Native token of crypto lending platform Celsius, which recently filed for “Chapter 11 bankruptcy” CEL tokenThe price continues to rise. As a result of the community’s “CEL Short Squeeze”, the token price increased by 80%.

As Koinfinans.com, as we have previously conveyed to you; Celsius’ bankruptcy filing also revealed the “dark” parts of $1.2 billion, including $750 million worth of mining rigs, the settlement of $840 million in debt from Tether, and the loss of 38,000 ETH from staking. It also has $411 million in outstanding loans to retail borrowers, backed by collateral of $765.5 million in digital assets.

As customers and depositors are unlikely to withdraw or get their funds back, many have started trying “CEL Short Squeeze” as a possible solution. In just one day, the CEL token price skyrocketed from $0.42 to a low of $0.83 and rallied nearly 80%. While preparing the news, Celsius (CEL) was trading at $0.78, up nearly 30%.

Users are planning a VGX-like “pump and dump” that has seen a massive 500% rally in price over the past 3 days. VHX price rallied from $0.14 to $1 a day before losing some of the gains as a result of taking profits. Crypto lending platform Voyager Digital After filing for bankruptcy, customers were unsure whether they would get their funds back. Several influencers and groups, including MetaForm Labs, have launched a “PumpVGXJuly18” scheme to pump the VGX price using a method called short squeeze.

