stablecoin ‘s are cryptocurrencies designed to provide stable value in the digital asset market by being pegged to an underlying asset (usually fiat currency). These types of cryptocurrencies are often preferred by users who want to avoid fluctuations or quickly trade in digital asset markets.

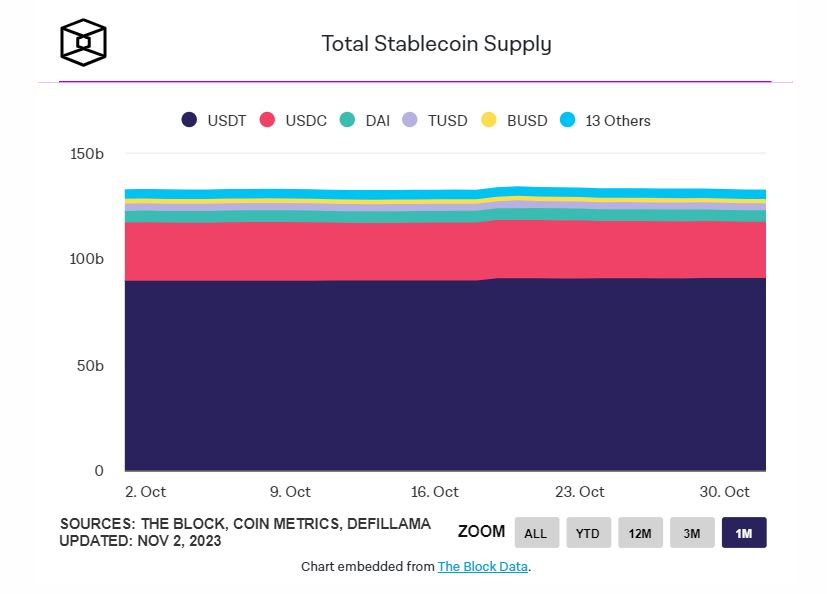

The increase in stablecoin supply observed on November 2, 2023 made the cryptocurrency community and analysts curious because it is interpreted together with the recent increase in Bitcoin price. This increase raises questions about what might happen in the digital asset market.

As we reported as Koinfinans.com, after the collapse of TerraUSD, it was observed that the stablecoin supply experienced a sharp decrease. However, as of early this year Bitcoin With the increase in price, there seems to have been a slight increase in the supply of stablecoins. This increase may suggest that market players are looking to hedge against fluctuations in the digital asset market or may turn to stablecoins for quick transactions.

However, it is not easy to interpret how the increase in stablecoin supply will affect long-term market trends and what kind of developments this situation may lead to in the future. Therefore, those who follow the cryptocurrency market closely should be careful about how changes in stablecoin supply can be interpreted.

The focus of this growth in stablecoin supply is the number one asset Tether It looks like (USDT). Tether, known for its price stability and widespread use in the cryptocurrency ecosystem, experienced a significant flow of funds.

According to Glassnode, the recovery of the long-stagnant “stablecoin” market is a strong indicator of capital inflows into the broader cryptocurrency market. Underlining a significant change in market dynamics, Glassnode’s analysis team said:

Until recently, Bitcoin led net inflows while stablecoins showed net outflows. Now Bitcoin, Ethereum and stablecoins have entered the positive range and are all increasing.

This change reflects the increase in stablecoin supply as a whole. cryptocurrency It went unnoticed by industry experts, who saw it as a clear signal of net capital inflow into the industry. According to the Glassnode analysis team, “These stablecoins signal investor demand for speculative capital” and underscore renewed confidence and interest in the digital asset market.