In cryptocurrency markets, the behavior of Bitcoin whales is closely monitored as they often have a significant impact on market movements and price trends. In this regard, IntoTheBlock’s analytical report shed light on the recent behavior of Bitcoin whales.

The report in question shows that whales have continued to pile on BTC, taking advantage of the crypto king’s withdrawal since March. However, lately there have been signs that there is a decrease in the tendency of whales to accumulate Bitcoin at the bottom in their large wallets.

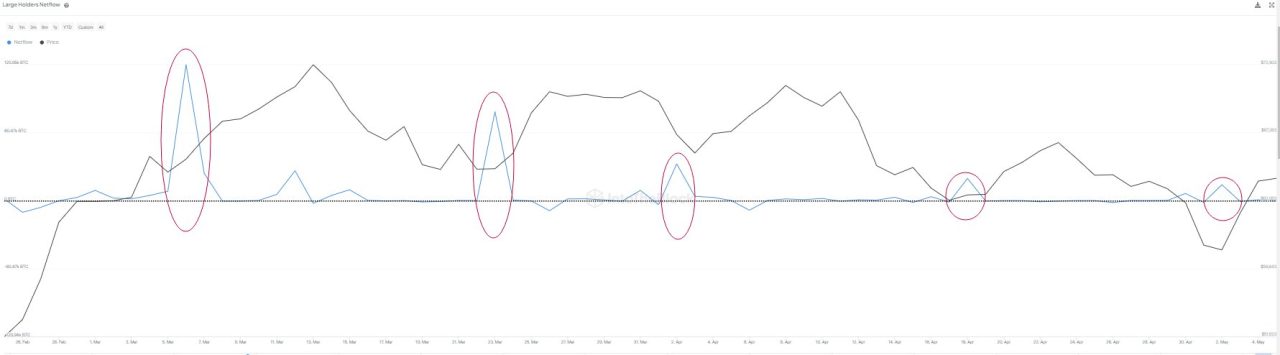

After the massive rally in March, the net flow of wallets holding more than 1,000 BTC began to decline. This may indicate that whales are no longer as willing to buy Bitcoin at dips as before. These large investors, who accumulated heavily especially when prices were falling, drew attention with the fact that prices rose in a short time after each accumulation. However, it is stated that the recent increases in whales’ accumulations are smaller than in previous periods.

“Whales are buying the dip but is their faith waning? Addresses holding more than 1,000 BTC have accumulated strongly in recent months, especially during declines. After each accumulation, prices soon increased. However, keep in mind that each increase in these owners’ savings is smaller than the previous one. Could this indicate that whales are gradually losing their appetite for buying dips?”

NEWS CONTINUES BELOW

This change in whales’ tendency to accumulate Bitcoin may increase uncertainty in the market. It is thought that whales, which increased prices by purchasing large amounts of Bitcoin in previous periods, have now started to adopt a more cautious approach. This can create a certain imbalance in the market, as whales’ movements often play an important role in determining Bitcoin’s price trends.

In addition, IntoTheBlock closely monitors the activities of investors in Chainlink (LINK), a decentralized oracle crypto project. is watching. According to the analytics firm, market participants continue to buy LINK despite the recent downward price movement.

“Despite recent price movements, last month’s data shows a negative net flow from exchanges for LINK, indicating accumulation. “The total net outflow during this period was approximately 3.6 million LINK.”

At the time of this writing, LINK is trading at $13.83, down more than 3.8% on the day.

Finally, it is important to remember that these trends always make it difficult to make a clear prediction about the future of the market. Whales’ behavior can be influenced by many factors, and the complexity of these factors can make market movements difficult to predict.

You can access current market movements here.