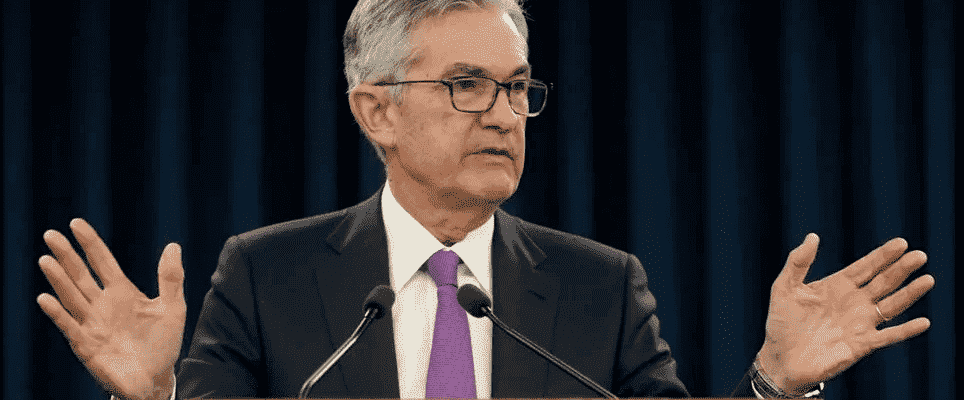

After Fed Chairman Powell’s statements, we observed that the selling pressure increased in US stock markets and risky products.

The sales heads of the Powell statements are as follows:

“We think that high inflation will decrease.

The FED has no tool to use to address supply shortages.

High inflation is likely to stay that way in the next year. However, we expect it to decrease by approaching our 2% target.

If the Fed sees that inflation will be permanent, it will use its necessary tools.

We need to make sure our policy is positioned for a variety of outcomes.

We’re starting to shrink, ending in mid-2022.

Inflation is now well above our targets. An interest rate hike at this stage will not be beneficial (it will be born dead).

We don’t know how long it will take for inflation to fall.

I think it’s time to downsize, but it’s not yet time to raise interest rates.”

After Powell’s statements, the Nasdaq fell 1% and became the most depreciated among US stock markets. The pullback on the Nasdaq, where tech stocks are traded, indicates an exit from risky products.

While Powell’s speech created a selling pressure across the US stock markets, Bitcoin fell to $ 60600, affected by the fluctuations in the global markets.