The price of gold fell sharply this week as the rise in the dollar gained momentum. The focus of the market will be on the data to be announced in the USA next week. According to market analyst Eren Şengezer, gold’s downtrend may remain intact as long as the $1,890-1,900 region remains resistance.

The US government did not shut down, data is next!

cryptokoin.comAs you follow from , gold remained resilient in the face of a hawkish Fed outlook in the previous week. However, it was subsequently hit hard due to broad-based US Dollar (USD) strength and rising US Treasury yields. Thus, the precious metal lost nearly 4% in value last week. The focus of the market will be on political developments in the USA and the US September employment report. It is possible that these will direct the near-term movement of gold.

It is possible that political headlines coming from the USA over the weekend will affect the weekly opening of gold. Republicans and Democrats reached a deal and averted a shutdown before the deadline. Therefore, US Treasury yields are likely to turn south at the beginning of the week. It is possible that this will help the gold price gain upward momentum on Monday. On the other hand, a government shutdown would likely trigger a flight to safety. This would create a heavy burden on the gold price.

Manufacturing and Services PMI data will be on the radar

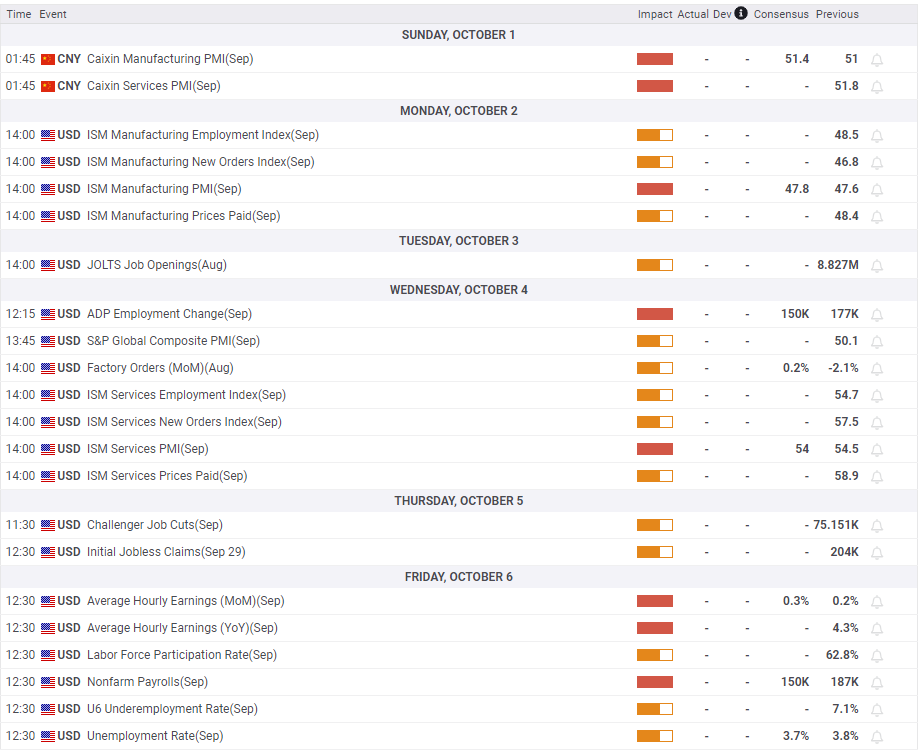

The US economic agenda will include ISM Manufacturing PMI data, which is expected to increase from 47.6 in August to 47.8 in September, on Monday. If this data comes above 50 and points to an expansion in the business activities of the manufacturing sector for the first time since October, it may provide a support to the dollar as an initial reaction. However, investors are likely to focus on the activity in bond markets depending on the outcome of the budget negotiations.

On Wednesday, expectations are that the September ISM Services PMI data will come in at 54. If the index rises close to or below 50, it will likely hurt the dollar. Therefore, it is possible that this may open a door of opportunity for gold. If the survey’s inflation component, the Prices Paid Index, remains near 60, the potentially negative impact of the disappointing headline Services PMI on the dollar may be short-lived.

Gold investors will follow US NFP closely

Finally, the U.S. Bureau of Labor Statistics will release its September employment report on Friday. Expectations are for Nonfarm Payroll (NFP) to increase by 150,000, following the 187,000 increase recorded in August. If the NFP rises to 200,000 or above, it could cause investors to consider the possibility of another Fed rate hike. It is possible that this will help the dollar gain strength ahead of the weekend.

The CME Group FedWatch Tool shows that markets still see a 66% chance that the US central bank will keep its policy rate unchanged for the rest of the year. It’s possible that lower-than-expected employment growth will allow dovish Fed bets to dominate market action. This will likely increase the gold price.

Gold technical view

Analyst Eren Şengezer evaluates the technical outlook of gold. The Relative Strength Index (RSI) on the daily chart has moved lower. This pointed to oversold conditions for gold. It is possible for the yellow metal to make an upward correction in the near term. However, it needs to turn the $1,900-1,890 region (Fibonacci 38.2% retracement of the long-term uptrend, static level, psychological level) back into support to start moving upward again. In this scenario, the 200-day Simple Moving Average (SMA) could be set as the next upside target before $1,940 (100-day SMA) and $1,950 (Fibonacci 23.6% retracement).

On the downside, static support stands at $1,860. However, the yellow metal fell below this level. If it now confirms this level as resistance, a drop to $1,840 (Fibonacci 50% retracement) is possible. Moreover, if it continues, it is likely to see a fresh decline towards $1,810 (static level).

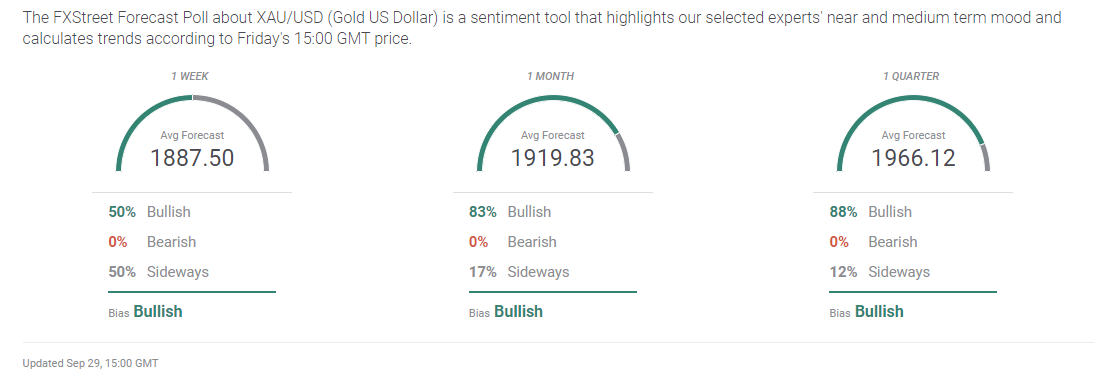

In the gold sentiment survey, bullish and neutral sentiment are tied in the short term. However, an upward trend prevails in the medium and long term.

To be informed about the latest developments, follow us twitter‘in, Facebookin and InstagramFollow on and Telegram And YouTube Join our channel!

For the rest of the article, Gold is in a Fall Trajectory: These Data Will Affect the Price Next Week!