An analyst from financial services giant Fidelity said that the price of Bitcoin has reached a level that makes it “attractively valuable.”

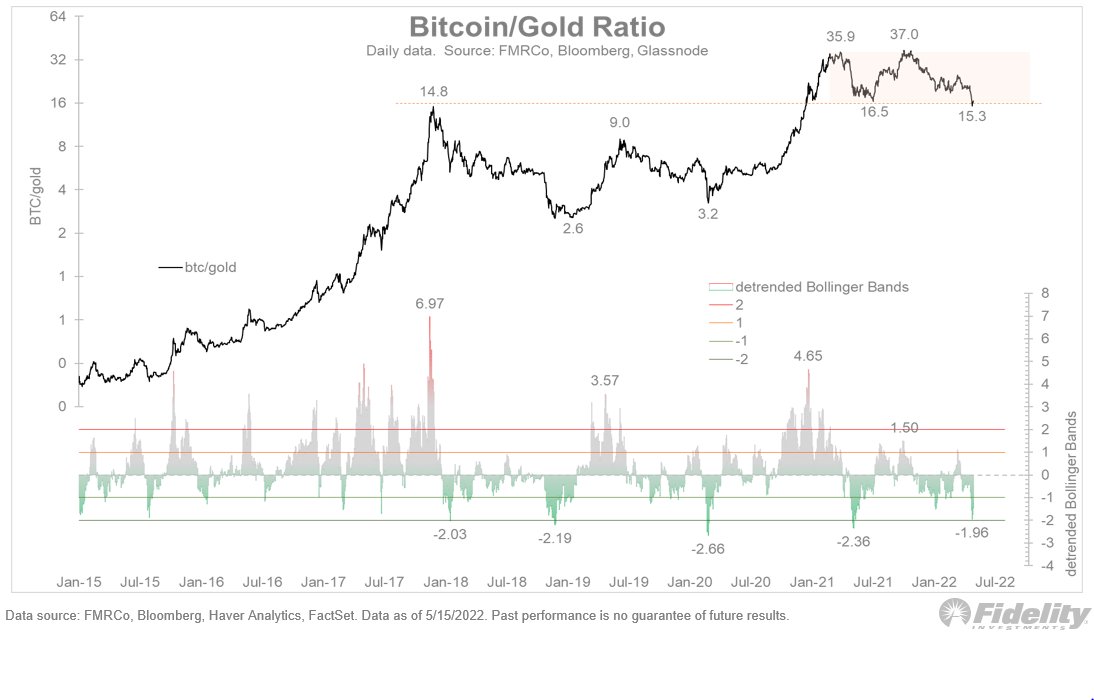

Analyst Jurrien Timmer said at the very beginning of his analysis that he looked at the Bitcoin/gold ratio, which pegs the price of both store of value assets against each other. told.

“Firstly, the Bitcoin/gold ratio, which I see as a barometer of how well this aspiring digital store of value is doing relative to the “original” store of value.

The BTC/gold ratio currently has major support at 2017 highs and 2021 lows. At the same time, the falling Bollinger Band shows that the rate is currently 2 standard deviations below the trend, which is a level that includes the last 3 drops.”

