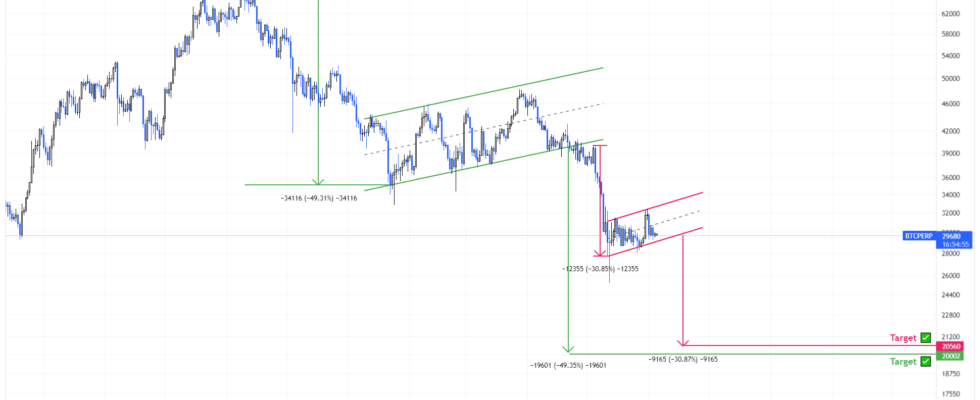

- bitcoin The price shows a ‘bear flag’ fractal form over a narrower time frame, suggesting that there may be a 30% collapse as a result.

- A downside break above the $30,000 level on the weekly timeframe could give strength to the bears and trigger further declines.

- The macro bearish view may be invalidated if BTC generates a higher high above $52,000.

A fractal is currently forming on the Bitcoin price chart, indicating that the downtrend is pretty close. This new development further strengthens the macro bearish thesis for BTC.

Bitcoin May Face Relentless Selling Pressure

Bitcoin price clearly showed a bear flag setup as it broke the lower trendline of the pattern on May 6. This move triggered a 36% crash in one week. Looking at the larger chart, it shows that BTC’s drop from its all-time high of $69,000 to $32,837 between November 10, 2021 and January 24, 2022 forms the flagstaff of the model.

After this collapse, Bitcoin, which consolidated in the form of higher lows and higher peaks between January 14 and May 22, continues to form an ascending parallel-like structure, also known as the ‘flag’.

This emerging technical formation bitcoin priceIt was confirmed when the price fell below $38,305 and is targeting the rather frightening level of $18,179. The biggest reason why such a sharp decline has not yet emerged is of course, the psychological level of $ 30,000 is still in play. A daily candlestick below this support level will likely trigger a drop towards the $20,000 level as a result.

While this pattern has been going on for quite some time, the recent consolidation seems to have set up another bear flag that predicts a 30% drop to the same target of $20,000.

This fractal formation confirms that an eventual drop in Bitcoin price is likely. This development also blocks the possibility of a relief rally to $35,000 or higher. Therefore, investors need to be careful as BTC consolidates without any directional bias in the game.

While the situation looks pretty bad for Bitcoin price, an increase in buying pressure pushing Bitcoin to $35,000 would invalidate the smaller bear flag. From a macro perspective, this would invalidate the massive bearish thesis if major crypto bulls push the asset to produce higher above $52,000.

In such a case, Bitcoin price could rise even higher and perhaps retest its all-time high of $69,000.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.