The altcoin market moved upwards, led by Bitcoin, after the US CPI data for March, which was announced recently. As BTC price rallies above $30,200, crypto analysts are warning of possible dips in the altcoin market.

Benjamin Cowen sets new lows for leading altcoin

The US CPI data released on April 12 is followed by Ethereum’s Shanghai upgrade. A potential selling pressure was expected in this upgrade as the hefty amount of ETH staked in December 2022 will be released. In his recent analysis, Cowen expects the rising BTC price with Shanghai to put negative pressure on ETH.

The analyst reminded that during the years when the crypto market was in the recovery phase, Bitcoin outperformed altcoins. He also warns that altcoins could crash much faster if the crypto moves down.

In his latest Youtube post, Cowen said that Ethereum could drop further before seeing ATH levels. On the potential selling pressure surrounding ETH, he noted:

Recovery years can still be brutal for the altcoin market in general. Therefore, we must remember that Bitcoin tends to outperform the majority of the altcoin market during the recovery.

Polkadot (DOT) shows basic signs of weakness

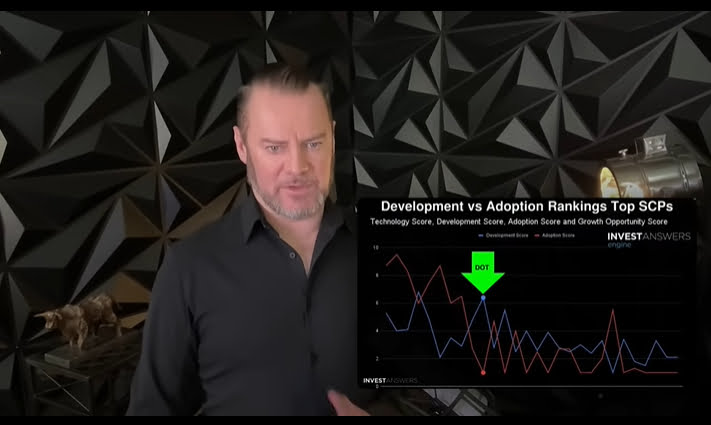

Analyst for Youtube channel InvestAnswers said in a new strategy session that there are many developments in the interoperability ecosystem, however, Polkadot is experiencing a lack of adoption, which is a negative sign for any Blockchain project:

Unbelievably good performance of Polkadot compared to the others. [gelişme] has points. But it lagged behind in terms of adoption.

According to crypto analyst Polkadot, it could solve the adoption problem overnight if Blockchain develops a great use case that attracts millions of new users:

Crypto is not loyal. We’ve seen how some Blockchains are slowly disappearing. But some may explode and develop unexpectedly. I don’t know if Polkadot will be one of them. I don’t know if some of the sub chains will be very successful. What I see is users are undecided. If they have an unrivaled market of value proposition products, millions of users may be gone overnight.

Can Polkadot increase network TVL with these factors?

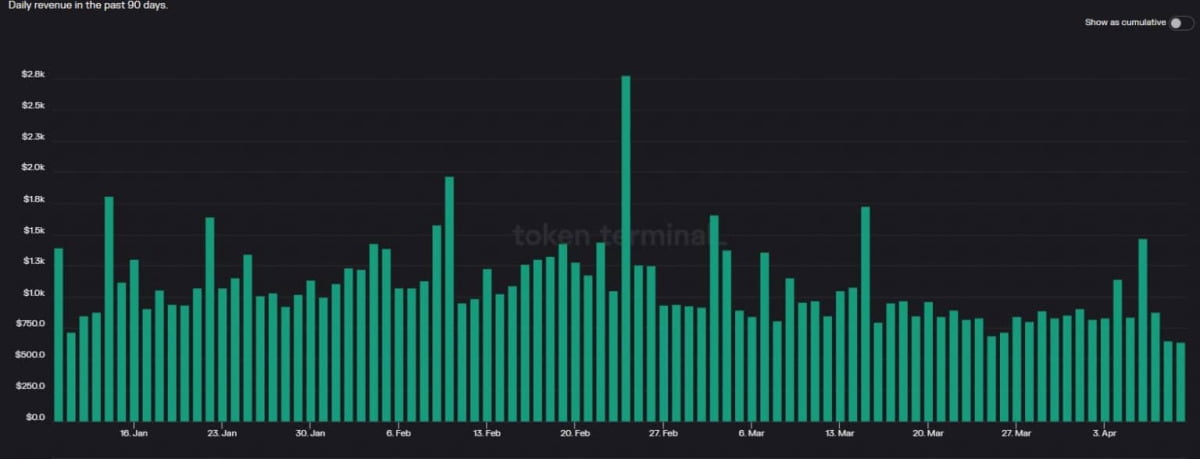

cryptocoin.com As we reported, the number of DOT stakers has gained upward momentum in recent weeks. According to Polkadot Insider’s April 10 tweet, Polkadot’s network revenue has increased considerably over the past week. Also, DOT recorded the highest revenue with $1,473 on April 6, 2023.

But data from Token Terminal shows that DOT’s revenue has fallen marginally over the past few weeks.

However, DOT’s social volume remained high, reflecting its popularity. After the drop, DOT’s one-week price volatility also rose, raising the possibility of a sustained uptrend that could help boost the network’s TVL further. The DOT was also in demand among long position traders, which could be another positive sign for the token.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.