Gold price lost some upside momentum around $1,923. However, despite this, it continued to rise for the fourth consecutive day. While gold does this, it reflects the market inactivity due to the US holidays and the light calendar elsewhere. Analysts, however, see some gains on the horizon.

These developments support the gold price.

The global economic slowdown and concerns about US-China relations are helping his trader stay active. Moreover, recent inaction by the Reserve Bank of Australia (RBA) to challenge the broad consensus for a third consecutive 25 basis point rate hike further bolstered market momentum.

The reversal between US 10-year and 2-year Treasury yields jumped to the highest level since 1981. This has brought recession concerns back to the agenda. US two-year Treasury yields fell to 4.85%, while 10-year bond yields fell to 3.78%. It should be noted that both benchmark bonds finished Monday’s trades at 4.93% and 3.86%, respectively.

cryptocoin.comAs you follow, US Treasury Secretary Janet Yellen is in Beijing. Therefore, concerns about US-China relations are growing. This also supports the gold price. Earlier in the day, the US Treasury Department made a statement to Reuters. “Treasury Secretary Janet Yellen had a ‘candid and fruitful’ meeting with the Chinese Ambassador today,” the ministry said. she said. The report also stated that US Treasury Secretary Yellen raised worrying issues. It was emphasized that the two countries conveyed the importance of working together.

Falcon Fed bets fail to push gold buyers

Meanwhile, bad US data failed to calm the hawkish Fed bets. Also, despite the sluggish markets, gold failed to push its buyers. It is useful to consider this situation. On Monday, US ISM Manufacturing PMI data for June fell to its lowest level in three years. The data came in at 46.0 compared to the forecast of 47.2 and 46.9 before. Thus, it remained below the 50.0 level for the seventh month in a row. In addition, the S&P Global Manufacturing PMI for June confirmed 46.3, the lowest value in the last five months, while Construction Expenditures increased 0.9% month-on-month, compared to expectations of 0.5% and 0.4% previous values for May. .

Reflecting the mood, S&P500 Futures slumped despite Wall Street posting small gains. Meanwhile, the US holiday and other places have a light calendar. These are risk catalysts for clear directions going forward.

Gold price technical analysis

Market analyst Anil Panchal draws the technical picture of gold as follows. Although gold price failed to break past the two-week descending resistance line, which was last around $1,930, it remains well above the $1,917 support combination consisting of the 200 Hourly Moving Average (HMA) and the four-day ascending support line. This makes the gold bulls hopeful to poke the indicated resistance line once again.

We can see that the weakness of the bid from June 16-29 and the 50% Fibonacci retracement add strength to the $1,930 resistance, which contains the previously mentioned falling trendline. Following this, a quick bounce towards the 61.8% Fibonacci retracement, also known as the golden Fibonacci ratio, near $1,940 cannot be ruled out. However, the 100-DMA on the daily chart and a bearish resistance line from early June converged around $1,945. This looks like a hard nut to crack later on for gold buyers.

Meanwhile, a downside break of the $1,917 support confluence would need confirmation of the 23.6% Fibonacci retracement level near $1,910 before leading the golden bears to the previous-month low near $1,893, the lowest since March.

Gold price technical view

Market analyst Sagar Dua discusses the technical outlook for gold as follows. Gold price rebounded from $1,909.55 on a daily basis near the 61.8% Fibonacci retracement (from $1,804.76 February 28 low to $2,079.76 May 03 high). The 20-period daily Exponential Moving Average (EMA) is at $1,933.54. This level acts as a roadblock for gold bulls.

Meanwhile, the Relative Strength Index (RSI) (14) bounced from the 20.00-40.00 bearish range to the 40.00-60.00 range. This indicates that the downside momentum is waning. Investors should keep in mind that the downtrend is still intact.

More bullishness on the table for gold in the short term

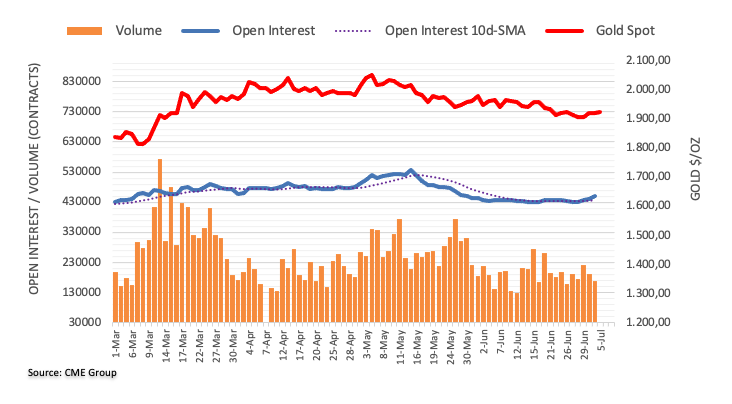

CME Group’s latest data on gold futures markets noted that traders increased their open interest by more than 8,000 contracts this time, for the third consecutive session on Monday. Volume, on the other hand, contracted for the second session in a row, reaching around 23.7 thousand contracts.

Gold extended its recovery from last week’s lows to the region below $1,900 earlier in the week. According to analyst Pablo Piovano, rising open interest has provided support for this reasonable progress. In addition, the analyst says that this shows that more upside is on the table for now. Meanwhile, extra gains are likely to face temporary resistance at the 100-day SMA, at $1,945 today.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your own research and due diligence before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.