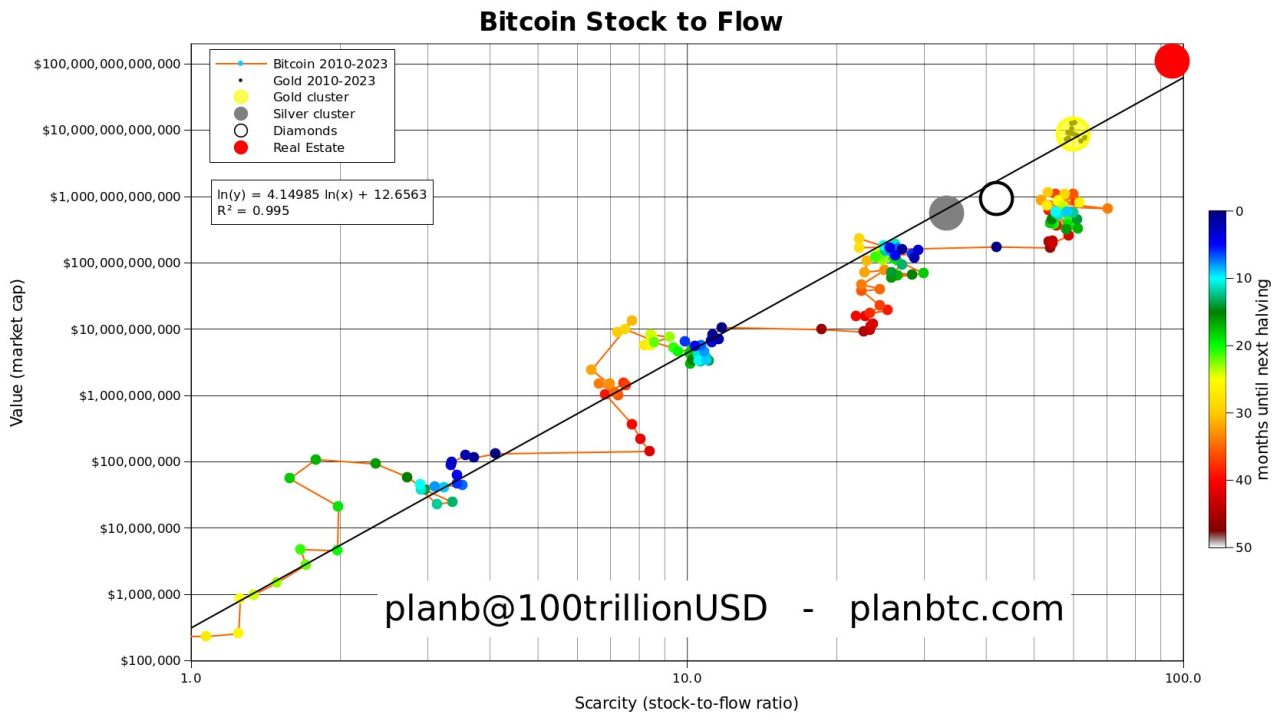

PlanB is a popular implementer of the stock flow model (S2F). S2F creates a partially predictive price model for an asset by proportioning an asset’s inventory (current supply) to its inflow (new production). That is, it tries to estimate the value of the asset by proportioning the current supply to the new production over a given period of time. To calculate an asset’s S2F ratio, the asset’s current supply must be divided by the number of years produced (approximately 58 for BTC and 60 for gold). This model was first used for commodities (e.g. gold) and was later adapted and popularized for Bitcoin by PlanB.

PlanB claims that after the Bitcoin halving, the leading crypto will eventually become very scarce and have a high value compared to other commodities such as gold, silver and diamonds.

“Bitcoin (S2F rate 58, market cap $400 billion) is extremely undervalued compared to:

– gold (S2F rate approx. 60, market cap approx. $10 trillion)

– diamonds (S2F ratio approx. 40, market cap approx. $1 trillion)

– silver (S2F around 30, market cap around $500 billion)

How will the markets react after the 2024 halving when the BTC S2F rate reaches 110?

In addition to these new statements, the analyst previously said that he predicted the price of about $ 50,000 as Bitcoin approaches the next halving event:

“The big question is what will be the price of Bitcoin at the April 2024 halving? We can only try to predict this from the 200-week moving average…

The 200-week moving average is currently [ayda] $500 is rising, so nine times $500 will be $4,500, and Bitcoin’s 200-week moving average is currently just under $28,000, so $28,000 plus $4,000 is $32,000, so at halving the 200-week moving average will be around $32,000.

And Bitcoin will be above that level, and usually 50% above that, which indicates that during the halving, Bitcoin will be in the range of $40,000 to $50,000.”

You can follow the current price action here.