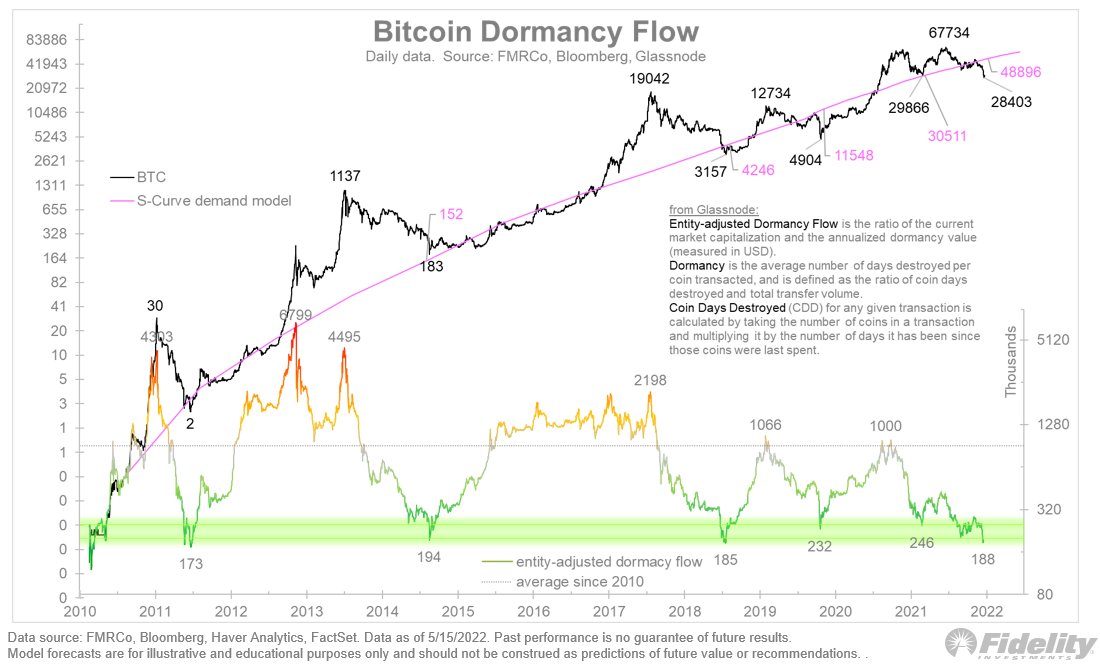

The analyst also drew attention to the “Dormancy Flow” indicator, which compares price with spending behavior. Timmer stated that the metric in question is currently at levels not seen since 2018.

“Next, roughly speaking, is the dormancy flow, which is a measure of strong and weak hands. Glassnode’s dormancy flow is at its lowest since the 2014 and 2018 lows.”