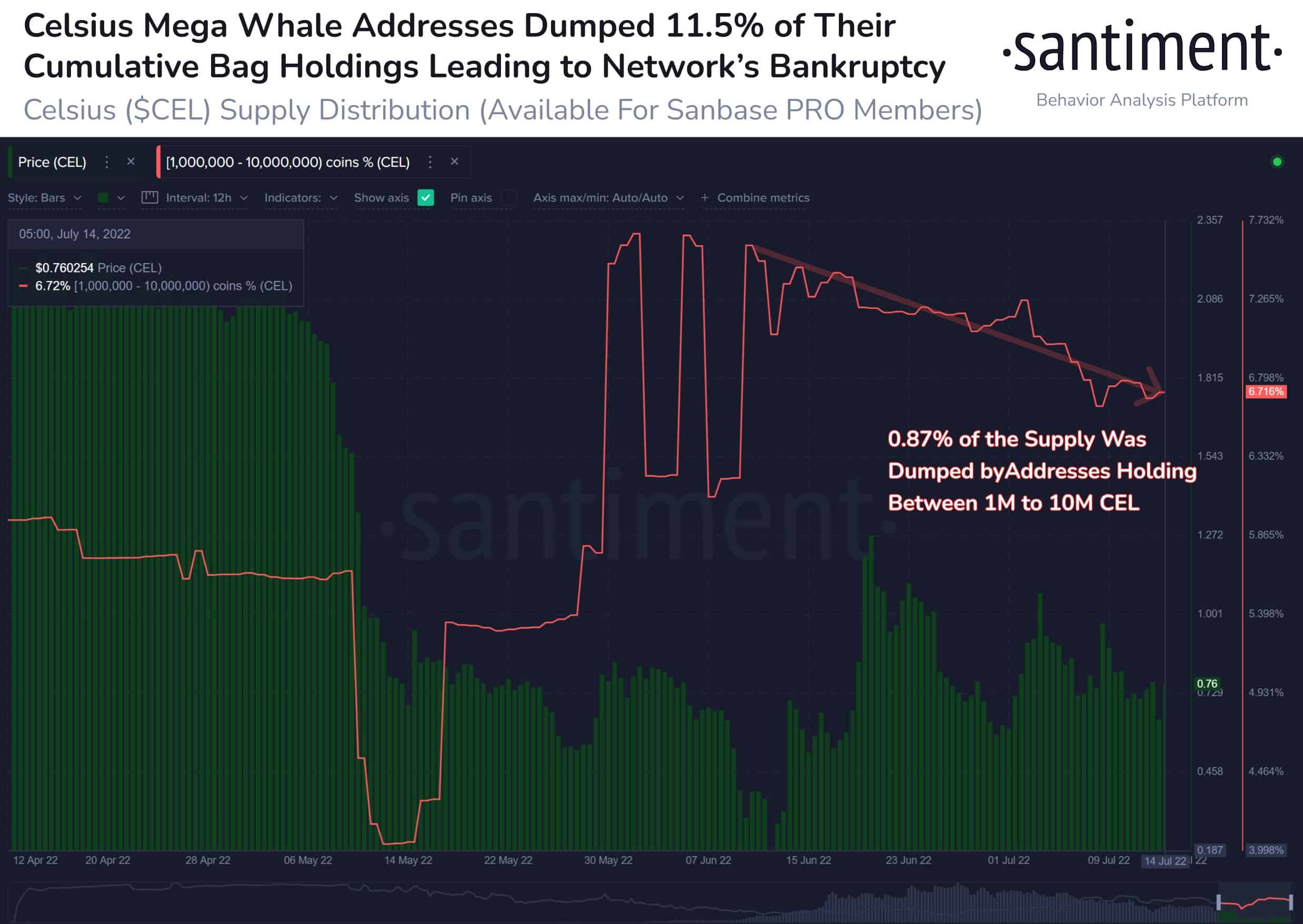

On-chain platform centimentAccording to Celsius (CEL) Whale Breakdown data, whales holding 1-10 million CEL tokens drained only 0.87% of the supply between the withdrawal halt and filing for bankruptcy. It has been found that whales continue to hold large numbers of CEL tokens and are constantly dumping the tokens.

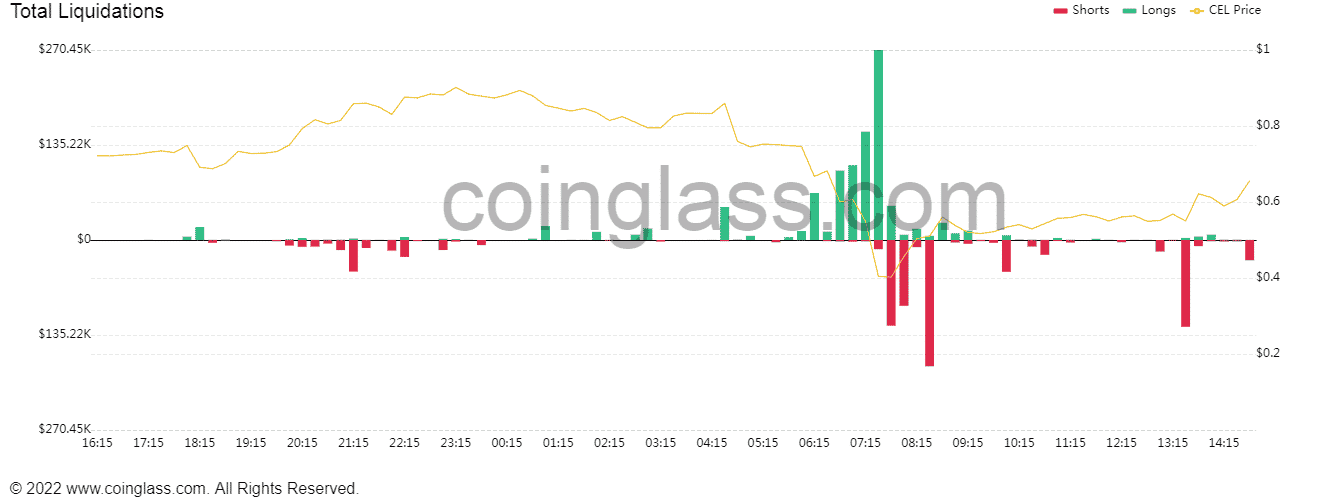

We can state that the reason for the rise in price is that “short sellers” are shorting CEL tokens on exchanges. Exchanges including FTX, Okex, and Huobi have shorted more than 80%, according to Coinglass. Also, Celsius cannot sell the CEL token on the market. Spot market shorts on FTX are bound to buy CEL tokens to close their positions.

The data shows huge shorts that have pushed the price upwards over the past 24 hours. In fact, it looks like plans for the CEL short squeeze are underway as the chart shows the big shorts today.

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.