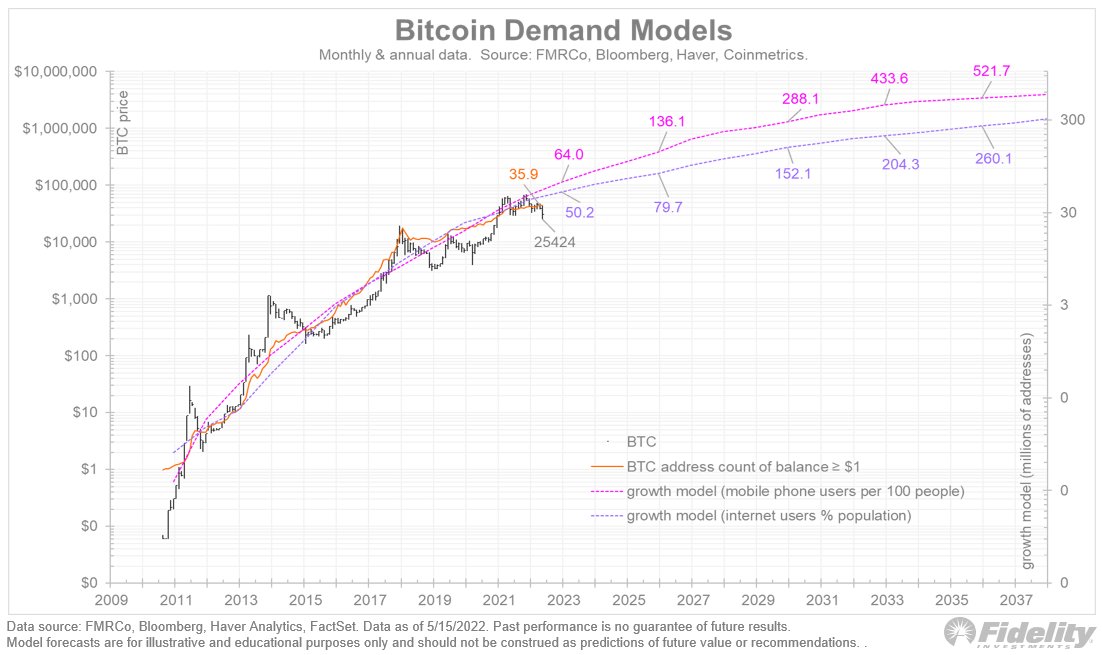

Timmer also shared a model comparing the adoption of Bitcoin to the rise of the internet and mobile phones. Assuming that BTC and cryptocurrencies are adopted at the same level as the internet and mobile phones, Bitcoin is now significantly undervalued by the metric.

“Next value. Bitcoin, which has now risen to $25,000, is currently below the price suggested by both the mobile phone-based S-curve model and the more classical internet adoption model.”

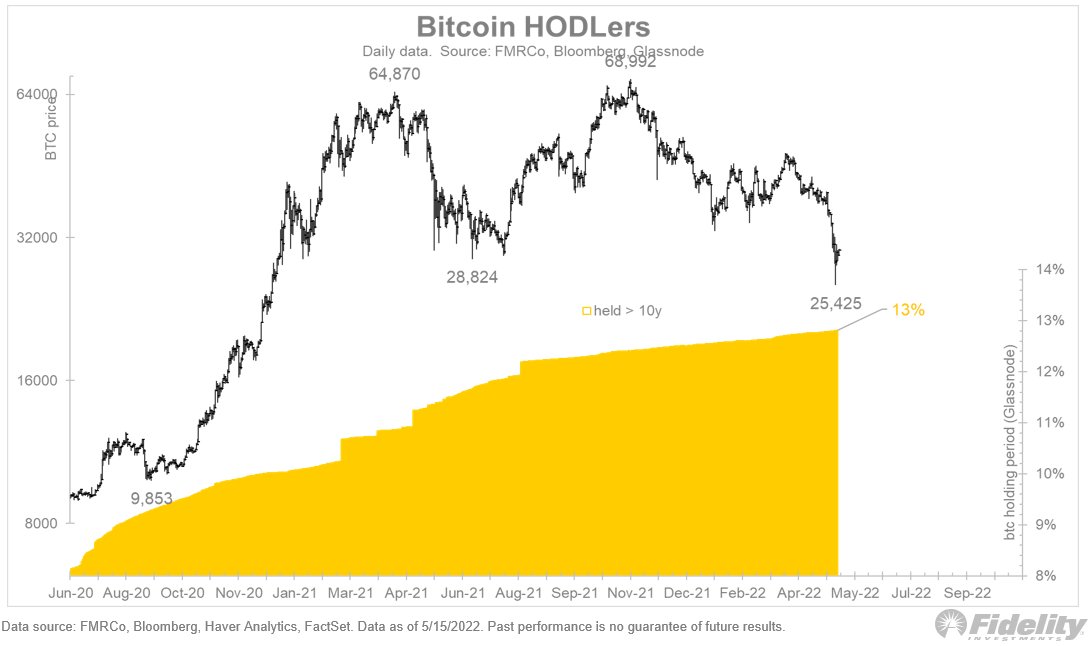

The Fidelity analyst added that he finds it remarkable that HODLers seem to be unaffected, despite Bitcoin’s significant price correction from its all-time high. The chart below shared by the analyst shows that the number of Bitcoins held for more than 10 years has remained stable at 13%.

Timmer thinks that, given all available metrics, Bitcoin is currently at an attractive price historically and has solid support. However, the only variable is stocks, which BTC says clearly has an impact on price action.

“All of the above tells me that Bitcoin not only has solid support, but also has attractive value. One caveat is that Bitcoin-sensitive stocks should confirm any recovery for Bitcoin.

These were disastrous heralds a few weeks before Bitcoin crashed, and now they will need to show strength in recovery for me to trust Bitcoin’s rally prospects.”

You can check the price movements here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.